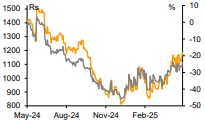

Add CreditAccess Grameen Ltd For Target Rs. 1,225 By Emkay Global Financial Services Ltd

To be key beneficiary of the MFI recovery storyAfter slipping into loss in 3Q, CREDAG was able to post profit (of Rs472mn) in Q4, mainly on improvement in margin and contained provisions. MFI asset quality continues to take a hit from MFIN guardrails as well as the adverse impact of the ordinance in Karnataka (which led to Rs1.5bn additional credit cost in Q4FY25). We believe full implementation of MFIN guardrails alongside adverse impact of the recent TN ordinance could keep MFI stress elevated in H1FY26. The company expects AUM growth of 14-18% in FY26, led by retail finance, albeit softer MFI growth due to accelerated write-offs in H1FY26 (expects a rebound in H2FY26). We cut FY26E earnings by 4.9%, factoring in the slower growth/elevated LLP. However, we retain ADD while revising up our TP by ~26% to Rs1,225 (Rs975 earlier), implying 2x FY27E ABV (at a premium to peers, including SFBs), given CREDAG’s credible track record to ride the MFI recovery story and deliver strong RoA (3-5% over FY26-28E). We also take comfort in its strong capital buffers and management pedigree vs peers.

Soft AUM growth continues, though recovery expected from H2FY26

CREDAG reported continued soft GLP growth, at 4.6% YoY/(2.9%) QoQ, largely on account of muted MFI growth amid the current stressed environment, stricter MFIN guardrails, and focus on collections instead of disbursement/GLP growth. The company expects overall AUM growth of 14-18% – with MFI contributing 8-12% and the rest driven by retail finance. However, due to the impact of the ordinance in Karnataka, MFI growth in FY26 is anticipated to be lower. Further, the company did not see any impact from the recent TN ordinance at ground level.

NPAs surge QoQ due to MFIN guardrails and Karnataka Ordinance effect

CREDAG saw a jump in GNPAs by 77bps QoQ to 4.8% and in PAR 0+ by 10bps QoQ to 6.9%, mainly due to higher stress seen in the MFI portfolio. GLP with CREDAG+3 lenders reduced to ~15% vs 19% in Q3FY25, while borrowers with CREDAG+3 lenders reduced ~20% vs 24% in Q3FY25. However, as part of its early risk recognition and conservative provisioning policy, CREDAG undertook an accelerated write-off of Rs4.8bn, of loan accounts with 180+DPD. The company believes accelerated write-offs shall be taken in H1FY26 with the aim of normalizing asset quality by Sep-25.

We retain ADD; revise up our TP to Rs1,225

We cut our FY26 earnings estimates by 4.9%, factoring in the slower growth and elevated LLP. However, we retain ADD on CREDAG while revising up our TP to Rs1,225 from Rs975 earlier, implying 2x FY27E ABV (at a premium to peers, including SFBs), given CREDAG’s credible track record of riding the MFI recovery and delivering strong RoA (3-5% over FY26-28E). Key risks: Slower than expected recovery in MFI, management attrition.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354