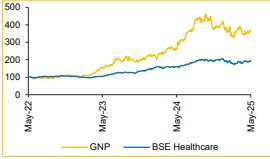

Buy Glenmark Pharmaceuticals Ltd For Target Rs. 1,670 - Choice Broking Ltd

Glenmark Set for Strong Growth with Pipeline and Margin Expansion

While Q4 performance was weak—impacted by delayed product launches, a subdued respiratory season, and compliance-related costs at the Monroe facility—we believe Glenmark is well-positioned for a rebound. Growth is expected to be driven by a robust pipeline in respiratory and injectable segments across existing markets, along with the expansion of key global brands into new geographies. Management has guided for 10–12% revenue growth in FY26. Furthermore, enhanced in-house manufacturing and cost optimization at IGI are likely to support EBITDA margin improvement.

Consequently, we revise our FY27E estimates upward by 1.4%, forecasting Revenue and EBITDA to grow at a CAGR of 13% and 43%, respectively, over FY24–27E. We maintain our valuation at a 20x PE multiple on FY27E EPS, keeping our target price at INR 1,670 and our BUY rating unchanged.

Largely Miss Across Metrics; PAT Dragged by One-time Charges

* Revenue grew 6.3% YoY / declined 3.9% QoQ to INR 32.6 Bn (vs. consensus estimate: INR 33.7 Bn).

* EBITDA rose 11.2% YoY / fell 6.5% QoQ to INR 5.6 Bn (vs. consensus: INR 6.0 Bn); margins expanded 76 bps YoY / contracted 49 bps QoQ to 17.2% (vs. consensus: 17.8%).

* Adj. PAT turned positive YoY and declined 18.3% QoQ to INR 2.8 Bn (vs. consensus estimate: INR 3.4 Bn).

* Exceptional items stood at INR 3.7 Bn due to legal charges, project write-offs, inventory scrapping, and restructuring costs.

North America Growth Set to Rebound from FY26 on Key Launches: North America, which contributes approximately 23% of revenue, is expected to see an uptick in FY26E driven by potential launches in the respiratory and injectables segments. The company is currently working on filing ANDAs for two additional strengths of gFlovent. The Monroe facility is also expected to undergo FDA inspection soon, which will be key to unlocking the injectables pipeline. Key launches anticipated in H1FY26, including Fluticasone 44 MDI and Fluticasone Nasal Spray, represent a market opportunity of USD 500 Mn.

Global Brands to Fuel Growth Across New Markets: The company’s global brands—Ryaltris, Envafolimab, and Winlevi—are expected to be key contributors to future growth. Expansion in both existing and new markets will likely drive strong momentum.

* Ryaltris: Expected to gain momentum as the respiratory season picks up; planned launches in 10–12 additional markets over the next few quarters. The company’s partner in China anticipates approval in FY26.

* Envafolimab: Set for its first market launch in FY26, with marketing authorization already secured in Kenya.

* Winlevi: UK launch expected in FY26, with additional regulatory approvals currently pending in other markets.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131