ADANIENT: 1,999.20 -40.70

ADANIPORTS: 1,421.30 -56.20

APOLLOHOSP: 7,779.00 54.50

ASIANPAINT: 2,220.80 -58.70

AXISBANK: 1,288.30 -27.50

BAJAJ-AUTO: 9,383.00 -433.00

BAJFINANCE: 938.05 -12.15

BAJAJFINSV: 1,841.50 -27.40

BEL: 457.35 -11.10

BPCL: 331.15 -21.60

BHARTIARTL: 1,866.70 -4.10

BRITANNIA: 5,890.00 -93.00

CIPLA: 1,325.00 3.80

COALINDIA: 437.65 -2.80

DIVISLAB: 6,330.00 1.00

DRREDDY: 1,287.00 -16.80

EICHERMOT: 7,266.00 -354.50

ETERNAL: 229.56 -3.01

GRASIM: 2,681.20 -37.20

HCLTECH: 1,358.60 1.90

HDFCBANK: 840.70 -16.35

HDFCLIFE: 653.75 -14.80

HEROMOTOCO: 5,480.00 -32.50

HINDALCO: 945.35 -13.55

HINDUNILVR: 2,194.60 -31.10

ICICIBANK: 1,278.40 -35.00

INDUSINDBK: 881.20 -36.65

INFY: 1,315.00 6.60

ITC: 306.00 -3.70

JSWSTEEL: 1,192.60 -41.10

KOTAKBANK: 386.35 -13.45

LT: 3,842.10 -107.70

M&M: 3,187.60 -144.90

MARUTI: 13,508.00 -651.00

MAXHEALTH: 1,041.50 -0.50

NESTLEIND: 1,235.80 -16.60

NTPC: 376.25 -4.35

ONGC: 270.80 -8.15

POWERGRID: 295.20 -3.95

RELIANCE: 1,424.00 19.20

SBILIFE: 1,912.50 -29.10

SHRIRAMFIN: 987.20 -20.30

SBIN: 1,098.50 -44.50

SUNPHARMA: 1,807.40 8.00

TCS: 2,527.40 -30.20

TATACONSUM: 1,102.50 -14.20

TMPV: 332.00 -18.75

TATASTEEL: 191.01 -7.45

TECHM: 1,336.30 4.60

TITAN: 4,159.20 -85.40

TRENT: 3,689.40 -33.40

ULTRACEMCO: 11,378.00 -609.00

WIPRO: 198.75 3.35

NIFTY

09-Mar-2026 [16:09]

09-Mar-2026 [16:09]

20 Microns Ltd.

21st Century Management Services Ltd.

360 One Wam Ltd.

3I Infotech Ltd.

3M India Ltd.

3P Land Holdings Ltd.

5Paisa Capital Ltd.

63 Moons Technologies Ltd.

AAA Technologies Ltd.

Aadhar Housing Finance Ltd.

Aakash Exploration Services Ltd.

Aarey Drugs & Pharmaceuticals Ltd.

Aarnav Fashions Ltd.

Aaron Industries Ltd.

Aartech Solonics Ltd.

Aarti Drugs Ltd.

Aarti Industries Ltd.

Aarti Pharmalabs Ltd.

Aarti Surfactants Ltd.

Aarvi Encon Ltd.

Aavas Financiers Ltd.

AB Cotspin India Ltd.

AB Infrabuild Ltd.

Abans Financial Services Ltd.

ABB India Ltd.

Abbott India Ltd.

ACC Ltd.

Accelya Solutions India Ltd.

Accuracy Shipping Ltd.

ACE Integrated Solutions Ltd.

Acme Solar Holdings Ltd.

Action Construction Equipment Ltd.

Acutaas Chemicals Ltd.

Adani Energy Solutions Ltd.

Adani Enterprises Ltd.

Adani Green Energy Ltd.

Adani Ports and Special Economic Zone Ltd.

Adani Power Ltd.

Adani Total Gas Ltd.

ADC India Communications Ltd.

ADF Foods Ltd.

Aditya Birla Capital Ltd.

Aditya Birla Fashion and Retail Ltd.

Aditya Birla Lifestyle Brands Ltd.

Aditya Birla Money Ltd.

Aditya Birla Real Estate Ltd.

Aditya Birla Sun Life AMC Ltd.

Aditya Infotech Ltd.

Aditya Vision Ltd.

Ador Welding Ltd.

Adroit Infotech Ltd.

Advait Energy Transitions Ltd.

Advance Agrolife Ltd.

Advance Metering Technology Ltd.

Advanced Enzyme Technologies Ltd.

Advani Hotels & Resorts (India) Ltd.

Advent Hotels International Ltd.

Aegis Logistics Ltd.

Aegis Vopak Terminals Ltd.

Aeonx Digital Technology Ltd.

Aequs Ltd.

Aeroflex Enterprises Ltd.

Aeroflex Industries Ltd.

Aeroflex Neu Ltd.

Aether Industries Ltd.

Afcons Infrastructure Ltd.

Affle 3i Ltd.

Affordable Robotic & Automation Ltd.

Agarwal Industrial Corporation Ltd.

AGI Greenpac Ltd.

AGI Infra Ltd.

Agri-Tech (India) Ltd.

Agro Phos India Ltd.

Ahlada Engineers Ltd.

Ahluwalia Contracts (India) Ltd.

AIA Engineering Ltd.

AION-Tech Solutions Ltd.

Airan Ltd.

Airo Lam Ltd.

Ajanta Pharma Ltd.

Ajax Engineering Ltd.

Ajmera Realty & Infra India Ltd.

Ajooni Biotech Ltd.

Akash Infra-Projects Ltd.

AKG Exim Ltd.

AKI India Ltd.

Aksh Optifibre Ltd.

Akshar Spintex Ltd.

Aksharchem (India) Ltd.

Akums Drugs & Pharmaceuticals Ltd.

Akzo Nobel India Ltd.

Alankit Ltd.

Albert David Ltd.

Alembic Ltd.

Alembic Pharmaceuticals Ltd.

Alfred Herbert (India) Ltd.

Algoquant Fintech Ltd.

Alicon Castalloy Ltd.

Alivus Life Sciences Ltd.

Alkali Metals Ltd.

Alkem Laboratories Ltd.

Alkyl Amines Chemicals Ltd.

All Time Plastics Ltd.

Allcargo Logistics Ltd.

Allcargo Terminals Ltd.

Alldigi Tech Ltd.

Allied Blenders And Distillers Ltd.

Allied Digital Services Ltd.

Almondz Global Securities Ltd.

Alok Industries Ltd.

Alpa Laboratories Ltd.

Alphageo (India) Ltd.

Amagi Media Labs Ltd.

Amanta Healthcare Ltd.

Amara Raja Energy & Mobility Ltd.

Amarjothi Spinning Mills Ltd.

Ambalal Sarabhai Enterprises Ltd.

Amber Enterprises India Ltd.

Ambica Agarbathies & Aroma Industries Ltd.

Ambika Cotton Mills Ltd.

Ambuja Cements Ltd.

AMD Industries Ltd.

Amforge Industries Ltd.

Amines & Plasticizers Ltd.

AMJ Land Holdings Ltd.

Amrutanjan Health Care Ltd.

Anand Rathi Share & Stock Brokers Ltd.

Anand Rathi Wealth Ltd.

Anant Raj Ltd.

Andhra Cements Ltd.

Andhra Paper Ltd.

Andhra Petrochemicals Ltd.

Andrew Yule & Company Ltd.

Angel One Ltd.

Anik Industries Ltd.

Anjani Portland Cement Ltd.

Anlon Healthcare Ltd.

Anmol India Ltd.

Ansal Housing Ltd.

Antarctica Ltd.

Antelopus Selan Energy Ltd.

Anthem Biosciences Ltd.

Antony Waste Handling Cell Ltd.

Anuh Pharma Ltd.

Anupam Rasayan India Ltd.

Apar Industries Ltd.

Apcotex Industries Ltd.

Apeejay Surrendra Park Hotels Ltd.

Apex Frozen Foods Ltd.

APL Apollo Tubes Ltd.

Apollo Hospitals Enterprise Ltd.

Apollo Micro Systems Ltd.

Apollo Pipes Ltd.

Apollo Sindoori Hotels Ltd.

Apollo Tyres Ltd.

Aptech Ltd.

Aptus Value Housing Finance India Ltd.

Aqylon Nexus Ltd.

Archean Chemical Industries Ltd.

Archidply Decor Ltd.

Archidply Industries Ltd.

Archies Ltd.

Aries Agro Ltd.

Arihant Capital Markets Ltd.

Arihant Foundations & Housing Ltd.

Arihant Superstructures Ltd.

Arisinfra Solutions Ltd.

Arkade Developers Ltd.

Arman Financial Services Ltd.

Aro Granite Industries Ltd.

Arrow Greentech Ltd.

Art Nirman Ltd.

Artemis Medicare Services Ltd.

Artson Ltd.

Aruna Hotels Ltd.

Arvee Laboratories (India) Ltd.

Arvind Fashions Ltd.

Arvind Ltd.

Arvind Smartspaces Ltd.

Asahi India Glass Ltd.

Asahi Songwon Colors Ltd.

Ashapura Minechem Ltd.

Ashiana Housing Ltd.

Ashima Ltd.

Ashok Leyland Ltd.

Ashoka Buildcon Ltd.

Ashoka Metcast Ltd.

ASI Industries Ltd.

Asian Energy Services Ltd.

Asian Granito India Ltd.

Asian Hotels (East) Ltd.

Asian Hotels (North) Ltd.

Asian Paints Ltd.

ASK Automotive Ltd.

Aspinwall And Company Ltd.

Associated Alcohols & Breweries Ltd.

Astec Lifesciences Ltd.

Aster DM Healthcare Ltd.

Astra Microwave Products Ltd.

Astral Ltd.

Astrazeneca Pharma India Ltd.

Astron Paper & Board Mill Ltd.

Atal Realtech Ltd.

Atam Valves Ltd.

Ather Energy Ltd.

Atlanta Electricals Ltd.

Atlantaa Ltd.

Atlas Cycles (Haryana) Ltd.

Atul Auto Ltd.

Atul Ltd.

AU Small Finance Bank Ltd.

Auri Grow India Ltd.

Aurionpro Solutions Ltd.

Aurobindo Pharma Ltd.

Aurum Proptech Ltd.

Authum Investment & Infrastructure Ltd.

Autoline Industries Ltd.

Automobile Corporation of Goa Ltd.

Automotive Axles Ltd.

Automotive Stampings and Assemblies Ltd.

Avadh Sugar & Energy Ltd.

Avalon Technologies Ltd.

Avantel Ltd.

Avanti Feeds Ltd.

Avenue Supermarts Ltd.

AvenuesAI Ltd.

AVG Logistics Ltd.

Avio Smart Market Stack Ltd.

Avonmore Capital & Management Services Ltd.

Avro India Ltd.

AVT Natural Products Ltd.

Awfis Space Solutions Ltd.

AWL Agri Business Ltd.

Axis Bank Ltd.

Axiscades Technologies Ltd.

AYE Finance Ltd.

AYM Syntex Ltd.

Azad Engineering Ltd.

B&B Triplewall Containers Ltd.

B.A.G. Films and Media Ltd.

B.C. Power Controls Ltd.

B.L. Kashyap and Sons Ltd.

Baazar Style Retail Ltd.

Bafna Pharmaceuticals Ltd.

Baid Finserv Ltd.

Bajaj Auto Ltd.

Bajaj Consumer Care Ltd.

Bajaj Electricals Ltd.

Bajaj Finance Ltd.

Bajaj Finserv Ltd.

Bajaj Healthcare Ltd.

Bajaj Hindusthan Sugar Ltd.

Bajaj Holdings & Investment Ltd.

Bajaj Housing Finance Ltd.

Bajel Projects Ltd.

