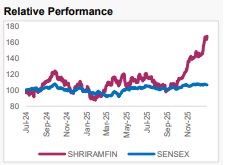

Buy Shriram Finance Ltd For Target Rs. 1,150 By Axis Securities Ltd

More Capital, Better Growth, Stronger Profitability, But Same Playbook!

Shriram Finance Limited (SFL) hosted a concall to highlight the rationale of the MUFG deal and the roadmap for utilisation of the funds. The management’s commentary reinstates confidence in the company’s ability to deliver strong and consistent growth, while simultaneously improving profitability. The growth capital should help SFL adequately accelerate its growth across segments without significantly altering its AUM mix over the foreseeable future. We expect SFL to deliver a robust 19/23/30% CAGR growth in terms of AUM/NII/Earnings over FY26-28E. We value SFL at 2.4x Sep’27E ABV to arrive at a target price of Rs 1,150/share, implying an upside of 17% from the CMP.

Business Mix: No Strategic Drift

The management reiterated that the partnership will not alter SFL’s core business model, as the company will continue to focus on its core rural markets to drive growth. While the southern and western markets continue their strong growth trajectory, the management expects better traction in the eastern, central, and northern markets to drive incremental growth, supported by efforts to strengthen the company’s footprint across these geographies.

SFL indicated that the strategic deal provides adequate fuel to accelerate AUM growth to 18– 20% over the medium term, 3-4% above its current growth run-rate, backed by healthy demand dynamics in its segment. Within the Vehicle Finance segment, the company will look to maintain its dominant position in the 2-wheeler and used CV segments, while gradually foraying into and strengthening its position in new vehicles and higher ticket-size loans. Additionally, within the 2-wheeler segment, SFL will look to build its strength in the bigger/transportation bikes segment.

Currently, SFL’s market share in new vehicle financing is at 3%, and the management has guided for doubling the market share over the next three years. However, new vehicle financing is expected to contribute ~5% of the overall customer base. The company would primarily look to tap the existing customer segment migrating to other NBFCs and banks for higher ticket-size loans or better interest rates (~30% currently), instead of exploring open market opportunities. The retention of existing customers should provide further support to SFL in achieving its aspirational 20% AUM growth.

Within the non-vehicle segment, SFL will continue to drive growth aggressively in the gold portfolio. The company is comfortable increasing the share of the gold portfolio by 2% over the medium term. Another focus area for SFL has been the SME segment, which is a key growth driver; however, the company will continue to remain conservative in growing the portfolio. The management indicated that SFL will not look to foray into LAP or higher ATS SME loans and will continue to build a niche in smaller ATS (Rs 10–12 Lc) SME loans with an average tenor of 5–7 years. Overall, the management does not expect any material change in the AUM mix over the next five years, reinforcing its growth strategy within existing product segments. The management has also ruled out plans to pursue inorganic growth opportunities.

Lower CoF = Rate Cut Benefit + Ratings Upgrades

Going forward, the capital infusion from MUFG is expected to materially reduce SFL’s reliance on incremental borrowings. The management has guided to a 100 bps reduction in borrowing costs over the next 2-3 years, collectively driven by repricing of borrowings, credit rating upgrades and benefits accruing from the rate cuts. Recently, CARE has already upgraded the company to AAA-Stable. The management remains confident of further ratings upgrades to follow, and clarified that the larger benefit on the CoF will flow from the repricing of the capital market borrowings and retail deposits. The spread on bank borrowings is comparatively less elastic to ratings upgrades. The company expects to pass on the benefit on CoF to select customers and does not expect the impact on NIMs from this pass-through to be negligible. The management has guided for NIM improvement hereon.Going forward, the capital infusion from MUFG is expected to materially reduce SFL’s reliance on incremental borrowings. The management has guided to a 100 bps reduction in borrowing costs over the next 2-3 years, collectively driven by repricing of borrowings, credit rating upgrades and benefits accruing from the rate cuts. Recently, CARE has already upgraded the company to AAA-Stable. The management remains confident of further ratings upgrades to follow, and clarified that the larger benefit on the CoF will flow from the repricing of the capital market borrowings and retail deposits. The spread on bank borrowings is comparatively less elastic to ratings upgrades. The company expects to pass on the benefit on CoF to select customers and does not expect the impact on NIMs from this pass-through to be negligible. The management has guided for NIM improvement hereon.

RoA Improvement on the Cards

The management has guided for a stark improvement in RoA to 3.8% immediately following the capital infusion, before normalising at 3.6%, compared with the current level of 2.8%. RoA improvement will be primarily driven by a sharp improvement in NIMs and lower credit costs. The management expects credit costs to lower by 10-20 bps over the medium term, driven by better quality customers getting retained. We expect RoA to settle between 3.6-3.8% over FY27-28E. Post the infusion, leverage is expected to drop to 2.8x vs 4.3x currently. Over the next 5-6 years, the company will look to inch back towards a steady state leverage of 4-5x. RoE could settle at 13.5% in the near term before gravitating to pre-deal levels over the next 5 years (by FY31).

Deal Completion Roadmap and Management Continuity

From a process completion perspective, the board has approved the capital infusion and has convened an EGM in Jan’26 to seek shareholders’ approval. Post the EGM, the company will seek regulatory clearances from RBI and CCI, which are expected to take 2–3 months. The management indicated that the transaction could be completed in the current FY, following regulatory approval or would close by Apr’26 at max. Post the completion of the deal, MUFG will have 2 board seats; however, the management has clarified that there will be no changes to the senior management or KMP level. The new inductions from MUFG would be at the second and third levels of management.

Recommendation & Valuation

We view the transaction as a positive development for SFL, as it validates the company’s business model and governance framework through the entry of a reputed global investor. We believe strong rural demand and healthy growth visibility across key segments should support steady AUM growth over the medium term, while the capital infusion provides adequate headroom to accelerate growth without compromising capital adequacy. We expect the MUFG deal to progressively strengthen SFL’s funding profile, with CARE having already upgraded the rating to AAA and expectations of further upgrades by other rating agencies. We believe lower CoF should support margin expansion, translating into RoA of ~3.6–3.8% over FY27-28E. However, we expect equity dilution to result in a moderation in RoE to ~13-15%, compared with ~16–17% earlier, over the medium term. We revise our estimates in line with management commentary of capital infusion likely during the year. Accordingly, we adjust our FY26 NII/Earnings estimates upward by ~3/~7%, respectively. With the management guiding AUM growth of ~19% CAGR over FY26-28E (vs 17% earlier), we also revise our FY27/28E NII/Earnings estimates upwards by 3-4%/9- 10%, factoring in better margin profile and lower credit costs

Post capital infusion, SFL would trade at 2.1x Sep’27E ABV. We value the stock at 2.4x Sep’27E ABV (unchanged) to arrive at a target price of Rs 1,150/share, implying an upside of 17% from the CMP. We reiterate our BUY recommendation on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)