Buy Apollo Tyres Ltd For Target Rs. 615 By JM Financial Services Ltd

RM benefit to continue; early signs of recovery seen in Europe

Apollo Tyres (APTY) reported a consolidated EBITDA margin of 14.9% in 1QFY26 (+130bps YoY, +170bps QoQ), 150bps above JMFe due to lower-than-expected RM costs (RM basket was down 3% QoQ). In India, OE and replacement demand saw 4%/2% growth; replacement demand got impacted due to postponement post GST rate cut announcement. Despite challenging environment challenging across key categories in EU region, APTY revenue grew of 4% YoY driven entirely by volumes. Demand outlook remains positive, with 3Q growth expected to be similar or better and 2H momentum supported by GST benefits and recovery in infrastructure and mining activity post-monsoon. APTY aims to drive growth through new products, brand strength, and an expanding dealer network. In Europe, while the outlook is still subdued, conditions have improved compared to two quarters ago, with low single-digit growth expected, per management. On the margin front, a rich product mix, stable to slightly down raw material costs, the closure of the Netherlands plant (benefit to accrue from FY27), and continued cost control initiatives are expected to support margins in the medium term. We have revised our EBITDA margin estimates upwards marginally. We roll forward and apply a 16x PE multiple (versus 15x earlier) on average FY27E/28E EPS to arrive at a TP of INR 615. We maintain BUY.

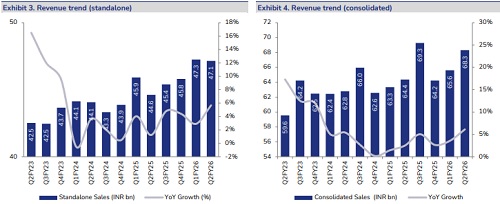

* 2QFY26 – Margin above estimate: APTY reported standalone revenue of INR 47.1bn (+5.7% YoY, flat QoQ). EBITDA for the quarter stood at INR 7.2bn (+33.7% YoY, +11.8% QoQ), with an EBITDA margin of 15.3% (+320bps YoY, +160bps QoQ). At the consolidated level, APTY reported revenue of INR 68.3bn (+6.1% YoY, +4.1% QoQ), 4% above JMFe. Cons. EBITDA came in at INR 10.2bn (+16.3% YoY, +17.6% QoQ), 15.5% above JMFe. Cons. EBITDA margin stood at 14.9% (+130bps YoY, +170bps QoQ), 150bps above JMFe due to lower-than-expected RM costs. Adjusted consolidated PAT stood at INR 4.4bn (+44.8% YoY, +14.4% QoQ), 27.9% above JMFe. However, reported PAT came in at ~INR 2.6bn (-13.2% YoY), impacted by restructuring costs at Apollo Netherlands (~INR 1.8bn) and an employee restructuring exercise (INR 36mn).

* India business: APTY posted steady growth in 2Q with volumes up 4%, supported by both OE and RE segments and a strong recovery in exports. Farm, 2W, and 3W categories delivered healthy growth, while truck and PC remained muted. RE grew 2% and OEM 4%, with RE impacted by purchase deferments post-GST announcement, which are expected to ease. Premium brand Vredestein achieved its highest-ever quarterly volume, and its share is expected to rise further. Market share remains industry-leading at 29% in TBR RE and 20% in PC RE, with TBR share loss arrested. OEM share was maintained, though PC OEM share dipped as the company avoided low-margin bids. Export volumes rose in double digits during the quarter, and management guided for high single-digit export growth for FY26. Demand outlook remains positive, with 3Q growth expected to be similar or better and 2H momentum supported by GST benefits and recovery in infrastructure and mining activity post-monsoon. APTY aims to drive growth through new products, brand strength, and an expanding dealer network.

* European business: Despite challenging environment challenging across key categories in EU region, APTY revenue grew of 4% YoY driven entirely by volumes. While the outlook is still subdued, conditions have improved compared to two quarters ago, with low single-digit growth expected. EBITDA margin declined by ~210 bps YoY to 12.7% (+190 bps QoQ), remaining below the company’s target as APTY executes strategic transition initiatives. The UHP mix increased to 49% versus 46% YoY, and PCR capacity expansion in Hungary is underway to support future growth. A settlement with the works council in the Netherlands has been finalized, resulting in an exceptional restructuring cost of EUR 17mn, payable in the next fiscal year. The closure, expected by June 2026, is anticipated to improve profitability in the EU region.

* Margin outlook: EBITDA margin stood at 14.9% (+130 bps YoY, +170 bps QoQ), 150 bps above JMFe, primarily due to lower-than-expected raw material costs. Overall RM costs declined 3% QoQ, with NR at INR 210/kg, SR at INR 175/kg, Carbon Black at INR 115/kg, and steel cord at INR 155/kg. RM prices are expected to remain stable to slightly lower in 3Q, staying range-bound and supporting margins for the India business.

* Capex/debt update: For FY26, the management maintained its capex guidance at INR 15bn (split between growth and maintenance capex). During 2QFY26, its consol. net debt increased to INR 26bn (vs. INR 21bn in 1QFY26), with Net Debt / EBITDA at 0.8x (vs. 0.7x in 1QFY26).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361