Bal Pharma Ltd.

Balaji Amines Ltd.

Balaji Telefilms Ltd.

Balaxi Pharmaceuticals Ltd.

Balkrishna Industries Ltd.

Balkrishna Paper Mills Ltd.

Balmer Lawrie & Company Ltd.

Balrampur Chini Mills Ltd.

Balu Forge Industries Ltd.

Banaras Beads Ltd.

Banco Products (India) Ltd.

Bandhan Bank Ltd.

Bang Overseas Ltd.

Bank Of Baroda

Bank Of India

Bank Of Maharashtra

Banka Bioloo Ltd.

Bannari Amman Spinning Mills Ltd.

Bannari Amman Sugars Ltd.

Bansal Wire Industries Ltd.

Banswara Syntex Ltd.

Barak Valley Cements Ltd.

Baroda Rayon Corporation Ltd.

BASF India Ltd.

Bata India Ltd.

Batliboi Ltd.

Bayer CropScience Ltd.

BCL Industries Ltd.

Beardsell Ltd.

Bella Casa Fashion & Retail Ltd.

Belrise Industries Ltd.

BEML Land Assets Ltd.

BEML Ltd.

Berger Paints India Ltd.

Beta Drugs Ltd.

BF Investment Ltd.

Bhageria Industries Ltd.

Bhagiradha Chemicals & Industries Ltd.

Bhagyanagar India Ltd.

Bhandari Hosiery Exports Ltd.

Bhansali Engineering Polymers Ltd.

Bharat Bijlee Ltd.

Bharat Coking Coal Ltd.

Bharat Dynamics Ltd.

Bharat Electronics Ltd.

Bharat Forge Ltd.

Bharat Gears Ltd.

Bharat Heavy Electricals Ltd.

Bharat Petroleum Corporation Ltd.

Bharat Rasayan Ltd.

Bharat Road Network Ltd.

Bharat Seats Ltd.

Bharat Wire Ropes Ltd.

Bharti Airtel Ltd.

Bharti Hexacom Ltd.

Bhartiya International Ltd.

Bigbloc Construction Ltd.

Bikaji Foods International Ltd.

Billionbrains Garage Ventures Ltd.

Bimetal Bearings Ltd.

Biocon Ltd.

Biofil Chemicals & Pharmaceuticals Ltd.

Birla Cable Ltd.

Birla Corporation Ltd.

BirlaNu Ltd.

Birlasoft Ltd.

Black Box Ltd.

BlackBuck Ltd.

Bliss GVS Pharma Ltd.

BLS E-Services Ltd.

BLS International Services Ltd.

Blue Coast Hotels Ltd.

Blue Dart Express Ltd.

Blue Jet Healthcare Ltd.

Blue Star Ltd.

Bluestone Jewellery And Lifestyle Ltd.

Bluspring Enterprises Ltd.

BMW Ventures Ltd.

Bodal Chemicals Ltd.

Bodhi Tree Multimedia Ltd.

Bombay Burmah Trading Corporation Ltd.

Bombay Dyeing And Manufacturing Company Ltd.

Bombay Super Hybrid Seeds Ltd.

Borosil Ltd.

Borosil Renewables Ltd.

Borosil Scientific Ltd.

Bosch Home Comfort India Ltd.

Bosch Ltd.

BPL Ltd.

Brainbees Solutions Ltd.

Brand Concepts Ltd.

Brigade Enterprises Ltd.

Brigade Hotel Ventures Ltd.

Bright Brothers Ltd.

Britannia Industries Ltd.

Brooks Laboratories Ltd.

BSE - 100 PE

BSE - 100 Yield

BSE - 200 PE

BSE - 200 Yield

BSE - 30 PE

BSE - 30 Price to Book Value

BSE - 30 Yield

Bse 100

BSE 100 ESG Index

Bse 1000

Bse 200

BSE 200 Equal Weight

Bse 250 Microcap

Bse 500

BSE 500 Enhanced Value 50

BSE 500 Equal Weight

BSE 500 Low Volatility 50

BSE 500 Momentum 50

BSE 500 Quality 50

Bse Allcap

Bse Auto

Bse Bankex

BSE Bharat 22 Index

Bse Capital Goods

BSE Capital Markets

Bse Carbonex

BSE Clean Environment

BSE Commodities

Bse Consumer Durables

BSE Dividend Stability Index

Bse Dollex 100

Bse Dollex 200

Bse Dollex 30

BSE Energy

Bse Fast Moving Consumer Goods

BSE Financial Services

BSE Focused IT

BSE Focused Midcap

BSE Focused Midcap

Bse Greenex

Bse Healthcare

BSE Hospitals

BSE Housing Index

BSE India 150 Index

BSE India Defence

BSE India Infrastructure Index

BSE India Manufacturing Index

BSE India Sectors Leaders

BSE Industrials

Bse Information Technology

BSE Insurance Index

BSE Internet Economy

Bse IPO

BSE LargeCap

BSE LargeCap 100 Momentum 30

BSE LargeCap 100 Quality 30

BSE Ltd.

Bse Metal

Bse Midcap

BSE MidCap Select Index

BSE MidSmallCap

BSE Momentum Index

Bse Next 250 Microcap

Bse Next 500

Bse Oil & Gas

Bse Power

BSE Power & Energy

BSE Premium Consumption

BSE Premium Consumption

BSE PSU Bank

Bse Realty

BSE REIT & InvIT Index (INR)

BSE Select Business Groups

BSE Select IPO Index

Bse Sensex

BSE Sensex 1x Inverse Daily

BSE Sensex 2x Inverse Daily

BSE Sensex 2x Leverage Daily

BSE Sensex 50

Bse Sensex 50 TMC

Bse Sensex Equal Weight

BSE Sensex Next 30

Bse Sensex Next 50

BSE SENSEX Next 50 TMC

BSE Sensex Sixty

BSE Sensex Sixty 65:35

BSE Services

Bse Smallcap

BSE SmallCap Select Index

Bse SME IPO

Bse Tasis Shariah 50

Bse Teck

BSE Telecommunication

BSE Top 10 Banks

BSE Utilities

BSEL Algo Ltd.

BSL Ltd.

Burnpur Cement Ltd.

Butterfly Gandhimathi Appliances Ltd.

California Software Company Ltd.

Cambridge Technology Enterprises Ltd.

Camlin Fine Sciences Ltd.

Campus Activewear Ltd.

Can Fin Homes Ltd.

Canara Bank

Canara HSBC Life Insurance Company Ltd.

Canara Robeco Asset Management Co Ltd.

Cantabil Retail India Ltd.

Capacit'e Infraprojects Ltd.

Capillary Technologies India Ltd.

Capital India Finance Ltd.

Capital Small Finance Bank Ltd.

Caplin Point Laboratories Ltd.

Capri Global Capital Ltd.

Caprihans India Ltd.

Carborundum Universal Ltd.

Care Ratings Ltd.

Career Point Edutech Ltd.

Carraro India Ltd.

CarTrade Tech Ltd.

Carysil Ltd.

Castrol India Ltd.

CCL Products (India) Ltd.

CE Info Systems Ltd.

Ceat Ltd.

Ceigall India Ltd.

Ceinsys Tech Ltd.

Celebrity Fashions Ltd.

Cello World Ltd.

Cemindia Projects Ltd.

Central Bank Of India

Central Depository Services (India) Ltd.

Centrum Capital Ltd.

Centum Electronics Ltd.

Century Enka Ltd.

Century Extrusions Ltd.

Century Plyboards (India) Ltd.

Cera Sanitaryware Ltd.

CESC Ltd.

CG Power and Industrial Solutions Ltd.

Chalet Hotels Ltd.

Chaman Lal Setia Exports Ltd.

Chambal Fertilisers and Chemicals Ltd.

Chembond Chemicals Ltd.

Chembond Material Technologies Ltd.

Chemcon Speciality Chemicals Ltd.

Chemfab Alkalis Ltd.

Chemplast Sanmar Ltd.

Chennai Petroleum Corporation Ltd.

Cheviot Company Ltd.

Choice International Ltd.

Cholamandalam Financial Holdings Ltd.

Cholamandalam Investment and Finance Company Ltd.

CIE Automotive India Ltd.

Cigniti Technologies Ltd.

Cineline India Ltd.

Cinevista Ltd.

Cipla Ltd.

Citurgia Biochemicals Ltd.

City Union Bank Ltd.

CL Educate Ltd.

Clean Max Enviro Energy Solutions Ltd.

Clean Science And Technology Ltd.

CMS Info Systems Ltd.

Coal India Ltd.

Coastal Corporation Ltd.

Cochin Shipyard Ltd.

Coffee Day Enterprises Ltd.

Coforge Ltd.

Cohance Lifesciences Ltd.

Colgate-Palmolive (India) Ltd.

Commercial Syn Bags Ltd.

Compucom Software Ltd.

Computer Age Management Services Ltd.

Concord Biotech Ltd.

Concord Enviro Systems Ltd.

Confidence Petroleum India Ltd.

Consolidated Construction Consortium Ltd.

Container Corporation Of India Ltd.

Control Print Ltd.

Coral India Finance & Housing Ltd.

Cords Cable Industries Ltd.

Coromandel Engineering Company Ltd.

Coromandel International Ltd.

CORONA Remedies Ltd.

Cosmo First Ltd.

Country Club Hospitality & Holidays Ltd.

Country Condo's Ltd.

CP Capital Ltd.

Craftsman Automation Ltd.

Creative Eye Ltd.

Creative Newtech Ltd.

CreditAccess Grameen Ltd.

Credo Brands Marketing Ltd.

Crest Ventures Ltd.

CRISIL Ltd.

Crizac Ltd.

Crompton Greaves Consumer Electricals Ltd.

Crown Lifters Ltd.

CSB Bank Ltd.

CSL Finance Ltd.

Cubex Tubings Ltd.

Cummins India Ltd.

Cupid Ltd.

CyberTech Systems And Software Ltd.

Cyient DLM Ltd.

Cyient Ltd.

D-Link (India) Ltd.

D.B. Corp Ltd.

D.P. Abhushan Ltd.

D.P. Wires Ltd.

Dabur India Ltd.

Dai-Ichi Karkaria Ltd.

Dalmia Bharat Ltd.

Dalmia Bharat Sugar And Industries Ltd.

Dalmia Refractories Ltd.

DAM Capital Advisors Ltd.

Damodar Industries Ltd.

Dangee Dums Ltd.

Data Patterns (India) Ltd.

Datamatics Global Services Ltd.

Davangere Sugar Company Ltd.

DB (International) Stock Brokers Ltd.

DC Infotech and Communication Ltd.

DCB Bank Ltd.

DCM Financial Services Ltd.

DCM Ltd.

DCM Nouvelle Ltd.

DCM Shriram Fine Chemicals Ltd.

DCM Shriram Industries Ltd.

DCM Shriram International Ltd.

DCM Shriram Ltd.

DCW Ltd.

DCX Systems Ltd.

Ddev Plastiks Industries Ltd.

De Nora India Ltd.

Deccan Cements Ltd.

Dee Development Engineers Ltd

Deep Industries Ltd.

Deepak Builders & Engineers India Ltd.

Deepak Fertilisers And Petrochemicals Corporation Ltd.

Deepak Nitrite Ltd.

Deepak Spinners Ltd.

Delhivery Ltd.

Delphi World Money Ltd.

Delta Corp Ltd.

Delta Manufacturing Ltd.

Den Networks Ltd.

Denta Water And Infra Solutions Ltd.

Dev Accelerator Ltd.

Dev Information Technology Ltd.

Devyani International Ltd.

Dhampur Bio Organics Ltd.

Dhampur Sugar Mills Ltd.

Dhanlaxmi Bank Ltd.

Dhanuka Agritech Ltd.

Dharmaj Crop Guard Ltd.

Dhruv Consultancy Services Ltd.

