Buy Aavas Financiers Ltd For Target Rs. 2,000 By JM Financial Services Ltd

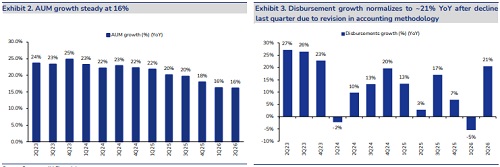

Aavas reported a strong rebound during the quarter, with PAT rising +11%/+18% YoY/QoQ (+6% vs. JMFe), translating into an RoA/RoE of 3.4%/14.3%. The beat was primarily driven by higher-than-expected NII (+19%/+10% YoY/QoQ, +5% JMFe), aided by a +49bps QoQ improvement in calc. NIMs and lower-than-estimated credit costs of 15bps (-7bps QoQ, vs. 21bps JMFe). AUM growth remained steady at +16%/+3% YoY/QoQ, supported by strong disbursements (+21%/+36% YoY/QoQ), which normalized post the accounting methodology change in 1Q. Asset quality remained stable with GS3/NS3 ratios at 1.24%/0.84% (+2bps/+1bps QoQ), while 1+ DPD improved to 3.99% (vs. 4.15% in 1Q). Mgmt. guided for ~18% AUM growth (vs. 18–20% guided earlier) and credit costs <25bps for FY26. The company targets monthly disbursement run-rate of ~INR 6.5–7bn (vs. ~INR 5bn currently), supported by continued expansion in TN and upcoming foray into AP/Telangana. We expect Aavas to maintain its strong performance going forward, backed by (a) revival in growth momentum, (b) margin benefits from CoF tailwind, (c) better operating leverage, and (d) benign credit costs. We largely maintain our FY26–27E EPS estimates and maintain BUY with an unchanged TP of INR 2,000, valuing the stock at 2.7x FY27E BVPS, in return for avg. RoA/RoE of 3.3%/14% over FY26–27E.

* Steady growth: AUM growth remained steady at +16%/+3% YoY/QoQ, supported by robust disbursements (+21%/+36% YoY/QoQ), which normalized post the 1Q dip caused by the shift in accounting methodology. Mgmt. targets a monthly disbursement run-rate of ~INR 6.5–7bn (vs. ~INR 5bn currently), driven by continued expansion in TN, where 8 new branches were added in 2Q and 8 more branches to be added in 2H. Further network expansion is planned in AP/Telangana in the near term. MSME segment grew +29%/+3% YoY/QoQ, while the LAP/HL portfolio registered growth of +16%/+13% YoY respectively. Mgmt. guided for FY26 AUM growth of ~18% (vs. 18–20% guided earlier) and expects growth to accelerate to ~20%+ over the next five years. We build in an AUM CAGR of ~17% over FY25–27E.

* Beat in operating performance and profitability: PPoP was a beat at INR 2.2bn (+12%/+15% YoY/QoQ, +5% JMFe), primarily due to strong NII (+19%/+10% YoY/QoQ, +5% JMFe). This was driven by a 49bps QoQ increase in NIMs (calc.), which in turn was led by a 45bps QoQ increase in calc. yields. Opex was higher than expected (+4% JMFe), however, lower-than-anticipated credit costs at 15bps (-7bps QoQ) resulted in further PAT beat (+11%/+18% YoY/QoQ, +6% JMFe). Mgmt. indicated the CoF benefits to accrue with 36% borrowings linked to external benchmarks and 25% to sub 3-month MCLR. PLR was also unchanged during the quarter, signalling further margin support going forward. We build in EPS CAGR of 17% over FY25-27E.

* Asset quality fairly steady: Headline asset quality remained broadly stable, with GS3/NS3 at 1.24%/0.84% (+2bps/+1bps QoQ). Notably, 1+ DPD improved to 3.99% (vs. 4.15% QoQ), indicating early signs of stabilization. Mgmt. flagged minor stress in parts of eastern MP and Surat, though the impact remains limited, with <1.8% of AUM exposed to tariff-related issues. PCR on stage-3 improved +30bps QoQ to 31.9%, while total ECL cover remained steady at 0.72% (vs. 0.70% in 1Q). We build in avg. credit cost of ~17bps over FY26E/27E.

* Valuation and view: We expect Aavas to maintain its strong performance going forward, backed by (a) revival in growth momentum, (b) margin benefits from CoF tailwind, (c) better operating leverage, and (d) benign credit costs. We largely maintain our FY26–27E EPS estimates and maintain BUY with an unchanged TP of INR 2,000, valuing the stock at 2.7x FY27E BVPS, in return for avg. RoA/RoE of 3.3%/14% over FY26–27E.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)