Buy MTAR Technologies Ltd for the Target Rs.1,900 by Motilal Oswal Financial Services Ltd

Fueling the next orbit of growth for MTARTECH

MTAR Technologies (MTARTECH) has been a key player in India’s aerospace industry with a longstanding association with ISRO, supplying critical assemblies for several key space missions. Leveraging this expertise and established credibility, the company is consistently onboarding global MNC aerospace clients. The aerospace segment currently contributes ~11% to MTARTECH’s total revenue, and this share is expected to rise to 16% by FY27.

* Being a key ISRO partner for over 35 years, MTARTECH supplies critical assemblies for launch vehicles and cryogenic engines used in missions like Mangalyaan and Chandrayaan. Backed by a zero-defect record and key certifications, the company plays a crucial role in supporting India’s indigenization efforts under the 2023 space policy.

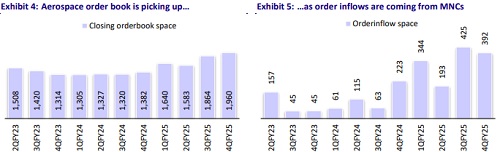

* Another emerging sub-segment is the MNC aerospace, where MTARTECH supplies high-precision engineered aerospace products to global OEMs like IAI, Thales, GKN, and Collins. FY25 order inflows in aerospace rose 3x to INR1.4b, of which majority was contributed by MNC aerospace companies. MNC aerospace accounts for ~50% (INR980m) of MTARTECH’s total aerospace order book of INR1.96b as on Mar’25 (including long-term contracts from IAI: USD90-120m).

* Management has guided that MNC-led growth will drive aerospace revenue to ~INR1.4b in FY26 (~80-90% YoY increase), while revenue from ISRO is expected to reach ~INR500m (67% YoY increase).

* MTARTECH is witnessing strong traction in the aerospace segment, driven by increasing contributions from global aerospace MNCs and consistent order inflows from ISRO. We expect MTARTECH to post a CAGR of 28%/47%/77% in revenue/EBITDA/Adj. PAT over FY25-27. We reiterate our BUY rating on the stock with a TP of INR1,900 (35x FY27 EPS).

MTARTECH’s legacy in motion: From ISRO’s core to MNC supply chains

* MTARTECH began its journey with ISRO in 1983, supplying ultraprecision assemblies for launch vehicles such as PSLV and GSLV. Over the years, it has steadily built a reputation for engineering excellence in critical assemblies.

* As ISRO’s missions grew more complex, MTAR transitioned from a parts supplier to a strategic partner, delivering integrated subassemblies and propulsion system components for advanced programs such as cryogenic engines and the Gaganyaan mission.

* This deep technical involvement and ability to meet ISRO’s stringent quality, consistency, and delivery benchmarks positioned MTARTECH as a trusted player in the aerospace ecosystem.

* The company’s revenue from this segment grew to INR776m from INR271m (CAGR of 23%) over FY20-25.

* Building on this credibility, MTARTECH is now undergoing a strategic shift in its aerospace portfolio, with global aerospace MNCs showing trust in its competence. As of Mar’25, these clients contributed ~50% (~INR980m) to the company’s total aerospace order book of INR1.96b, reflecting the growing global trust in Indian precision engineering and EMS capabilities.

* While the aerospace segment was previously driven largely by ISRO-led programs, future growth is expected to be led by MNC aerospace orders, with management guiding for FY26 revenue of over INR1b from MNC aerospace (vs ~INR450-500m in FY25) and ~INR500m from ISRO (vs ~INR300m).

* MTARTECH has also signed a long-term agreement with IAI to supply missioncritical assemblies in the aviation sector, with a contract value of USD90-120m to be executed over the next 15 years.

* Additionally, the company has signed a long-term agreement with Thales and has commenced batch production for both Thales and GKN Aerospace.

* We expect MTARTECH to enter into multiple long-term agreements in the aerospace segment, which are likely to serve as key growth drivers starting FY26.