Dhunseri Investments Ltd.

Dhunseri Tea & Industries Ltd.

Dhunseri Ventures Ltd.

Diamines & Chemicals Ltd.

Diamond Power Infrastructure Ltd.

DIC India Ltd.

Diffusion Engineers Ltd.

Digicontent Ltd.

Digidrive Distributors Ltd.

Digispice Technologies Ltd.

Digitide Solutions Ltd.

Digjam Ltd.

Diligent Media Corporation Ltd.

Dilip Buildcon Ltd.

Disa India Ltd.

Dish TV India Ltd.

Dishman Carbogen Amcis Ltd.

Divgi Torqtransfer Systems Ltd.

Divi's Laboratories Ltd.

Dixon Technologies (India) Ltd.

DLF Ltd.

DMCC Speciality Chemicals Ltd.

Dodla Dairy Ltd

Dolat Algotech Ltd.

Dollar Industries Ltd.

Dolphin Offshore Enterprises (India) Ltd.

DOMS Industries Ltd.

Donear Industries Ltd.

Dr. Agarwal's Health Care Ltd.

Dr. Lal Pathlabs Ltd.

Dr. Reddy's Laboratories Ltd.

DRC Systems India Ltd.

Dreamfolks Services Ltd.

Dredging Corporation Of India Ltd.

DSJ Keep Learning Ltd.

Ducon Infratechnologies Ltd.

Dwarikesh Sugar Industries Ltd.

Dynacons Systems & Solutions Ltd.

Dynamatic Technologies Ltd.

Dynamic Cables Ltd.

Dynemic Products Ltd.

E-Land Apparel Ltd.

E.I.D. - Parry (India) Ltd.

Easy Trip Planners Ltd.

eClerx Services Ltd.

Ecos (India) Mobility & Hospitality Ltd.

Edelweiss Financial Services Ltd.

EFC (I) Ltd.

Eicher Motors Ltd.

EIH Associated Hotels Ltd.

EIH Ltd.

Eimco Elecon (India) Ltd.

Elantas Beck India Ltd.

Eldeco Housing & Industries Ltd.

Elecon Engineering Company Ltd.

Electronics Mart India Ltd.

Electrosteel Castings Ltd.

Electrotherm (India) Ltd.

Elgi Equipments Ltd.

Elgi Rubber Company Ltd.

Elin Electronics Ltd.

Ellenbarrie Industrial Gases Ltd.

Elnet Technologies Ltd.

Elpro International Ltd.

Emami Ltd.

Emami Paper Mills Ltd.

Emami Realty Ltd.

Emcure Pharmaceuticals Ltd.

Emkay Global Financial Services Ltd.

Emmbi Industries Ltd.

Emmvee Photovoltaic Power Ltd.

EMS Ltd.

eMudhra Ltd.

Endurance Technologies Ltd.

Energy Development Company Ltd.

Engineers India Ltd.

Entero Healthcare Solutions Ltd.

Entertainment Network (India) Ltd.

Enviro Infra Engineers Ltd.

EPACK Durable Ltd.

EPack Prefab Technologies Ltd.

Epigral Ltd.

EPL Ltd.

Equitas Small Finance Bank Ltd.

Eris Lifesciences Ltd.

Esab India Ltd.

ESAF Small Finance Bank Ltd.

Escorts Kubota Ltd.

Essar Shipping Ltd.

Ester Industries Ltd.

Eternal Ltd.

Ethos Ltd.

Eureka Forbes Ltd.

Euro India Fresh Foods Ltd.

Euro Panel Products Ltd.

Euro Pratik Sales Ltd.

Eveready Industries India Ltd.

Everest Industries Ltd.

Everest Kanto Cylinder Ltd.

Excel Industries Ltd.

Excel Realty N Infra Ltd.

Excelsoft Technologies Ltd.

Exicom Tele-Systems Ltd.

Exide Industries Ltd.

Expleo Solutions Ltd.

Exxaro Tiles Ltd.

Fabtech Technologies Ltd.

Fairchem Organics Ltd.

FCS Software Solutions Ltd.

FDC Ltd.

Fedbank Financial Services Ltd

Federal-Mogul Goetze (India) Ltd.

FGP Ltd.

Fiem Industries Ltd.

Filatex Fashions Ltd.

Filatex India Ltd.

Fine Organic Industries Ltd.

Fineotex Chemical Ltd.

Finkurve Financial Services Ltd.

Fino Payments Bank Ltd.

Finolex Cables Ltd.

Finolex Industries Ltd.

Firstsource Solutions Ltd.

Fischer Medical Ventures Ltd.

Five-Star Business Finance Ltd.

Flair Writing Industries Ltd.

Flexituff Ventures International Ltd.

Focus Lighting & Fixtures Ltd.

Foods & Inns Ltd.

Forbes & Company Ltd.

Force Motors Ltd.

Fortis Healthcare Ltd.

Foseco India Ltd.

Fractal Analytics Ltd.

FSN E-Commerce Ventures Ltd.

Fujiyama Power Systems Ltd.

Fusion Finance Ltd.

Future Market Networks Ltd.

G-Tec Jainx Education Ltd.

Gabriel India Ltd.

GACM Technologies Ltd.

GACM Technologies Ltd. - (DVR)

GAIL (India) Ltd.

Gala Precision Engineering Ltd.

Galada Power & Telecommunication Ltd.

Galaxy Surfactants Ltd.

Gallantt Ispat Ltd.

Gandhar Oil Refinery (India) Ltd.

Gandhi Special Tubes Ltd.

Ganesh Benzoplast Ltd.

Ganesh Consumer Products Ltd.

Ganesh Housing Ltd.

Ganesha Ecosphere Ltd.

Ganga Forging Ltd.

Ganges Securities Ltd.

Garden Reach Shipbuilders & Engineers Ltd.

Garuda Construction & Engineering Ltd.

Garware Hi-Tech Films Ltd.

Garware Technical Fibres Ltd.

Gateway Distriparks Ltd.

Gayatri Highways Ltd.

GE Vernova T&D India Ltd.

GeeCee Ventures Ltd.

Geekay Wires Ltd.

Gem Aromatics Ltd.

General Insurance Corporation of India

Generic Engineering Construction And Projects Ltd.

Genesys International Corporation Ltd.

Genus Paper & Boards Ltd.

Genus Power Infrastructures Ltd.

Geojit Financial Services Ltd.

GFL Ltd.

GHCL Ltd.

GHCL Textiles Ltd.

GIC Housing Finance Ltd.

Gillanders Arbuthnot & Company Ltd.

Gillette India Ltd.

Ginni Filaments Ltd.

GK Energy Ltd.

GKW Ltd.

Gland Pharma Ltd.

Glaxosmithkline Pharmaceuticals Ltd.

Glenmark Pharmaceuticals Ltd.

Global Education Ltd.

Global Health Ltd.

Global Offshore Services Ltd.

Global Surfaces Ltd.

Global Vectra Helicorp Ltd.

Globale Tessile Ltd.

Globe Civil Projects Ltd.

Globe Enterprises (India) Ltd.

Globus Spirits Ltd.

Gloster Ltd.

Glottis Ltd.

GM Breweries Ltd.

GMM Pfaudler Ltd.

GMR Airports Ltd.

GMR Power and Urban Infra Ltd.

GNA Axles Ltd.

GNG Electronics Ltd.

Go Digit General Insurance Ltd.

Go Fashion (India) Ltd.

Goa Carbon Ltd.

GOCL Corporation Ltd.

Godavari Biorefineries Ltd.

Godawari Power And Ispat Ltd.

Godfrey Phillips India Ltd.

Godrej Agrovet Ltd.

Godrej Consumer Products Ltd.

Godrej Industries Ltd.

Godrej Properties Ltd.

Gokaldas Exports Ltd.

Gokul Agro Resources Ltd.

Gokul Refoils and Solvent Ltd.

Goldiam International Ltd.

Goodluck India Ltd.

Goodricke Group Ltd.

Goodyear India Ltd.

Gopal Snacks Ltd.

GP Petroleums Ltd.

GPT Healthcare Ltd.

GPT Infraprojects Ltd.

GR Infraprojects Ltd.

Granules India Ltd.

Graphite India Ltd.

Grasim Industries Ltd.

Grauer & Weil (India) Ltd.

Gravita India Ltd.

Greaves Cotton Ltd.

Greenlam Industries Ltd.

Greenpanel Industries Ltd.

Greenply Industries Ltd.

Grindwell Norton Ltd.

GRM Overseas Ltd.

GRP Ltd.

GSECBM NSE

GSS Infotech Ltd.

GTL Infrastructure Ltd.

GTL Ltd.

GTN Industries Ltd.

GTPL Hathway Ltd.

Gufic Biosciences Ltd.

Gujarat Alkalies And Chemicals Ltd.

Gujarat Ambuja Exports Ltd.

Gujarat Apollo Industries Ltd.

Gujarat Cotex Ltd.

Gujarat Fluorochemicals Ltd.

Gujarat Gas Ltd.

Gujarat Industries Power Company Ltd.

Gujarat Kidney And Super Speciality Ltd.

Gujarat Mineral Development Corporation Ltd.

Gujarat Narmada Valley Fertilizers & Chemicals Ltd

Gujarat Pipavav Port Ltd.

Gujarat Raffia Industries Ltd.

Gujarat State Fertilizers & Chemicals Ltd.

Gujarat State Petronet Ltd.

Gujarat Themis Biosyn Ltd.

Gulf Oil Lubricants India Ltd.

Gulshan Polyols Ltd.

GVP Infotech Ltd.

H.G. Infra Engineering Ltd.

Halder Venture Ltd.

Haleos Labs Ltd.

HandsOn Global Management (HGM) Ltd.

Happiest Minds Technologies Ltd.

Happy Forgings Ltd.

Harig Crankshafts Ltd.

Hariom Pipe Industries Ltd.

Harrisons Malayalam Ltd.

Harsha Engineers International Ltd.

Hathway Cable & Datacom Ltd.

Hatsun Agro Product Ltd.

Havells India Ltd.

Hawkins Cookers Ltd.

HB Stockholdings Ltd.

HBL Engineering Ltd.

HCL Infosystems Ltd.

HCL Technologies Ltd.

HDB Financial Services Ltd.

HDFC Asset Management Company Ltd.

HDFC Bank Ltd.

HDFC Life Insurance Company Ltd.

Heads UP Ventures Ltd.

Health X Platform Ltd.

Healthcare Global Enterprises Ltd.

HEC Infra Projects Ltd.

HEG Ltd.

Heidelberg Cement India Ltd.

Hemisphere Properties India Ltd.

Heranba Industries Ltd.

Hercules Investments Ltd.

Heritage Foods Ltd.

Hero MotoCorp Ltd.

Hester Biosciences Ltd.

Hexa Tradex Ltd.

Hexaware Technologies Ltd.

HFCL Ltd.

Hi-Tech Pipes Ltd.

Highway Infrastructure Ltd.

Hikal Ltd.

Hilton Metal Forging Ltd.

Himadri Speciality Chemical Ltd.

Himatsingka Seide Ltd.

Hind Rectifiers Ltd.

Hindalco Industries Ltd.

Hindcon Chemicals Ltd.

Hindprakash Industries Ltd.

Hinduja Global Solutions Ltd.

Hindustan Aeronautics Ltd.

Hindustan Composites Ltd.

Hindustan Construction Company Ltd.

Hindustan Copper Ltd.

Hindustan Foods Ltd.

Hindustan Media Ventures Ltd.

Hindustan Motors Ltd.

Hindustan Oil Exploration Company Ltd.

Hindustan Organic Chemicals Ltd.

Hindustan Petroleum Corporation Ltd.

Hindustan Tin Works Ltd.

Hindustan Unilever Ltd.

Hindustan Zinc Ltd.

Hindware Home Innovation Ltd.

Hisar Metal Industries Ltd.

