Buy Hero MotoCorp Ltd For Target Rs. 6,650 By JM Financial Services Ltd

Strong demand outlook; HMCL to outperform

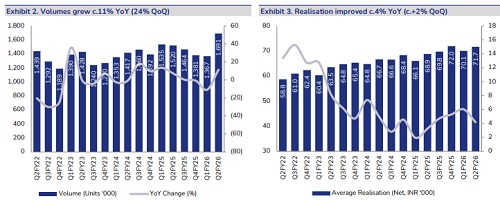

During 2QFY26, Hero MotoCorp’s (HMCL) EBITDA margin stood at 15% (+50 bps YoY, +60 bps QoQ), 30 bps above JMFe. The ICE business reported a margin of 17.7% in 2Q compared to 16.5% in 2QFY25. Realisations grew c.4% YoY (+2.4% QoQ), primarily driven by a favourable mix and pricing. Management indicated that demand post-festive season remains strong, with inventory at its lowest in recent years and receivables reduced to 12 days from 30 days earlier, reflecting buoyancy in the market. HMCL expects the domestic 2W industry to grow by 8–10% in 2HFY26, supported by GST rate cuts, a pickup in first-time buyers, rural recovery, a healthy monsoon, RBI rate cuts, income tax reductions, and lower inflation. Management believes HMCL will outperform the industry in both domestic and export segments, driven by recent and upcoming product launches and expansion into new geographies. The company has maintained its long-term EBITDA margin guidance at 14–16%. We are revising our estimates upwards, driven by launches (both in ICE and EVs) and improved operating efficiency. Volume estimates for FY26E/FY27E have been raised by 0.3%/3% respectively. Consequently, EPS estimates have been revised upward by 1.6%/4.8%. We roll forward and apply a 19x PE multiple (versus 17x earlier) on average FY27E/28E EPS to arrive at a TP of INR 6,650. We maintain BUY.

* 2QFY26 - margin above JMFe: HMCL reported net sales of INR 121.3 bn (+15.9% YoY, +26.6% QoQ), in line with JMFe. Volumes during 2Q grew 11.3% YoY (+23.7% QoQ) to c. 1.69 mn units. Realisations improved by 4.2% YoY (+2.4% QoQ), primarily driven by a favourable mix and pricing. EBITDA stood at INR 18.2 bn (+20.3% YoY, +32% QoQ), 2.9% above JMFe. EBITDA margin was 15% (+50 bps YoY, +60 bps QoQ), beating JMFe estimates by 30 bps. PAT came in at INR 13.9 bn (+15.7% YoY, +23.7% QoQ), 2% below JMFe. Spares revenue stood at INR 15.3 bn (+5% YoY), accounting for approximately 13% of revenue during 2Q.

* Market share performance: Management highlighted that HMCL maintained its leadership position in retail sales, with Vahan market share at 31.6% in Oct’25 (+370 bps YoY). During the festive season (23rd Aug’25 to 12th Nov’25), HMCL’s ICE Vahan registrations grew 16.2%, outpacing industry growth of 14.7% and driving a 40 bps market share gain. This was led by strong traction in the entry segment (MS expanded 300 bps in 2Q), as well as the deluxe and scooter categories. Recent launches, Destiny 125 and Xoom 125, helped HMCL capture approximately 10% share in the 125cc segment, largely from strong scooter markets such as Kerala, Karnataka, Maharashtra, and Gujarat. Management remains confident of building on this momentum with the upcoming launch of Xoom 160, a premium scooter.

* Demand outlook: Management indicated that demand has sustained post-festive season, supported by GST rate cuts, an influx of first-time buyers, and strong traction for newly launched products. The company currently holds its lowest inventory levels in recent years, corroborating robust demand. Moreover, receivables have declined to 12 days from 30 days earlier, reflecting market buoyancy. Management expects the domestic 2W industry to grow by 8–10% in 2HFY26, driven by positive sentiment from GST rate cuts, first-time buyer additions, rural recovery aided by a healthy monsoon, income tax reductions, and lower inflation. HMCL is expected to outperform the industry, leveraging its deep presence in the entry-level segment, which is witnessing strong demand, along with recent product launches.

* Performance in export markets: Export dispatches grew 77% YoY in 2Q, which is 3x the industry growth, driven by strong performance in Bangladesh, Sri Lanka, Nepal, and Colombia. The premium portfolio now accounts for over 40% of HMCL’s exports. The company also marked its entry into Europe and the UK, expanding its presence to 52 countries. HMCL’s share in exports expanded by 250 bps to 8.6%.

* Update on EV business: HMCL exited 2Q with approximately 11.7% market share in the E2W segment compared to 6.8% in 2QFY25, driven by brand-building initiatives and the launch of VIDA VX2. Management indicated that the current focus is on investments in new products and brand building. Profitability is expected to be supported by volume ramp-up, localization efforts, price interventions, and PLI benefits. The company received PLI certification for the VIDA V2 Pro in July 2025 and is working on approvals for other models.

* Outlook on profitability: During 2Q, EBITDA margin expanded by 50 bps YoY to 15% (+60 bps QoQ). The ICE business EBITDA margin improved by 120 bps YoY to 17.7%, supported by a favourable product mix, price increases, and cost optimization efforts. The company indicated that it will continue investing in the EV business. Overall, higher operating leverage and a continued focus on cost-saving measures are expected to support margin performance. Longterm margin guidance remains intact at 14–16%.

* Other highlights: 1) 2W financing penetration remained stable and is expected to stay at similar levels in 2HFY26. 2) Investment in the EV business stood at INR 2.52 bn in 2Q. 3) Advertising spends increased by 10% in 1HFY26, while overall customer-related spending remained unchanged, indicating slightly lower discounts.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)