Key player in ISRO’s supply chain

* MTARTECH has been a trusted supplier to ISRO for over 35 years, delivering critical assemblies such as turbopumps, gas generators, booster pumps, and injector heads for India’s launch vehicles, including PSLV, GSLV, and GSLV Mk III.

* These assemblies are integral to both liquid (Vikas) and cryogenic engines (CE7.5, CE-20), supporting landmark missions like Mangalyaan and Chandrayaan II and III.

* ISRO prefers MTARTECH for its zero-defect delivery record and global aerospace certifications (AS9100D, ISO 9001). Its proven manufacturing capabilities, built over decades, create high entry barriers for competitors.

* The Indian Space Policy 2023 promotes over 20% indigenization in critical systems, and MTARTECH plays a key role in helping ISRO meet these targets while reducing dependence on imports. This not only reduces geopolitical risks but also ensures faster execution.

* The company is targeting revenue of INR500m from ISRO in FY26, indicating 67% YoY growth. As of FY25, the order book from ISRO stands at ~INR800m.

From blueprints to liftoff

* Over the years, US and European companies have steadily increased their presence in Asia. For instance, Thales is setting up facilities in ME and India, and has already established two engineering competence centers (ECC) in India. This trend is expected to continue, with more key aerospace companies likely to set up their operations/supply chains in India.

* MTARTECH manufactures and supplies precision-engineered assemblies and sub-systems for aerospace platforms, primarily for global OEMs and Tier-1 suppliers such as IAI, Thales, GKN, and Collins. These are typically high-value, low-volume products.

* Customers provide 2D/3D designs, and MTARTECH manufactures assemblies with tight tolerances, adhering to stringent aerospace quality standards. Its product portfolio includes actuator housings, landing gear assemblies, airframe parts, and structural frames and rings among others.

* These assemblies are integrated into aerospace platforms such as commercial aircraft (like Boeing and Airbus), fighter jets, unmanned aerial vehicles (drones), and space payloads including satellites.

* High entry barrier: MTARTECH’s aerospace business is highly specialized and value-accretive. Unlike mass-produced goods, aerospace products require precise engineering, long lead times for qualification, and adherence to stringent global standards. Aerospace OEMs typically take 12-24 months to approve a vendor, making supplier switching both costly and operationally risky.

* Further, every part must have full traceability, and intellectual property (IP) sensitivity often limits vendor proliferation among MNCs. MTARTECH operates at micron-level tolerances (as tight as 5 microns), a capability that only a few global players possess. It also holds critical certifications like NADCAP and AS9100D, both of which require significant investment and time to obtain, creating a strong entry barrier for potential competitors.

* In FY25, order inflows in the aerospace segment grew 3x YoY to INR1.4b, with approximately 60% of the orders contributed by MNC aerospace customers. Correspondingly, revenue from the MNC aerospace segment surged 6x YoY to INR476m. The company has guided for 45-50% growth in MNC aerospace for the next 3-4 years.

* The company is currently executing first articles for IAI and has commenced batch production for GKN Aerospace, Rafael, and Thales. These engagements are expected to be major revenue drivers for the aerospace segment starting FY26.

Valuation and view

* MTARTECH has established a strong niche as a trusted supplier of precisionengineered systems to global MNCs, government agencies, and major Indian public and private sector enterprises. Its long-standing expertise and execution track record position it well across high-entry-barrier sectors.

* Simultaneously, MTARTECH’s aerospace business is gaining strong traction, with growing contributions from global MNCs like IAI, Thales, GKN, and Collins.

* The company is executing first articles and has initiated batch production for several key aerospace and clean energy clients, which is expected to translate into batch production from 2HFY26.

* We estimate MTARTECH to clock a CAGR of 28%/47%/77% in revenue/ EBITDA/adj. PAT over FY25-27 on the back of strong order inflows. We reiterate our BUY rating on the stock with a TP of INR1,900 (35x FY27 EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412