Hitachi Energy India Ltd.

Hitech Corporation Ltd.

HLE Glascoat Ltd.

HLV Ltd.

HMA Agro Industries Ltd.

Home First Finance Company India Ltd.

Honasa Consumer Ltd.

Honda India Power Products Ltd.

Honeywell Automation India Ltd.

Housing & Urban Development Corporation Ltd.

HP Adhesives Ltd.

HPL Electric & Power Ltd.

HT Media Ltd.

Hubtown Ltd.

Huhtamaki India Ltd.

Hybrid Financial Services Ltd.

Hyundai Motor India Ltd.

ICDS Ltd.

ICE Make Refrigeration Ltd.

ICICI Bank Ltd.

ICICI Lombard General Insurance Company Ltd.

ICICI Prudential Asset Management Company Ltd.

ICICI Prudential Life Insurance Company Ltd.

ICL Multitrading India Ltd.

ICRA Ltd.

IDBI Bank Ltd.

Ideaforge Technology Ltd.

IDFC First Bank Ltd.

IFB Agro Industries Ltd.

IFB Industries Ltd.

IFCI Ltd.

IFGL Refractories Ltd.

IG Petrochemicals Ltd.

Igarashi Motors India Ltd.

IIFL Capital Services Ltd.

IIFL Finance Ltd.

IKIO Technologies Ltd.

IL&FS Investment Managers Ltd.

Imagicaaworld Entertainment Ltd.

IMEC Services Ltd.

Incredible Industries Ltd.

Ind-Swift Laboratories Ltd.

Indbank Merchant Banking Services Ltd.

Indef Manufacturing Ltd.

Indegene Ltd.

India Glycols Ltd.

India Homes Ltd.

India Lease Development Ltd.

India Motor Parts & Accessories Ltd.

India Nippon Electricals Ltd.

India Pesticides Ltd.

India Power Corporation Ltd.

India Shelter Finance Corporation Ltd.

India Tourism Development Corporation Ltd.

India VIX

Indiabulls Ltd.

Indiamart Intermesh Ltd.

Indian Acrylics Ltd.

Indian Bank

Indian Card Clothing Company Ltd.

Indian Energy Exchange Ltd.

Indian Hume Pipe Company Ltd.

Indian Metals & Ferro Alloys Ltd.

Indian Oil Corporation Ltd.

Indian Overseas Bank

Indian Railway Catering And Tourism Corporation Ltd.

Indian Railway Finance Corporation Ltd.

Indian Renewable Energy Development Agency Ltd.

Indian Terrain Fashions Ltd.

Indigo Paints Ltd.

Indiqube Spaces Ltd.

Indo Amines Ltd.

Indo Borax & Chemicals Ltd.

Indo Count Industries Ltd.

Indo Farm Equipments Ltd.

Indo Rama Synthetics (India) Ltd.

Indo Tech Transformers Ltd.

Indo Thai Securities Ltd.

Indo US Bio-Tech Ltd.

Indo-National Ltd.

Indoco Remedies Ltd.

Indogulf Cropsciences Ltd.

Indostar Capital Finance Ltd.

Indowind Energy Ltd.

Indraprastha Gas Ltd.

Indraprastha Medical Corporation Ltd.

Indus Towers Ltd.

IndusInd Bank Ltd.

Industrial Investment Trust Ltd.

Info Edge (India) Ltd.

Infobeans Technologies Ltd.

Infomedia Press Ltd.

Infosys Ltd.

Ingersoll-Rand (India) Ltd.

Innova Captab Ltd.

Innovana Thinklabs Ltd.

Inox Green Energy Services Ltd.

Inox India Ltd.

Inox Wind Ltd.

Insecticides (India) Ltd.

Insolation Energy Ltd.

Integra Essentia Ltd.

Intellect Design Arena Ltd.

Intense Technologies Ltd.

Interarch Building Solutions Ltd.

Interglobe Aviation Ltd.

International Constructions Ltd.

International Conveyors Ltd.

International Gemmological Institute (India) Ltd.

International Travel House Ltd.

Intrasoft Technologies Ltd.

Inventure Growth & Securities Ltd.

Inventurus Knowledge Solutions Ltd.

Invigorated Business Consulting Ltd.

IOL Chemicals And Pharmaceuticals Ltd.

Ion Exchange (India) Ltd.

Ipca Laboratories Ltd.

IRB Infrastructure Developers Ltd.

Ircon International Ltd.

Iris Clothings Ltd.

IRIS RegTech Solutions Ltd.

IRM Energy Ltd.

ISGEC Heavy Engineering Ltd.

Ishan Dyes and Chemicals Ltd.

ITC Hotels Ltd.

ITC Ltd.

ITI Ltd.

Ivalue Infosolutions Ltd.

IVP Ltd.

J Kumar Infraprojects Ltd.

Jagran Prakashan Ltd.

Jagsonpal Pharmaceuticals Ltd.

Jai Balaji Industries Ltd.

Jai Corp Ltd.

Jain Irrigation Systems Ltd.

Jain Irrigation Systems Ltd. (DVR)

Jain Resource Recycling Ltd.

Jaiprakash Power Ventures Ltd.

Jamna Auto Industries Ltd.

Jana Small Finance Bank Ltd.

Jaro Institute of Technology Management and Research Ltd.

Jasch Industries Ltd.

Jash Engineering Ltd.

Jay Bharat Maruti Ltd.

Jay Shree Tea & Industries Ltd.

Jayant Agro-Organics Ltd.

Jayaswal Neco Industries Ltd.

Jaykay Enterprises Ltd.

JB Chemicals & Pharmaceuticals Ltd.

JBM Auto Ltd.

JCT Ltd.

Jeena Sikho Lifecare Ltd.

Jet Freight Logistics Ltd.

JG Chemicals Ltd.

JHS Svendgaard Laboratories Ltd.

JHS Svendgaard Retail Ventures Ltd.

Jindal Drilling & Industries Ltd.

Jindal Photo Ltd.

Jindal Poly Films Ltd.

Jindal Poly Investment and Finance Company Ltd.

Jindal Saw Ltd.

Jindal Stainless Ltd.

Jindal Steel Ltd.

Jindal Worldwide Ltd.

Jinkushal Industries Ltd.

JIO Financial Services Ltd.

JK Cement Ltd.

JK Lakshmi Cement Ltd.

JK Paper Ltd.

JK Tyre & Industries Ltd.

JM Financial Ltd.

JNK India Ltd.

Jocil Ltd.

John Cockerill India Ltd

JSW Cement Ltd.

JSW Energy Ltd.

JSW Holdings Ltd.

JSW Infrastructure Ltd.

JSW Steel Ltd.

JTEKT India Ltd.

JTL Industries Ltd

Jubilant Agri And Consumer Products Ltd.

Jubilant FoodWorks Ltd.

Jubilant Ingrevia Ltd.

Jubilant Pharmova Ltd.

Jullundur Motor Agency (Delhi) Ltd.

Juniper Hotels Ltd.

Jupiter Life Line Hospitals Ltd.

Jupiter Wagons Ltd.

Just Dial Ltd.

Jyothy Labs Ltd.

Jyoti CNC Automation Ltd.

Jyoti Structures Ltd.

K-Lifestyle Industries Ltd.

K.C.P. Sugar And Industries Corporation Ltd.

K.M. Sugar Mills Ltd.

K.P.R. Mill Ltd.

Kabra Extrusiontechnik Ltd.

Kajaria Ceramics Ltd.

Kakatiya Cement Sugar & Industries Ltd.

Kalpataru Ltd.

Kalpataru Projects International Ltd.

Kalyan Jewellers India Ltd.

Kalyani Forge Ltd.

Kalyani Investment Company Ltd.

Kalyani Steels Ltd.

Kamat Hotels (India) Ltd.

Kamdhenu Ltd.

Kamdhenu Ventures Ltd.

Kanani Industries Ltd.

Kanoria Chemicals & Industries Ltd.

Kanpur Plastipack Ltd.

Kansai Nerolac Paints Ltd.

Karma Energy Ltd.

Karur Vysya Bank Ltd.

Kaushalya Infrastructure Development Corporation Ltd.

Kaveri Seed Company Ltd.

Kaya Ltd.

Kaynes Technology India Ltd.

KCP Ltd.

KDDL Ltd.

KEC International Ltd.

KEI Industries Ltd.

Kellton Tech Solutions Ltd.

Kennametal India Ltd.

Kernex Microsystems (India) Ltd.

Kesar Enterprises Ltd.

Kesar Terminals & Infrastructure Ltd.

Kewal Kiran Clothing Ltd.

Keynote Financial Services Ltd.

Keystone Realtors Ltd

KFin Technologies Ltd.

KG Denim Ltd.

Khadim India Ltd.

Khaitan (India) Ltd.

Khaitan Chemicals & Fertilizers Ltd.

Khandwala Securities Ltd.

Kilburn Engineering Ltd.

Kilitch Drugs (India) Ltd.

Kinetic Engineering Ltd.

Kingfa Science & Technology (India) Ltd.

KIOCL Ltd.

Kiri Industries Ltd.

Kirloskar Brothers Ltd.

Kirloskar Electric Company Ltd.

Kirloskar Ferrous Industries Ltd.

Kirloskar Industries Ltd.

Kirloskar Oil Engines Ltd.

Kirloskar Pneumatic Company Ltd.

Kitex Garments Ltd.

KN Agri Resources Ltd.

Knowledge Marine & Engineering Works Ltd.

KNR Constructions Ltd.

Kohinoor Foods Ltd.

Kokuyo Camlin Ltd.

Kolte-Patil Developers Ltd.

Kopran Ltd.

Kotak Mahindra Bank Ltd.

Kothari Industrial Corporation Ltd.

Kothari Petrochemicals Ltd.

Kothari Products Ltd.

Kothari Sugars And Chemicals Ltd.

Kovai Medical Center & Hospital Ltd.

KP Energy Ltd.

KPI Green Energy Ltd.

KPIT Technologies Ltd.

KRBL Ltd.

Krebs Biochemicals & Industries Ltd.

Kridhan Infra Ltd.

Krishana Phoschem Ltd.

Krishival Foods Ltd.

Krishna Defence and Allied Industries Ltd.

Krishna Institute of Medical Sciences Ltd

Kriti Industries (India) Ltd.

Kriti Nutrients Ltd.

Kritika Wires Ltd.

KRN Heat Exchanger And Refrigeration Ltd.

Kronox Lab Sciences Ltd.

Kross Ltd.

Krsnaa Diagnostics Ltd.

Krystal Integrated Services Ltd

KSB Ltd.

KSolves India Ltd.

Kuantum Papers Ltd.

Kush Industries Ltd.

Kwality Wall's (India) Ltd.

L&T Finance Ltd.

L&T Technology Services Ltd.

La Opala RG Ltd.

Lagnam Spintex Ltd.

Lakshmi Electrical Control Systems Ltd.

Lakshmi Finance & Industrial Corporation Ltd.

Lakshmi Mills Company Ltd.

Lambodhara Textiles Ltd.

Lancer Container Lines Ltd.

Landmark Cars Ltd.

Landmark Property Development Company Ltd.

Larsen & Toubro Ltd.

Lasa Supergenerics Ltd.

Latent View Analytics Ltd.

Latteys Industries Ltd.

Laurus Labs Ltd.

Laxmi Dental Ltd.

Laxmi Goldorna House Ltd.

Laxmi India Finance Ltd.

Laxmi Organic Industries Ltd.

Le Merite Exports Ltd.

Le Travenues Technology Ltd.

Leela Palaces Hotels & Resorts Ltd.

Lemon Tree Hotels Ltd.

Lenskart Solutions Ltd.

LG Balakrishnan & Bros Ltd.

LG Electronics India Ltd.

Libas Consumer Products Ltd.

Liberty Shoes Ltd.

