Buy Bikaji Foods International Ltd For Target Rs. 775 BUY Bikaji Foods International

Margin recovery positive; pushing growth in Core, key ahead

We maintain BUY on Bikaji with unchanged Mar-26E TP of Rs775, on 60xP/E, as we continue to believe in the strong growth narrative ahead. With headwinds in the base, we see organic business growth recovering to the low teens, a midsingle-digit revenue contribution from M&A initiatives, and better margin on the horizon. We anticipate robust ~29% adjusted earnings (ex-PLI) growth over FY25-28E. Q4 results logged gradual recovery in growth momentum (core business) to ~11%, revenue contribution of 3% from M&As, and full recovery in gross margin (GM; at 32%, in line with 1H). The mgmt sees volume growth recovery in Core to 12-13%. Bikaji Retail is set to gain perspective in FY27.

Q4 topline in line; volume growth at 8.9%; M&As to drive growth ahead

Consolidated revenue grew 14.6% to Rs6bn in Q4FY25. Core business growth stood at 11.3% YoY, up from 7.8% in Q3, however lower than the mid-teen growth in 1H. We reckon M&As contributed ~3% to revenue. Volume growth stood at 8.9% (organic business growth at 7-7.5%), up from 3% in Q3, albeit lower than the low-teen aspiration. Core markets (71% of sales) sustained the low double-digit growth momentum, at 10%. Focus states saw 22% growth in the base business, while sales grew 39% (including THF revenue of Rs110mn). The Ethnics portfolio saw 11.4% growth YoY to Rs4.2bn. Western snacks recovered the growth momentum to 21.5% in Q4 vs 1% growth in Q3 (when the company reduced focus on the inflation-hit potato). Packaged sweets (fewer wedding dates) and papad delivered a muted show, with -1% and 5% YoY growth.

Raw material easing heartening; to aid better margins ahead

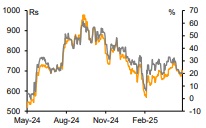

Adjusted for PLI, GM in Q4 stood at ~32% in Q4, down by 115bps YoY and up by 435bps QoQ. Such further adjustment for M&As is likely have been ~31%. With CPO prices seeing easing in Q1 (now 17% higher vs Sep-24, when the GoI effected 22% duty hikes), we expect a full GM recovery in FY26. On steady price basis, we see margin benefits for Bikaji ahead, as the 22% duty increases have been offset by the company taking price hikes of 2-2.5% in 2HFY25. Bikaji has effected 0.5% price hikes in Q1FY26. We also see GM accretion from M&As where the margin is over 50%. Adjusted for PLI, EBITDA margin stood at 10%, down by 300bps YoY and up by 415bps QoQ. We believe the recovery in EBITDA margin for the core business is sufficient for absorbing dilution from M&As. With headwinds now behind, we see 29% earnings CAGR over FY25-28E.

Growth narrative strong; maintain BUY

Bikaji's growth narrative continues to swiftly improve under its professional management, which has dual focus – of strengthening core operations and enhancing fundamentals through strategic M&A initiatives. Over the medium term, the company is likely to focus on its QSR aspiration under The Hazelnut Factory, while thrust on its own Bikaji store will gain focus from FY27. We maintain BUY on the stock, with Mar-26E TP of Rs775 on 60x P/E.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354