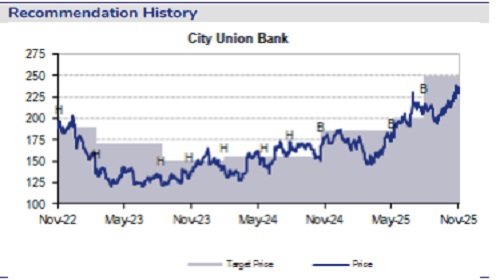

Buy City Union Bank Ltd For Target Rs. 285 By JM Financial Services

CUBK delivered a PAT growth 7% QoQ, supported by 7% QoQ growth in NII and lower credit cost. NIMs (calc.) expansion of 4bps QoQ was driven by faster repricing of deposits and gold loan migration to fixed-rate pricing. Management expects margins to remain steady in coming quarters, aided by deposit cost re-pricing. Asset quality improved further, with 35bps QoQ reduction in gross slippages, and negative net slippages driven by higher recoveries. Consequently, credit cost was down by 12bps QoQ to 40bps despite increase in PCR to 63%. SMA-2 book also declined to 1.34% vs. 1.6% in 1QFY26, which provides additional comfort on future asset quality trends. Loan and deposit growth momentum continue to remain healthy at 19%/21% YoY. With a strong capital base (CAR at 21.7%), improving asset quality, and a largely stable margin profile, we believe CUBK is well positioned to sustain its growth trajectory. We raise EPS by ~1%-3% for FY26-28E and build in average ROA/ROE of 1.5%/13% over FY26-28E. We maintain BUY with a revised TP of INR 285, valuing the bank at 1.8x FY27E BVPS.

* Assets quality robust: Gross slippages moderated to ~1.2% from ~1.5% in 1QFY26. However, net slippages trending negative led by higher recoveries/upgrades of ~15.5% (un-annualized). Despite increase in PCR by 245bps QoQ to ~63%, credit cost declined to 41bps from 53bps in 1QFY26. The bank also made an additional ECL buffer provision of INR 100mn during the quarter. Management has indicated that recoveries will continue to exceed slippages in the coming quarter.

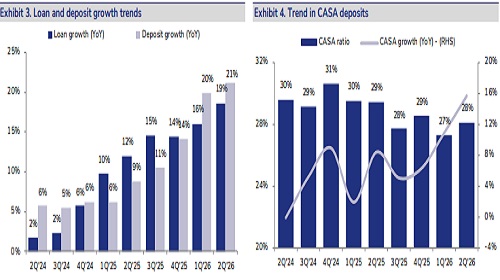

* Highest growth in a decade: CUBK reported its highest loans/deposits growth in a decade, loans/deposits growing at 19%/21% YoY. Loan growth was driven by personal loan (grew 2x) followed by 52% YoY growth in non-agri gold, 26% YoY growth in MSME, 18% YoY growth in agri gold, and 17% YoY growth in home loans. Deposit growth was driven by 9% QoQ increase in low-cost deposits and 4.5% QoQ rise in term deposits. Deposit growth outpacing loan growth led to decline in CD ratio by 60bps QoQ to 81.6%.

* Deposit repricing aided NIM: The bank’s margin expanded by 4bps QoQ driven by faster repricing of high-cost liabilities/term deposit and accelerated growth in CASA. This was further aided gold loan migration to fixed rate. Management guided for stable NIM in coming quarter on the back of faster repricing of liabilities.

* Valuation and view: The bank has delivered stellar outperformance with operational and PAT beat of 4% and 7%. Strong visibility of +2%-3% higher growth than sector growth led by MSME/gold/retail. We believe CUBK is well position to sustain its growth trajectory with sufficient capital adequacy of 21.7%. With bank’s legacy in underwriting and managing MSME portfolio and minimal exposure to unsecured retail further underpins its resilient assets quality. At 1.5x FY27E BVPS the stock offers a favorable risk-reward profile. Sustained growth momentum, prudent risk management and improving operating leverage should aid further rerating. We maintain our loan growth estimates ~15% over FY25-28E with average ROA/ROE of ~1.5% /13% for FY26-28E. Maintain BUY with a revised TP of INR 285, valuing the bank at 1.8x FY27E BVPS closer to its historical valuation of 1.8x one-year fwd P/B.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361