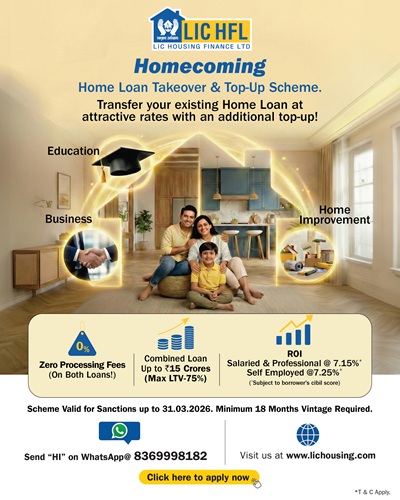

LIC Housing Finance Ltd.

Life Insurance Corporation of India

Likhitha Infrastructure Ltd.

Linc Ltd.

Lincoln Pharmaceuticals Ltd.

Linde India Ltd.

LKP Finance Ltd.

Lloyds Engineering Works Ltd.

Lloyds Enterprises Ltd.

Lloyds Metals & Energy Ltd.

LMW Ltd.

Lodha Developers Ltd.

Lokesh Machines Ltd.

Lords Chloro Alkali Ltd.

Lorenzini Apparels Ltd.

Lotus Eye Hospital And Institute Ltd.

Lovable Lingerie Ltd.

LT Foods Ltd.

LTIMindtree Ltd.

Lumax Auto Technologies Ltd.

Lumax Industries Ltd.

Lupin Ltd.

Lux Industries Ltd.

Lyka Labs Ltd.

Lypsa Gems & Jewellery Ltd.

M&B Engineering Ltd.

Maan Aluminium Ltd.

Macpower CNC Machines Ltd.

Madhav Marbles And Granites Ltd.

Madhucon Projects Ltd.

Madhya Bharat Agro Products Ltd.

Madras Fertilizers Ltd.

Mafatlal Industries Ltd.

Magadh Sugar & Energy Ltd.

Magellanic Cloud Ltd.

Magnum Ventures Ltd.

Maha Rashtra Apex Corporation Ltd.

Mahalaxmi Fabric Mills Ltd.

Mahalaxmi Rubtech Ltd.

Mahamaya Steel Industries Ltd.

Mahanagar Gas Ltd.

Mahanagar Telephone Nigam Ltd.

Maharashtra Scooters Ltd.

Maharashtra Seamless Ltd.

Maheshwari Logistics Ltd.

Mahindra & Mahindra Financial Services Ltd.

Mahindra & Mahindra Ltd.

Mahindra EPC Irrigation Ltd.

Mahindra Holidays & Resorts India Ltd.

Mahindra Lifespace Developers Ltd.

Mahindra Logistics Ltd.

Maithan Alloys Ltd.

Majestic Auto Ltd.

Mallcom (India) Ltd

Malu Paper Mills Ltd.

Mamata Machinery Ltd.

Man Industries (India) Ltd.

Man InfraConstruction Ltd.

Manaksia Coated Metals & Industries Ltd.

Manaksia Ltd.

Manaksia Steels Ltd.

Manali Petrochemicals Ltd.

Manappuram Finance Ltd.

Manba Finance Ltd.

Mangal Credit and Fincorp Ltd.

Mangal Electrical Industries Ltd.

Mangalam Cement Ltd.

Mangalam Global Enterprise Ltd.

Mangalam Organics Ltd.

Mangalam Worldwide Ltd.

Mangalore Refinery And Petrochemicals Ltd.

Manjeera Constructions Ltd.

Mankind Pharma Ltd.

Manoj Vaibhav Gems 'N' Jewellers Ltd.

Manomay Tex India Ltd.

Manorama Industries Ltd.

Manugraph India Ltd.

Maral Overseas Ltd.

Marathon Nextgen Realty Ltd.

Marico Ltd.

Marine Electricals (India) Ltd.

Markolines Pavement Technologies Ltd.

Marksans Pharma Ltd.

Maruti Suzuki India Ltd.

MAS Financial Services Ltd.

Mask Investments Ltd.

Mastek Ltd.

Master Trust Ltd.

Matrimony.Com Ltd.

Mawana Sugars Ltd.

Max Estates Ltd.

Max Financial Services Ltd.

Max Healthcare Institute Ltd.

Max India Ltd.

Mayur Uniquoters Ltd.

Mazagon Dock Shipbuilders Ltd.

Mazda Ltd.

MBL Infrastructure Ltd.

Mcleod Russel India Ltd.

Medi Assist Healthcare Services Ltd.

Medi-Caps Ltd.

Media Matrix Worldwide Ltd

Medicamen Biotech Ltd.

Medico Remedies Ltd.

Medplus Health Services Ltd.

Meesho Ltd.

Megastar Foods Ltd.

Meghmani Organics Ltd.

Menon Bearings Ltd.

Metro Brands Ltd.

Metroglobal Ltd.

Metropolis Healthcare Ltd.

MIC Electronics Ltd.

Midwest Ltd.

Minda Corporation Ltd.

Mindteck (India) Ltd.

Mirc Electronics Ltd.

Mirza International Ltd.

Mishra Dhatu Nigam Ltd.

Mitcon Consultancy & Engineering Services Ltd.

Mittal Life Style Ltd.

MK Proteins Ltd.

MM Forgings Ltd.

MMP Industries Ltd.

MMTC Ltd.

Modern Insulators Ltd.

Modern Malleables Ltd.

Modern Threads (India) Ltd.

Modi Naturals Ltd.

Modi Rubber Ltd.

Modi's Navnirman Ltd.

Modipon Ltd.

Modison Ltd.

Mohit Industries Ltd.

MOIL Ltd.

Moksh Ornaments Ltd.

Mold-Tek Packaging Ltd.

Mold-Tek Technologies Ltd.

Monarch Networth Capital Ltd.

Moneyboxx Finance Ltd.

Monte Carlo Fashions Ltd.

Morepen Laboratories Ltd.

Moschip Technologies Ltd.

Motherson Sumi Wiring India Ltd.

Motilal Oswal Financial Services Ltd.

Motisons Jewellers Ltd.

Mphasis Ltd.

MPS Ltd.

MRF Ltd.

Mrs. Bectors Food Specialities Ltd.

MSP Steel & Power Ltd.

MSTC Ltd.

MTAR Technologies Ltd.

Mufin Green Finance Ltd.

Mukand Ltd.

Mukka Proteins Ltd.

Mukta Arts Ltd.

Multi Commodity Exchange Of India Ltd.

Munjal Auto Industries Ltd.

Munjal Showa Ltd.

Murudeshwar Ceramics Ltd.

Music Broadcast Ltd.

Muthoot Capital Services Ltd.

Muthoot Finance Ltd.

Muthoot Microfin Ltd.

Mysore Petro Chemicals Ltd.

N.B.I. Industrial Finance Co. Ltd.

NACL Industries Ltd.

Naga Dhunseri Group Ltd.

Nagarjuna Fertilizers and Chemicals Ltd.

Nagreeka Capital & Infrastructure Ltd.

Nagreeka Exports Ltd.

Nahar Capital And Financial Services Ltd.

Nahar Industrial Enterprises Ltd.

Nahar Poly Films Ltd.

Nahar Spinning Mills Ltd.

Nakoda Group Of Industries Ltd.

Nalwa Sons Investments Ltd.

Nandan Denim Ltd.

Nandani Creation Ltd.

Naperol Investments Ltd.

Narayana Hrudayalaya Ltd.

Narmada Agrobase Ltd.

Narmada Gelatines Ltd.

Natco Pharma Ltd.

Nath Bio-Genes (India) Ltd.

National Aluminium Company Ltd.

National Fertilizers Ltd.

National Oxygen Ltd.

Natural Capsules Ltd.

Nava Ltd.

Navin Fluorine International Ltd.

Navkar Corporation Ltd.

Navkar Urbanstructure Ltd.

Navneet Education Ltd.

Nazara Technologies Ltd.

NBCC (India) Ltd.

NCC Ltd.

NCL Industries Ltd.

NDL Ventures Ltd.

NDR Auto Components Ltd.

Nectar Lifesciences Ltd.

Nelcast Ltd.

Nelco Ltd.

Neogen Chemicals Ltd.

Nephrocare Health Services Ltd.

Nesco Ltd.

Nestle India Ltd.

Netweb Technologies India Ltd.

Network 18 Media & Investments Ltd.

Network People Services Technologies Ltd.

Neuland Laboratories Ltd.

New Delhi Television Ltd.

Newgen Software Technologies Ltd.

Next Mediaworks Ltd.

NFP Sampoorna Foods Ltd.

NGL Fine-Chem Ltd.

NHPC Ltd.

NIBE Ltd.

Nifty 10 yr Benchmark G-Sec

Nifty 100

Nifty 11-15 yr G-Sec Index

Nifty 1D Rate Index

Nifty 200

Nifty 4-8 yr G-Sec Index

Nifty 50

Nifty 50 Arbitrage

Nifty 50 Futures Index

Nifty 50 Futures TR Index

Nifty 500

Nifty 500 Equal Weight

Nifty 8-13 yr G-Sec

Nifty Alpha 50

NIFTY Alpha Low-Volatility 30

Nifty Auto

Nifty Bank

Nifty Capital Markets Index

Nifty Cement

Nifty Chemicals Index

Nifty Commodities

Nifty Composite G-sec Index

Nifty Conglomerate 50

Nifty Consumer Durables

Nifty Core Housing

Nifty CPSE

Nifty Energy

Nifty EV & New Age Automotive

Nifty Financial Services

Nifty Financial Services 25/50

Nifty FMCG

NIFTY FULL MIDCAP 100

NIFTY FULL SMALLCAP100

Nifty Growth Sectors 15

Nifty Healthcare Index

Nifty High Beta 50

Nifty Housing

Nifty India Consumption

Nifty India Defence

NIFTY India Digital

Nifty India FPI 150

Nifty India Internet Index

NIFTY India Manufacturing

Nifty India Railways PSU Index

Nifty India Tourism

Nifty Infrastructure

Nifty IPO Index

Nifty IT

NIFTY LargeMidcap 250

Nifty Low Volatility 50

Nifty Media

Nifty Metal

Nifty Microcap 250

NIFTY Midcap 100

Nifty Midcap 150

NIFTY MIDCAP 200

Nifty Midcap 50

Nifty Midcap Liquid 15

Nifty Midcap Select

Nifty Midcap150 Momentum 50

NIFTY Midcap150 Quality 50

Nifty MidSmall Healthcare

Nifty MidSmall IT & Telecom

Nifty MidSmallcap 400

Nifty MidSmallcap400 50:50

Nifty MNC

Nifty Mobility

Nifty Next 50

Nifty Oil & Gas

Nifty Pharma

Nifty Private Bank

Nifty PSE

NIFTY PSU

Nifty PSU Bank

Nifty Realty

NIFTY REITs & InvITs Index

Nifty REITs & Realty

Nifty Rural Index

Nifty Services Sector

Nifty Shariah 25

NIFTY Smallcap 100

Nifty Smallcap 250

Nifty Smallcap 50

Nifty Smallcap 500

Nifty Smallcap250 Quality 50

NIFTY SME EMERGE

Nifty Top 10 Equal Weight

Nifty Total Market

Nifty Waves Index

NIFTY100 Alpha 30

NIFTY100 Enhanced ESG

Nifty100 Equal Weight

NIFTY100 ESG

Nifty100 ESG Sector Leaders

Nifty100 Liquid 15

Nifty100 Low Volatility 30

NIFTY100 Quality 30

NIFTY200 Alpha 30

Nifty200 Momentum 30

NIFTY200 Quality 30

Nifty50 Dividend Points

NIFTY50 Equal Weight

Nifty50 PR 1x Inverse

Nifty50 PR 2x Leverage

Nifty50 Shariah

Nifty50 TR 1x Inverse

Nifty50 TR 2x Leverage

NIFTY50 USD Index

Nifty50 Value 20

Nifty500 Multifactor MQVLv 50

Nifty500 Healthcare Index

Nifty500 Momentum 50

Nifty500 Multicap 50:25:25

Nifty500 Quality 50 Index

Nifty500 Shariah

NIFTY500 Value 50

NIIT Learning Systems Ltd.

