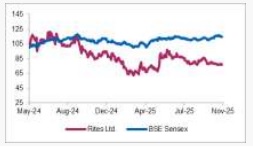

Buy Rites Ltd For Target Rs. 280 By Axis Securities Ltd

Est. Vs. Actual for Q2FY26: Revenue: INLINE; EBITDA Margin: BEAT; PAT: BEAT

Change in Estimates post Q2FY26 (Abs.)

FY26E/FY27E: Revenue: 0%/0%; EBITDA: 2%/4%; PAT: 3%/4%

Recommendation Rationale

Strong Order Book: In Q2FY26, the company secured over 150 new orders worth Rs 851 Cr, taking the total order book to Rs 9,090 Cr and ensuring strong revenue visibility for the next 2–2.5 years. Notably, 34% of the order book comprises the high-margin consultancy segment, underscoring its profitability profile. Backed by a robust pipeline and increasing opportunities across the infrastructure space, the company remains well-positioned to deliver sustainable long-term growth.

Export Vertical to Support Revenue Growth: The company has secured export orders worth Rs 1,541 Cr, with revenue contribution from exports improving since Q2FY26. Given this momentum, the company’s revenue is expected to register a CAGR of 23% over FY25–FY27E.

Turnkey Projects to Contribute to Sales Growth from Q4FY26: Turnkey projects account for 46% of the company’s order book and are expected to be a key driver of revenue growth. Although turnkey sales have currently seen a decline as most projects are in the initial stages, execution progress and transition to advanced stages are likely to accelerate revenue momentum going forward.

Sector Outlook: POSITIVE

Company Outlook & Guidance: For FY26, management expects a double digit revenue growth and margins of around 20%.

Current Valuation: 24x FY27E (Earlier Valuation: 24x FY27E EPS).

Current TP: Rs 280/share (Earlier TP: Rs 280/share).

Recommendation: We maintain our BUY recommendation for the stock.

Financial Performance

RITES Ltd. reported a positive performance in Q2FY26, with revenue of Rs 549 Cr (up 1% YoY), driven by growth in consultancy and export segments. EBITDA stood at Rs 130 Cr (up 15% YoY), while PAT came in at Rs 110 Cr (up 82% YoY). The company reported EBITDA margins of 23.7% in Q2FY26 (our estimate: 20.2%) compared to 19.7% in Q2FY25.

The rise in revenue from other segments offset the decline in turnkey revenue. During the quarter, RITES recorded Consultancy sales of Rs 298 Cr (up 10% YoY), Export sales of Rs 61 Cr (up 2523% YoY), Leasing sales of Rs 43 Cr (up 22% YoY), and Turnkey sales of Rs 113 Cr (down 44% YoY). The EBITDA margins of the Consultancy and Leasing segments were not disclosed

Outlook

The company maintains a robust order book along with a clean balance sheet, strong return ratios, and a healthy dividend payout. With favourable opportunities across segments, particularly in highmargin consultancy projects, it is expected to deliver Revenue/EBITDA/PAT growth of 23%/24%/21% CAGR over FY25-27E. However, elevated competitive intensity is likely to keep margin pressures intact.

Valuation & Recommendation

The stock is currently trading at 25x/21x FY26E/FY27E EPS. We value the company at 24x FY27 EPS to arrive at a TP of Rs 280/share, implying an upside of 13% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633