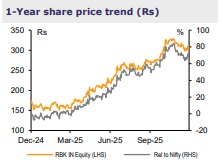

Buy RBL Bank Ltd For Target Rs.375 By Emkay Global Financial Services Ltd

We met MD & CEO R Subramaniakumar of RBL Bank (RBK), to understand the progress on the Emirates NBD (ENBD) deal and the growth outlook, particularly in view of the huge capital boost post-deal. He indicated that regulatory approvals are expected by mid-4QFY26, after which ENBD could launch an open offer of Rs280/share followed by preference capital infusion, as indicated earlier. The bank sees the deal as a game-changer, with boost in networth to ~Rs450bn/CET 1 to 39% (depending on ENBD stake purchase/capital raise), which would catapult it into a different orbit vs peers, in terms of assets-liability scale-up (organic/inorganic) and fee opportunity. The mgmt believes that the better cost of funds due to higher share of equity funding, improved debt rating and access to NRI fund-flow should enable the bank to strategically shift its loan portfolio toward mortgages/corporates, leading to better RoA/RoRWA. Also, RBK is likely to explore inorganic opportunities, to strengthen its liabilityasset mix and thus accelerate RoE in the long run. Near term, we believe the recent rate cut would weigh on margins and thus trim FY26E earnings, while raising earnings for FY27-28E by 8% given the better growth potential. We retain BUY on the stock while raising our TP by 7% to Rs375, now rolling fwd on 1.2x Dec-27E ABV. We have not factored in the business/RoA surge due to the deal (as it is not yet completed), which has upside potential.

ENBD deal to be game-changer; regulatory approvals by mid-4Q awaited The proposed strategic investment by ENBD to acquire majority stake (minimum 51%) in RBK is currently progressing well, with the mgmt awaiting regulatory clearance—RBI, DPIIT, CCEA, CCI, BSE, and NSE—by mid-4Q. Officials of both entities are actively engaging with regard to the operational and accounting norms. However, until, regulatory approvals are in place, the bank shall refrain from outlining any detailed post-deal strategy in terms of building scale, cross-bank synergies, or re-orientation of its current product portfolio. That said, the mgmt believes the deal would accelerate the bank’s growth trajectory via organic/inorganic routes and should be earnings-/RoA-positive.

Rate cuts to hurt NIMs/RoA in near term, but shoot-up over medium-long term RBK logged a strong credit-growth bounce back in 2Q which it hopes to sustain, given the strong underlying growth impulse post GST rate-cut. Disbursements are picking up in the MFI business, thus leading to sequential growth. Realignment of card business collection, from BAF to RBK, is taking longer than expected and could thus keep slippages elevated in the near term, while CIF growth would turn positive from 1QFY27. The recent rate-cut as well as potential cut in 4Q could keep margins under pressure for longer than expected and should hence push back the quarterly RoA run-rate of 1% post-4QFY26. However, we believe that lower CoF benefiting from higher share of zero-cost equity funding, access to NRI fund-flow, and improved debt rating would, in turn, expand the bank’s margin and thus the RoA in the long term (at least by 20-40bps over FY27-28E), though RoE is likely to keep to a single digit. The deal and thus the larger capital pool/balance sheet would also open up fee opportunities from trade/transaction banking.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354