NIIT Ltd.

Nila Infrastructures Ltd.

Nila Spaces Ltd.

Nilkamal Ltd.

Nintec Systems Ltd.

Nippon Life India Asset Management Ltd.

Niraj Cement Structurals Ltd.

Nirlon Ltd.

Nitco Ltd.

Nitin Spinners Ltd.

Nitiraj Engineers Ltd.

Nitta Gelatin India Ltd.

Niva Bupa Health Insurance Company Ltd.

NK Industries Ltd.

NLC India Ltd.

NMDC Ltd.

NMDC Steel Ltd.

Nocil Ltd.

Noida Toll Bridge Company Ltd.

North Eastern Carrying Corporation Ltd.

Northern ARC Capital Ltd.

Nova Agritech Ltd.

Novartis India Ltd.

NR Agarwal Industries Ltd.

NRB Bearings Ltd.

NRB Industrial Bearings Ltd.

NSE ALL

NTPC Green Energy Ltd.

NTPC Ltd.

Nucleus Software Exports Ltd.

Nupur Recyclers Ltd.

Nureca Ltd.

Nuvama Wealth Management Ltd.

Nuvoco Vistas Corporation Ltd.

OBCL Ltd.

Oberoi Realty Ltd.

OCCL Ltd.

Odigma Consultancy Solutions Ltd.

Oil & Natural Gas Corporation Ltd.

Oil Country Tubular Ltd.

Oil India Ltd.

OLA Electric Mobility Ltd.

Olectra Greentech Ltd.

Om Freight Forwarders Ltd.

Om Infra Ltd.

Omax Autos Ltd.

Omaxe Ltd.

Omnitech Engineering Ltd.

One Mobikwik Systems Ltd.

One Point One Solutions Ltd.

One97 Communications Ltd.

Onelife Capital Advisors Ltd.

Onesource Specialty Pharma Ltd.

Onmobile Global Ltd.

Onward Technologies Ltd.

Optiemus Infracom Ltd.

Oracle Financial Services Software Ltd.

Orbit Exports Ltd.

Orchasp Ltd.

Orchid Pharma Ltd.

Oricon Enterprises Ltd.

Orient Bell Ltd.

Orient Cement Ltd.

Orient Ceratech Ltd.

Orient Electric Ltd.

Orient Green Power Company Ltd.

Orient Paper & Industries Ltd.

Orient Press Ltd.

Orient Technologies Ltd.

Oriental Aromatics Ltd.

Oriental Hotels Ltd.

Oriental Trimex Ltd.

Orkla India Ltd.

OSIA Hyper Retail Ltd.

Oswal Agro Mills Ltd.

Oswal Greentech Ltd.

Oswal Minerals Ltd.

Oswal Pumps Ltd.

Pace Digitek Ltd.

Pacific Industries Ltd.

PAE Ltd.

Page Industries Ltd.

Paisalo Digital Ltd.

Pakka Ltd.

Palash Securities Ltd.

Palred Technologies Ltd.

Panacea Biotec Ltd.

Panama Petrochem Ltd.

Panasonic Carbon India Company Ltd.

Panasonic Energy India Company Ltd.

Panchmahal Steel Ltd.

Panchsheel Organics Ltd.

Pansari Developers Ltd.

Panyam Cements & Mineral Industries Ltd.

Par Drugs And Chemicals Ltd.

Paradeep Phosphates Ltd.

Parag Milk Foods Ltd.

Paramount Communications Ltd.

Paras Defence And Space Technologies Ltd.

Park Medi World Ltd.

Parsvnath Developers Ltd.

Pashupati Cotspin Ltd.

Pasupati Acrylon Ltd.

Patanjali Foods Ltd.

Patel Engineering Ltd.

Patel Integrated Logistics Ltd.

Patel Retail Ltd.

Paushak Ltd.

Pavna Industries Ltd.

PB Fintech Ltd.

PBA Infrastructure Ltd.

PC Jeweller Ltd.

PCBL Chemical Ltd.

PDS Ltd.

Pearl Global Industries Ltd.

Pearl Polymers Ltd.

Peninsula Land Ltd.

Pennar Industries Ltd.

Persistent Systems Ltd.

Petronet LNG Ltd.

Pfizer Ltd.

PG Electroplast Ltd.

Physicswallah Ltd.

PI Industries Ltd.

Piccadily Agro Industries Ltd.

Piccadily Sugar & Allied Industries Ltd.

Pidilite Industries Ltd.

PIL ITALICA Lifestyle Ltd.

Pilani Investment And Industries Corporation Ltd.

Pine Labs Ltd.

Pioneer Embroideries Ltd.

Piramal Finance Ltd.

Piramal Pharma Ltd.

Pitti Engineering Ltd.

Pix Transmissions Ltd.

Plastiblends India Ltd.

Platinum Industries Ltd.

Plaza Wires Ltd.

PN Gadgil Jewellers Ltd.

PNB Gilts Ltd.

PNB Housing Finance Ltd.

PNC Infratech Ltd.

PNGS Reva Diamond Jewellery Ltd.

Poddar Pigments Ltd.

Pokarna Ltd.

Poly Medicure Ltd.

Polycab India Ltd.

Polychem Ltd.

Polyplex Corporation Ltd.

Pondy Oxides & Chemicals Ltd.

Ponni Sugars (Erode) Ltd.

Poonawalla Fincorp Ltd.

Popular Vehicles & Services Ltd.

Power & Instrumentation (Gujarat) Ltd.

Power Finance Corporation Ltd.

Power Grid Corporation Of India Ltd.

Power Mech Projects Ltd.

PPAP Automotive Ltd.

Prabha Energy Ltd

Praj Industries Ltd.

Prajay Engineers Syndicate Ltd.

Prakash Industries Ltd.

Prakash Pipes Ltd.

Prakash Steelage Ltd.

Prataap Snacks Ltd.

Praxis Home Retail Ltd.

Precision Camshafts Ltd.

Precision Wires India Ltd.

Premier Energies Ltd.

Premier Explosives Ltd.

Premier Polyfilm Ltd.

Prestige Estates Projects Ltd.

Pricol Ltd.

Prime Focus Ltd.

Prime Securities Ltd.

Primo Chemicals Ltd.

Prince Pipes and Fittings Ltd.

Prism Johnson Ltd.

Prithvi Exchange (India) Ltd.

Priti International Ltd.

Pritika Auto Industries Ltd.

Pritish Nandy Communications Ltd.

Privi Speciality Chemicals Ltd.

Priya Ltd.

Procter & Gamble Health Ltd.

Procter & Gamble Hygiene and Health Care Ltd.

Prostarm Info Systems Ltd.

Protean e-Gov Technologies Ltd.

Prozone Realty Ltd.

Prudent Corporate Advisory Services Ltd.

Prudential Sugar Corporation Ltd.

PSP Projects Ltd.

PTC India Financial Services Ltd.

PTC India Ltd.

PTC Industries Ltd.

PTL Enterprises Ltd.

Pudumjee Paper Products Ltd.

Punjab & Sind Bank

Punjab Chemicals & Crop Protection Ltd.

Punjab Communications Ltd.

Punjab National Bank

Puravankara Ltd.

PVP Ventures Ltd.

PVR Inox Ltd.

Pyramid Technoplast Ltd.

Quadrant Future Tek Ltd.

Quality Power Electrical Equipments Ltd.

Quess Corp Ltd.

Quick Heal Technologies Ltd.

R Systems International Ltd.

R.P.P. Infra Projects Ltd.

Race Eco Chain Ltd.

RACL Geartech Ltd.

Radaan Mediaworks India Ltd.

Radhika Jeweltech Ltd.

Radiant Cash Management Services Ltd.

Radico Khaitan Ltd.

Raghav Productivity Enhancers Ltd.

Rail Vikas Nigam Ltd.

Railtel Corporation Of India Ltd.

Rain Industries Ltd.

Rainbow Children's Medicare Ltd.

Raj Oil Mills Ltd.

Raj Television Network Ltd.

Rajapalayam Mills Ltd.

Rajdarshan Industries Ltd.

Rajnandini Metal Ltd.

Rajoo Engineers Ltd.

Rajratan Global Wire Ltd.

Rajshree Polypack Ltd.

Rajshree Sugars & Chemicals Ltd.

Rallis India Ltd.

Ram Ratna Wires Ltd.

Rama Phosphates Ltd.

Rama Steel Tubes Ltd.

Ramco Industries Ltd.

Ramco Systems Ltd.

Ramkrishna Forgings Ltd.

Ramky Infrastructure Ltd.

Rana Sugars Ltd.

Rane (Madras) Ltd.

Rane Holdings Ltd.

Rashi Peripherals Ltd.

Rashtriya Chemicals and Fertilizers Ltd.

RateGain Travel Technologies Ltd.

Ratnamani Metals & Tubes Ltd.

Ratnaveer Precision Engineering Ltd.

RattanIndia Enterprises Ltd.

RattanIndia Power Ltd.

Ravi Kumar Distilleries Ltd.

Ravindra Energy Ltd.

Raymond Lifestyle Ltd.

Raymond Ltd.

Raymond Realty Ltd.

RBL Bank Ltd.

RBZ Jewellers Ltd.

REC Ltd.

Redington Ltd.

Redtape Ltd.

Refex Industries Ltd.

Regaal Resources Ltd.

Regency Ceramics Ltd.

Relaxo Footwears Ltd.

Reliable Data Services Ltd.

Reliance Chemotex Industries Ltd.

Reliance Industrial Infrastructure Ltd.

Reliance Industries Ltd.

Reliance Power Ltd.

Religare Enterprises Ltd.

Remsons Industries Ltd.

Renaissance Global Ltd.

Repco Home Finance Ltd.

Repro India Ltd.

Responsive Industries Ltd.

Restaurant Brands Asia Ltd.

Revathi Equipment India Ltd.

Rhetan TMT Ltd.

RHI Magnesita India Ltd.

Rico Auto Industries Ltd.

Rishabh Instruments Ltd.

Ritco Logistics Ltd.

Rites Ltd.

RK Swamy Ltd.

RKEC Projects Ltd.

RM Drip and Sprinklers System Ltd.

Robust Hotels Ltd.

Rolex Rings Ltd

Rossari Biotech Ltd.

Rossell India Ltd.

Rossell Techsys Ltd.

Roto Pumps Ltd.

Route Mobile Ltd.

Royal Orchid Hotels Ltd.

RPG Life Sciences Ltd.

RPSG Ventures Ltd.

RR Kabel Ltd.

RS Software (India) Ltd.

RSWM Ltd.

Rubfila International Ltd.

Rubicon Research Ltd.

Ruchi Infrastructure Ltd.

Ruchira Papers Ltd.

Rudra Global Infra Products Ltd.

Rudrabhishek Enterprises Ltd.

Rupa & Company Ltd.

Rushil Decor Ltd.

S Chand And Company Ltd.

S.P. Apparels Ltd.

Saatvik Green Energy Ltd.

Sadbhav Infrastructure Project Ltd.

Sadhana Nitro Chem Ltd.

Safari Industries (India) Ltd.

Sagar Cements Ltd.

Sagardeep Alloys Ltd.

Sagility Ltd.

Sahyadri Industries Ltd.

Sai Life Sciences Ltd.

Sai Silks (Kalamandir) Ltd.

Sakar Healthcare Ltd.

Saksoft Ltd.

Sakthi Finance Ltd.

Sakthi Sugars Ltd.

Sakuma Exports Ltd.

Salasar Techno Engineering Ltd.

