Buy Deepak Nitrite Ltd For Target Rs. 2,005 By JM Financial Services Ltd

Recovery likely from 2HFY26

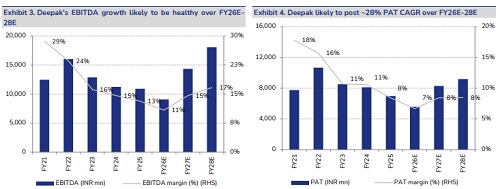

Deepak Nitrite’s 2QFY26 consol EBITDA was in line with our muted expectations. The company’s phenolics segment saw improvement while the advanced intermediates segment declined sequentially. It intends to rapidly ramp up the utilisation of its hydrogenation and nitration (likely to be commissioned in 3QFY26) capacities. This is likely to provide a lift to AI segment margins from 2HFY26 while there could also be some recovery in volume, in our view. Further, the commissioning of MIBK/MIBC, acetophenone capacities in 2HFY26 will be positive for the phenolics segment. Additionally, the polycarbonate complex, to be commissioned by end-FY28, will provide the company the next leg of growth. Factoring in 2QFY26 performance and subdued phenol spreads, our FY26-28 EPS estimates are revised downwards by ~12-29%. We roll forward to Dec’27E earnings and maintain BUY with a revised Dec’26 TP of INR 2,005 (based on 30x Dec’27E EPS) (from Sep’26 TP of INR 2,265 earlier).

* EBITDA in line with JMFe: Deepak Nitrite’s 2QFY26 consol gross profit came in 4% below JMFe at ~INR 5.2bn (down 1%/19% QoQ/YoY) as gross margin was lower than expected at 27.6% (vs. JMFe of 28.6%, ~28% in 1QFY26) while sales was largely in line with JMFe and consensus at ~INR 19bn (flat QoQ, down 6% YoY). During the quarter, other expenses came in slightly lower at ~INR 2.2bn (vs. JMFe of ~INR 2.3bn and ~INR 2.3bn in 1QFY26). As a result, EBITDA was in line with JMFe while 6% above consensus and stood at ~INR 2bn (up 8% QoQ while down 31% YoY). Further, PAT came in 6% below JMFe and 6% above consensus at ~INR 1.2bn (up 6% QoQ while down 39% YoY). In 2QFY26, the company received incentives from the government in one of its subsidiaries amounting to INR 164.6mn (vs. ~INR 172.3mn in 1QFY26). Excluding this, 2QFY26 EBITDA would be ~8%/2% below JMFe/consensus at ~INR 1.88bn.

* Phenolics EBIT higher than expected; advanced intermediates EBIT significantly lower: Deepak’s phenolics EBIT was higher than expected and stood at ~INR 1.4bn (vs. JMFe of ~INR 1.3bn, up 23% QoQ while down 33% YoY) as phenolics EBIT margin improved to 10.9% (vs. JMFe of 10.1% and 9% in 1QFY26) and revenue was above our estimate at ~INR 13.3bn (vs. JMFe of ~INR 12.9bn and ~INR 13bn in 1QFY26). Deepak’s advanced intermediates EBIT came in significantly below our expectation at INR 230mn (vs. JMFe of INR 430mn and INR 355mn in 1QFY26) as advanced intermediates EBIT margin declined to 3.9% (vs. JMFe of 6.7% and 5.9% in 1QFY26) and revenue was lower than expected at ~INR 5.9bn (vs. JMFe of ~INR 6.4bn and ~INR 6.1bn in 1QFY26).

* Estimate 28% EPS CAGR over FY26E-28E; maintain BUY: The company has launched seven new products in 2QFY26 with applications in life sciences, polymers and mining among others. These are expected to contribute to the top line from FY27E. Further, the company plans to commission its integrated polycarbonate complex by end-FY28. This is likely to sustain longterm growth along with providing margin benefits. Factoring in 2QFY26 results and management commentary, we lower our FY26E-28E EBITDA and EPS estimates by ~4-27% and ~12-29%, respectively. We maintain BUY with a revised Dec’26 TP of INR 2,005 (based on 30x Dec’27E EPS) (from Sep’26 TP of INR 2,265 earlier).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361