Buy PSP Projects Ltd For the Target Rs. 695 by the Axis Securites

Recommendation Rationale

Robust Order Book: As of December 31, 2024, the company’s order book stood at Rs 6,417 Cr, with an order inflow of Rs 1,983 Cr in 9MFY25. The current bid pipeline for Q4FY25 stands at Rs 1,800 Cr. A healthy order book provides strong revenue visibility for the next two years, with the company expected to achieve a 19% revenue CAGR over FY24-26E.

Margins and Profits to Grow with Execution Pickup: In Q3FY25, project execution for delayed projects picked up and is expected to drive EBITDA and PAT growth. Accordingly, EBITDA and PAT are anticipated to grow at a CAGR of 16% and 24%, respectively, over FY24-26E.

Revenue Growth Supported by Partnership with Adani Infra: The company has entered into an arrangement with Adani Infra, wherein Adani Infra will acquire up to a 30% stake from the founder promoter. Management has indicated an expected order inflow of Rs 2,000 Cr by Mar’25 through this partnership. This collaboration will enhance visibility in securing construction orders and strengthen capabilities, significantly contributing to revenue growth in the coming years.

Sector Outlook: Positive

Company Outlook & Guidance: The company has guided revenue to be around Rs 2600 Cr, EBITDA margin in the range of 9-10%, and an order inflow of Rs 3,500-4,000 Cr in FY25. For FY26, it has guided revenue of over Rs 4,000 Cr, EBITDA margins of 9-10%, and the order inflow of Rs 5,000 Cr

Current Valuation: 14.5x FY26 EPS (Earlier Valuation: 14.5x FY26E EPS)

Current TP: Rs 695/share (Earlier TP: Rs 665/share)

Recommendation: We maintain our recommendation to BUY on the stock.

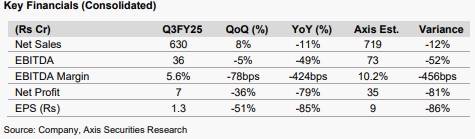

Financial Performance PSP Projects Ltd. (PSPPL) reported a weak set of numbers owing to slower execution. In Q3FY25, the company reported revenue of Rs 630 Cr (down 11% YoY), EBITDA of Rs 36 Cr (down 5% YoY), and APAT of Rs 7 Cr (down 79% YoY). EBITDA margins were 5.6% in Q3FY25 (compared to the estimate of 10.2%), down from 9.9% in Q3FY24.

The order book break-up is as follows: 55% of the total order book is from the Government (Rs 3560 Cr), 9% from Industrial (Rs 562 Cr), 26% from Institutional (Rs 1659 Cr), 10% from Private Residential (Rs 636 Cr) and balance from Government Residential (Rs 164 Cr) .

.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633