Add Tata Steel Ltd For Target Rs. 146 By Yes Securities Ltd

Strong performance in India continues, while Europe business heads towards break-even

Results Synopsis

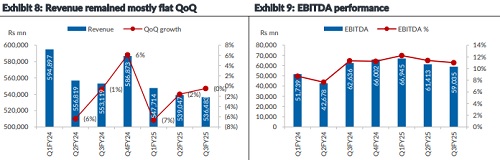

Tata Steel's Q3FY25 performance was above the consensus expectations, primarily driven by stable volumes and falling raw material prices, which offset the declines in NSR on a QoQ basis. Net revenue from operations decreased by 0.5% QoQ and 3% YoY, with EBITDA down c.4% QoQ and c.7% YoY. The results included a write back of Rs 14,129 million in ‘Other Expenses’ thereby inflating the EBITDA at the consolidated level.

The company’s Kalinganagar 5.0 mtpa brownfield expansion remains on schedule, with the CRM complex adding annealing lines expected to be commissioned soon (one annealing line was commissioned during December 2024). Tata Steel is also advancing its expansion plans at the NINL production site as part of its broader strategy to achieve its Indian capacity targets for FY2031 and is currently undergoing the EC approval process.

In Europe, the performance saw losses peaking in Q2FY25 due to TSUK blast furnace shutdowns, poor demand seen in the Netherlands and falling NSR. In Q3FY25, TSUK losses nearly halved, due to the savings on fixed costs post closure of the blast furnaces. TSN saw an increase of deliveries on a QoQ basis by 2%. Falling NSR in Netherlands deter the higher volumes and the TSN business ended up at a minute loss on the EBITDA level.

TSUK transition continues while KP Phase II 5.0 mtpa expansion ramps-up steadily

Tata Steel’s current operational capacity in India stands at 26.60 mtpa, which includes the 5.0 mtpa brownfield expansion at Kalinganagar. This expansion is expected to reach full ramp-up within the next few quarters (H1FY26E). The 2.20 mtpa CRM complex is adding galvanizing and annealing facilities, which will contribute to an improved product mix by increasing the share of VAP thereby enhancing realizations. Kalinganagar plant will bring in significant fixed costs savings, higher efficiencies and be free of the ‘legacy costs’ attached to the Jamshedpur facilities.

While the KP-II progresses, the company’s focus will be towards cost reductions on the European business which has been facing its challenges since the acquisition of Corus. The TSUK blast furnaces have been completely shut down and shall be procuring it substrate from TSN however, the downstream assets continue to function and meet with orders in the geography.

Valuation and View

We project Revenue/EBITDA growth for Tata Steel at a CAGR of 8%/24%, over FY25- 27E. We value Tata Steel on a SOTP basis to arrive at our revised target price of Rs 146/sh.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632