M&A and Strategic Deals in the BFSI space rise 3x in CY25 YoY: Equirus Capital

The number of deals in the BFSI space rise 3x in CY25 (YoY), the year saw as many as 30 deals vs 10 in CY24. Within the BFSI sector, Banks and NBFCs accounted for M&As and strategic deals worth Rs 42,939 crore, while other BFSI segments recorded deals worth Rs 43014 crore, this as per a press note released by Equirus Capital – Mumbai based full-service investment banking. The press note details the M&A developments in the BFSI sector.

NBFCs outperform banks over the last one year

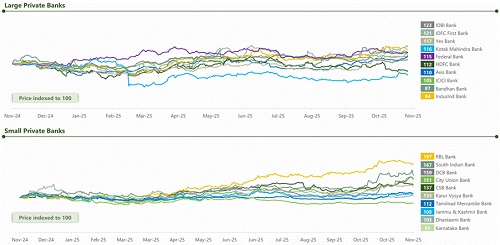

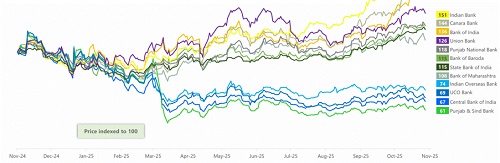

NBFCs have outperformed PSU, large and small private banks in terms of price movement and returned garnered in the past 12 months. The price indexed to 100 for NBFCs, witnessed L&T Finance share price rallying the most, it has almost doubled to 204, followed by Muthoot Finance, Manappuram Finance at 188, 184 respectively. The best performing large private banks in terms of share price movement were IDBI Bank, IDFC First Bank and Yes Bank. For small private bank it was RBL Bank, South Indian Bank, DCB Bank with price growth at 197, 167 and 159 respectively. Among the PSU Banks, Indian Bank, Canara Bank, Bank of India were best performing at 151, 144 and 136 respectively.

Above views are of the author and not of the website kindly read disclaimer