Salona Cotspin Ltd.

Salora International Ltd.

Salzer Electronics Ltd.

Sambandam Spinning Mills Ltd.

Sambhaav Media Ltd.

Sambhv Steel Tubes Ltd.

Samhi Hotels Ltd.

Sammaan Capital Ltd.

Sampann Utpadan India Ltd.

Samvardhana Motherson International Ltd.

Sanathan Textiles Ltd.

Sanathnagar Enterprises Ltd.

Sandhar Technologies Ltd.

Sandur Manganese & Iron Ores Ltd.

Sangam (India) Ltd.

Sanghi Industries Ltd.

Sanghvi Movers Ltd.

Sanofi Consumer Healthcare India Ltd.

Sanofi India Ltd.

Sansera Engineering Ltd.

Sanstar Ltd.

Sapphire Foods India Ltd.

Saraswati Saree Depot Ltd.

Sarda Energy & Minerals Ltd.

Saregama India Ltd.

Sarla Performance Fibers Ltd.

Sarthak Industries Ltd.

Sarthak Metals Ltd.

Sarveshwar Foods Ltd.

Sasken Technologies Ltd.

Satchmo Holdings Ltd.

Satia Industries Ltd.

Satin Creditcare Network Ltd.

Saurashtra Cement Ltd.

Savera Industries Ltd.

Savita Oil Technologies Ltd.

SBC Exports Ltd.

SBFC Finance Ltd.

SBI Cards And Payment Services Ltd.

SBI Life Insurance Company Ltd.

Schaeffler India Ltd.

Scoda Tubes Ltd.

Seamec Ltd.

Secmark Consultancy Ltd.

Securekloud Technologies Ltd.

Sejal Glass Ltd.

SEL Manufacturing Company Ltd.

Semac Construction Ltd.

Senco Gold Ltd.

Senores Pharmaceuticals Ltd.

SEPC Ltd.

Servotech Renewable Power System Ltd.

Seshaasai Technologies Ltd.

Seshasayee Paper and Boards Ltd.

Setco Automotive Ltd.

SG Finserve Ltd.

SG Mart Ltd.

SH Kelkar And Company Ltd.

Shadowfax Technologies Ltd.

Shah Alloys Ltd.

Shah Metacorp Ltd.

Shaily Engineering Plastics Ltd.

Shakti Pumps (India) Ltd.

Shalby Ltd.

Shalimar Paints Ltd.

Shankar Lal Rampal Dye-Chem Ltd.

Shankara Building Products Ltd.

Shankara Buildpro Ltd.

Shanthi Gears Ltd.

Shanti Gold International Ltd.

Shanti Overseas (India) Ltd.

Sharda Cropchem Ltd.

Sharda Motor Industries Ltd.

Shardul Securities Ltd.

Share India Securities Ltd.

Sheela Foam Ltd.

Shekhawati Industries Ltd.

Shemaroo Entertainment Ltd.

Shetron Ltd.

Shilchar Technologies Ltd.

Shilpa Medicare Ltd.

Shipping Corporation of India Land and Assets Ltd.

Shipping Corporation Of India Ltd.

Shiv Aum Steels Ltd.

Shiva Mills Ltd.

Shiva Texyarn Ltd.

Shivalik Bimetal Controls Ltd.

Shivalik Rasayan Ltd.

Shivam Autotech Ltd.

Shoppers Stop Ltd.

Shradha Realty Ltd.

Shree Cement Ltd.

Shree Digvijay Cement Company Ltd.

Shree Oswal Seeds and Chemicals Ltd.

Shree Precoated Steels Ltd.

Shree Pushkar Chemicals & Fertilisers Ltd.

Shree Rama Multi-Tech Ltd.

Shree Rama Newsprint Ltd.

Shree Renuka Sugars Ltd.

Shree Tirupati Balajee Agro Trading Company Ltd

Shree Vasu Logistics Ltd.

Shreeji Shipping Global Ltd.

Shreyans Industries Ltd.

Shri Dinesh Mills Ltd.

Shringar House of Mangalsutra Ltd.

Shriram Finance Ltd.

Shriram Pistons & Rings Ltd

Shriram Properties Ltd.

Shristi Infrastructure Development Corporation Ltd

Shyam Century Ferrous Ltd.

Shyam Metalics And Energy Ltd.

Shyam Telecom Ltd.

Sicagen India Ltd.

Siemens Energy India Ltd.

Siemens Ltd.

Sigachi Industries Ltd.

Sigma Advanced Systems Ltd.

Sigma Solve Ltd.

Signatureglobal (India) Ltd.

Signet Industries Ltd.

Signpost India Ltd.

Sikko Industries Ltd.

SIL Investments Ltd.

SILGO Retail Ltd.

Silly Monks Entertainment Ltd.

Silver Touch Technologies Ltd.

Simplex Castings Ltd.

Simplex Infrastructures Ltd.

Sinclairs Hotels Ltd.

Sindhu Trade Links Ltd.

Singer India Ltd.

Sintercom India Ltd.

SIRCA Paints India Ltd.

SIS Ltd.

Siyaram Silk Mills Ltd.

SJS Enterprises Ltd.

SJVN Ltd.

SKF India (Industrial) Ltd.

SKF India Ltd.

Skipper Ltd.

SKM Egg Products Export (India) Ltd.

Sky Gold and Diamonds Ltd.

Smartlink Holdings Ltd.

Smartworks Coworking Spaces Ltd.

SMC Global Securities Ltd.

SML Mahindra Ltd.

SMS Pharmaceuticals Ltd.

Snowman Logistics Ltd.

Sobha Ltd.

SoftTech Engineers Ltd.

Solar Industries India Ltd.

Solara Active Pharma Sciences Ltd.

Solarworld Energy Solutions Ltd.

Solex Energy Ltd.

Som Distilleries And Breweries Ltd.

Somany Ceramics Ltd.

Somi Conveyor Beltings Ltd.

Sona BLW Precision Forgings Ltd.

Sonam Ltd.

Sonata Software Ltd.

Sorich Foils Ltd.

South West Pinnacle Exploration Ltd.

Southern Petrochemical Industries Corporation Ltd.

Spacenet Enterprises India Ltd.

Spandana Sphoorty Financial Ltd.

Speciality Restaurants Ltd.

Spectrum Electrical Industries Ltd.

SPEL Semiconductor Ltd.

Spencer's Retail Ltd.

SpiceJet Ltd.

SPL Industries Ltd.

SPML Infra Ltd.

Sportking India Ltd.

Sree Rayalaseema Hi-Strength Hypo Ltd.

Sreeleathers Ltd.

SRF Ltd.

SRG Housing Finance Ltd.

Sri Chamundeswari Sugars Ltd.

Sri Havisha Hospitality and Infrastructure Ltd.

Sri Lotus Developers And Realty Ltd.

Srinibas Pradhan Constructions Ltd.

SRM Contractors Ltd.

Stallion India Fluorochemicals Ltd.

Standard Batteries Ltd.

Standard Engineering Technology Ltd.

Standard Industries Ltd.

Stanley Lifestyles Ltd.

Star Cement Ltd.

Star Health and Allied Insurance Company Ltd.

Star Paper Mills Ltd.

Starlog Enterprises Ltd.

Starteck Finance Ltd.

State Bank Of India

Steel Authority Of India Ltd.

Steel City Securities Ltd.

Steel Exchange India Ltd.

Steel Strips Wheels Ltd.

Steelcast Ltd.

STEL Holdings Ltd.

Sterling and Wilson Renewable Energy Ltd.

Sterling Tools Ltd.

Sterlite Technologies Ltd.

STL Global Ltd.

STL Networks Ltd.

Stove Kraft Ltd.

Strides Pharma Science Ltd.

Studds Accessories Ltd.

Stylam Industries Ltd.

Styrenix Performance Materials Ltd.

Subex Ltd.

Subros Ltd.

Sudarshan Chemical Industries Ltd.

Sudarshan Colorants India Ltd.

Sudeep Pharma Ltd.

Sukhjit Starch & Chemicals Ltd.

Sula Vineyards Ltd.

Sumeet Industries Ltd.

Sumit Woods Ltd.

Sumitomo Chemical India Ltd.

Summit Securities Ltd.

Sun Pharma Advanced Research Company Ltd.

Sun Pharmaceutical Industries Ltd.

Sun TV Network Ltd.

Sundaram Brake Linings Ltd.

Sundaram Finance Ltd.

Sundaram Multi Pap Ltd.

Sundaram-Clayton Ltd.

Sundram Fasteners Ltd.

Sundrop Brands Ltd.

Sunflag Iron And Steel Company Ltd.

Sunteck Realty Ltd.

Super Sales India Ltd.

Super Spinning Mills Ltd.

Superhouse Ltd.

Suprajit Engineering Ltd.

Supreme Holdings & Hospitality (India) Ltd.

Supreme Industries Ltd.

Supreme Petrochem Ltd.

Supriya Lifescience Ltd.

Suraj Estate Developers Ltd.

Suraj Ltd.

Suraksha Diagnostic Ltd.

Surana Solar Ltd.

Surana Telecom And Power Ltd.

Suratwwala Business Group Ltd.

Surya Roshni Ltd.

Suryalakshmi Cotton Mills Ltd.

Suryoday Small Finance Bank Ltd.

Sutlej Textiles And Industries Ltd.

Suven Life Sciences Ltd.

Suvidhaa Infoserve Ltd.

Suyog Telematics Ltd.

Suzlon Energy Ltd.

Swan Corp Ltd.

Swaraj Engines Ltd.

Swelect Energy Systems Ltd.

Swiggy Ltd.

Symphony Ltd.

Syncom Formulations (India) Ltd.

Synergy Green Industries Ltd.

Syngene International Ltd.

Syrma SGS Technology Ltd.

Systematix Corporate Services Ltd.

Tainwala Chemicals & Plastics (India) Ltd.

Taj GVK Hotels & Resorts Ltd.

Talbros Automotive Components Ltd.

Tamil Nadu Newsprint & Papers Ltd.

Tamilnad Mercantile Bank Ltd.

Tamilnadu Petroproducts Ltd.

Tamilnadu Telecommunications Ltd.

Tanfac Industries Ltd.

Tanla Platforms Ltd.

Tara Chand Infralogistic Solutions Ltd.

Tarapur Transformers Ltd.

TARC Ltd.

Tarsons Products Ltd.

Tasty Bite Eatables Ltd.

Tata Capital Ltd.

Tata Chemicals Ltd.

Tata Communications Ltd.

Tata Consultancy Services Ltd.

Tata Consumer Products Ltd.

Tata Elxsi Ltd.

Tata Investment Corporation Ltd.

Tata Motors Ltd.

Tata Motors Passenger Vehicles Ltd.

Tata Power Company Ltd.

Tata Steel Ltd.

Tata Technologies Ltd.

Tata Teleservices (Maharashtra) Ltd.

Tatva Chintan Pharma Chem Ltd.

TBO Tek Ltd.

TCC Concept Ltd.

TCI Express Ltd.

TCI Finance Ltd.

TCPL Packaging Ltd.

TD Power Systems Ltd.

Team India Guaranty Ltd.

TeamLease Services Ltd.

Teamo Productions HQ Ltd.

Tech Mahindra Ltd.

Techno Electric & Engineering Company Ltd.

Technocraft Industries (India) Ltd.

Tecil Chemicals & Hydro Power Ltd.

Tega Industries Ltd.

Tejas Networks Ltd.

Tembo Global Industries Ltd.

Tenneco Clean Air India Ltd.

Tera Software Ltd.

Texmaco Infrastructure & Holdings Ltd.

Texmaco Rail & Engineering Ltd.

Texmo Pipes And Products Ltd.

TGB Banquets And Hotels Ltd.

TGV SRACC Ltd.

Thangamayil Jewellery Ltd.

The Andhra Sugars Ltd.

The Anup Engineering Ltd.

The Byke Hospitality Ltd.

The Federal Bank Ltd.

The Fertilisers And Chemicals Travancore Ltd.

The Great Eastern Shipping Company Ltd.

The Grob Tea Company Ltd.

The India Cements Ltd.

The Indian Hotels Company Ltd.

The Investment Trust of India Ltd.

The Jammu & Kashmir Bank Ltd.

The Karnataka Bank Ltd.

The Motor & General Finance Ltd.

The New India Assurance Company Ltd.

The Orissa Minerals Development Company Ltd.

The Peria Karamalai Tea And Produce Company Ltd.

The Phoenix Mills Ltd.

The Ramco Cements Ltd.

The Ruby Mills Ltd.

The Sandesh Ltd.

The South Indian Bank Ltd.

The State Trading Corporation Of India Ltd.

The Ugar Sugar Works Ltd.

The United Nilgiri Tea Estates Company Ltd.

The Western Indian Plywoods Ltd.

Thejo Engineering Ltd.

Themis Medicare Ltd.

Thermax Ltd.

Thirumalai Chemicals Ltd.

Thomas Cook (India) Ltd.

Thomas Scott (India) Ltd.

Thyrocare Technologies Ltd.

Tiger Logistics (India) Ltd.

TIL Ltd.

Tilaknagar Industries Ltd.

Time Technoplast Ltd.

Timex Group India Ltd.

Timken India Ltd.

Tinna Rubber And Infrastructure Ltd.

Tips Films Ltd.

Tips Music Ltd.

Tirupati Forge Ltd.

Titagarh Rail Systems Ltd.

Titan Company Ltd.

TMT (India) Ltd.

Tokyo Plast International Ltd.

Tolins Tyres Ltd.

Torrent Pharmaceuticals Ltd.

Torrent Power Ltd.

Total Transport Systems Ltd.

Touchwood Entertainment Ltd.

Tourism Finance Corporation Of India Ltd.

TPI India Ltd.

TPL Plastech Ltd.

Tracxn Technologies Ltd.

Transchem Ltd.

Transformers & Rectifiers (India) Ltd.

Transindia Real Estate Ltd.

Transpek Industry Ltd.

Transport Corporation Of India Ltd.

Transrail Lighting Ltd.

Transwarranty Finance Ltd.

Transworld Shipping Lines Ltd.

Travel Food Services Ltd.

Treadsdirect Ltd.

Trejhara Solutions Ltd.

Trent Ltd.

TRF Ltd.

Tribhovandas Bhimji Zaveri Ltd.

Trident Ltd.

Trigyn Technologies Ltd.

Triveni Engineering & Industries Ltd.

Triveni Turbine Ltd.

TruAlt Bioenergy Ltd.

TruCap Finance Ltd.

TSF Investments Ltd.

TTK Healthcare Ltd.

TTK Prestige Ltd.

Tube Investments of India Ltd.

TV Today Network Ltd.

TVS Electronics Ltd.

TVS Holdings Ltd.

TVS Motor Company Ltd.

TVS Srichakra Ltd.

Twamev Construction And Infrastructure Ltd.

UCAL Ltd.

UCO Bank

Uflex Ltd.

UFO Moviez India Ltd.

Ugro Capital Ltd.

Ujaas Energy Ltd.

Ujjivan Small Finance Bank Ltd.

Ultramarine & Pigments Ltd.

Ultratech Cement Ltd.

Uma Exports Ltd.

Umiya Buildcon Ltd.

Unichem Laboratories Ltd.

Unicommerce eSolutions Ltd.

Uniinfo Telecom Services Ltd.

Unimech Aerospace and Manufacturing Ltd.

Union Bank Of India

Uniparts India Ltd.

Uniphos Enterprises Ltd.

Unitech Ltd.

United Breweries Ltd.

United Drilling Tools Ltd.

United Foodbrands Ltd.

United Polyfab Gujarat Ltd.

United Spirits Ltd.

Univastu India Ltd.

Universal Cables Ltd.

UNO Minda Ltd.

Updater Services Ltd.

UPL Ltd.

Uravi Defence and Technology Ltd.

Urban Company Ltd.

Urja Global Ltd.

Usha Martin Education & Solutions Ltd.

Usha Martin Ltd.

Ushdev International Ltd.

UTI Asset Management Company Ltd.

Utique Enterprises Ltd.

Utkarsh Small Finance Bank Ltd.

Uttam Sugar Mills Ltd.

UY Fincorp Ltd.

V-Guard Industries Ltd.

V-Mart Retail Ltd.

V.S.T. Tillers Tractors Ltd.

V2 Retail Ltd.

VA Tech Wabag Ltd.

Vadilal Industries Ltd.

Vaibhav Global Ltd.

Vaishali Pharma Ltd.

Vakrangee Ltd.

Valiant Laboratories Ltd.

Valiant Organics Ltd.

Valor Estate Ltd.

Vardhman Acrylics Ltd.

Vardhman Holdings Ltd.

Vardhman Special Steels Ltd.

Vardhman Textiles Ltd.

Varroc Engineering Ltd.

Varun Beverages Ltd.

Varvee Global Ltd.

Vascon Engineers Ltd.

Vaswani Industries Ltd.

Vaxtex Cotfab Ltd.

Vedant Fashions Ltd.

Vedanta Ltd.

Veedol Corporation Ltd.

Veerhealth Care Ltd.

Venky'S (India) Ltd.

Venlon Enterprises Ltd.

Ventive Hospitality Ltd.

Venus Pipes & Tubes Ltd.

Venus Remedies Ltd.

Veranda Learning Solutions Ltd.

Vertoz Ltd.

Vesuvius India Ltd.

Veto Switchgears And Cables Ltd.

Vibhor Steel Tubes Ltd.

Vidhi Specialty Food Ingredients Ltd.

Vidya Wires Ltd.

Vijaya Diagnostic Centre Ltd.

Viji Finance Ltd.

Vikas EcoTech Ltd.

Vikas Lifecare Ltd.

Vikram Solar Ltd.

Vikran Engineering Ltd.

Vimta Labs Ltd.

Vinati Organics Ltd.

Vindhya Telelinks Ltd.

Vineet Laboratories Ltd.

Vinny Overseas Ltd.

Vintage Coffee & Beverages Ltd.

Vinyl Chemicals (India) Ltd.

VIP Clothing Ltd.

VIP Industries Ltd.

Virinchi Ltd.

Visa Steel Ltd.

Visagar Polytex Ltd.

Visaka Industries Ltd.

Vishal Fabrics Ltd.

Vishal Mega Mart Ltd.

Vishnu Chemicals Ltd.

Vishnu Prakash R Punglia Ltd.

Vishwaraj Sugar Industries Ltd.

Vivimed Labs Ltd.

Viyash Scientific Ltd.

VL E-Governance & IT Solutions Ltd.

VLS Finance Ltd.

VMS TMT Ltd.

Vodafone Idea Ltd.

Voltamp Transformers Ltd.

Voltas Ltd.

Vraj Iron & Steel Ltd.

VRL Logistics Ltd.

VST Industries Ltd.

VTM Ltd.

W.S. Industries (India) Ltd.

Waaree Energies Ltd.

Waaree Renewable Technologies Ltd.

Wakefit Innovations Ltd.

Walchandnagar Industries Ltd.

Warren Tea Ltd.

Waterbase Ltd.

We Win Ltd.

Wealth First Portfolio Managers Ltd.

Websol Energy System Ltd.

Weizmann Ltd.

Welspun Corp Ltd.

Welspun Enterprises Ltd.

Welspun Investments and Commercials Ltd.

Welspun Living Ltd.

Welspun Specialty Solutions Ltd.

Wendt (India) Ltd.

West Coast Paper Mills Ltd.

Western Carriers (India) Ltd.

Westlife Foodworld Ltd

Wework India Management Ltd.

Wheels India Ltd.

Whirlpool Of India Ltd.

Williamson Magor & Company Ltd.

Wim Plast Ltd.

Windlas Biotech Ltd.

Windsor Machines Ltd.

WinPro Industries Ltd.

Wipro Ltd.

Wockhardt Ltd.

Wonder Electricals Ltd.

Wonderla Holidays Ltd.

Worth Peripherals Ltd.

Xchanging Solutions Ltd.

Xelpmoc Design And Tech Ltd.

Xpro India Ltd.

XT Global Infotech Ltd.

Yasho Industries Ltd.

Yatharth Hospital & Trauma Care Services Ltd.

Yatra Online Ltd

Yes Bank Ltd.

Yuken India Ltd.

Zaggle Prepaid Ocean Services Ltd.

Zee Entertainment Enterprises Ltd.

Zee Learn Ltd.

Zen Technologies Ltd.

Zenith Exports Ltd.

Zenith Steel Pipes & Industries Ltd.

Zensar Technologies Ltd.

ZF Commercial Vehicle Control Systems India Ltd.

ZF Steering Gear (India) Ltd.

Zim Laboratories Ltd.

Zodiac Clothing Company Ltd.

Zodiac Energy Ltd.

Zodiac-JRD-MKJ Ltd.

Zota Health Care Ltd.

Zuari Agro Chemicals Ltd.

Zuari Industries Ltd.

Zydus Lifesciences Ltd.

Zydus Wellness Ltd.

Latest Update

Market Indices - Gainers

Currency

Crypto

JSWSTEEL

buy

PRESTIGE

buy

JSWINFRA

buy

SUZLON

buy

AMBUJACEM

buy

TIMETECHNO

buy

HINDPETRO

buy

COFORGE

buy

BHARATFORG

neutral

BIOCON

buy

Duration:6 Month

Target:1144

Duration:6 Month

Target:1659

Duration:6 Month

Target:360

Duration:6 Month

Target:74

Duration:6 Month

Target:750

Duration:6 Month

Target:289

Duration:6 Month

Target:590

Duration:6 Month

Target:3000

Duration:6 Month

Target:1290

Duration:6 Month

Target:460

NIFTY

Advances

Declines

Unchanged

Last updated on: 2024-05-23 11:44

Advances

Declines

Unchanged

Last updated on: 2024-05-23 11:44

FII Cash

DII Cash

Consumer Goods Se...

Consumer Goods Sector Update : Print appears to be improving; jewelry continues to outperform by Motilal Oswal Financial Services Ltd

Read more...

Stock to watch

ASIANPAINT

2220.8

0.00[0.00%]

BRITANNIA

5890

0.00[0.00%]

COLPAL

2156.3

0.00[0.00%]

DABUR

466.7

0.00[0.00%]

INDIGOPNTS

838.3

0.00[0.00%]

HINDUNILVR

2194.6

0.00[0.00%]

GODREJCP

1080.3

0.00[0.00%]

EMAMILTD

443.05

0.00[0.00%]

DAAWAT

379.8

0.00[0.00%]

JYOTHYLAB

241.05

0.00[0.00%]

ITC

306

0.00[0.00%]

PAGEIND

31145

0.00[0.00%]

NESTLEIND

1235.8

0.00[0.00%]

MARICO

778

0.00[0.00%]

PGHH

10604

0.00[0.00%]

PIDILITIND

1386.4

0.00[0.00%]

RADICO

2751.6

0.00[0.00%]

MCDOWELL-N

1355.8

0.00[0.00%]

UBL

1721.5

0.00[0.00%]

TATACONSUM

1102.5

0.00[0.00%]

VBL

437.75

0.00[0.00%]

ZYDUSWELL

373.5

0.00[0.00%]

BARBEQUE

231.3

0.00[0.00%]

SAPPHIRE

174.76

0.00[0.00%]

JUBLFOOD

488.65

0.00[0.00%]

DEVYANI

109.98

0.00[0.00%]

KALYANKJIL

389

0.00[0.00%]

WESTLIFE

469.05

0.00[0.00%]

RBA

62.91

0.00[0.00%]

TITAN

4159.2

0.00[0.00%]