Buy Vishal Mega Mart Ltd For Target Rs. 175 By JM Financial Services Ltd

All-round beat; hitting the right notes

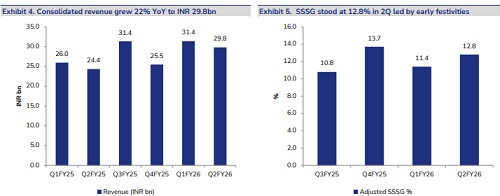

The company reported a robust all-round performance, beating our estimates on all fronts, with revenue growing 23% YoY to INR 29.8bn (4% beat), led by strong SSSG of 12.8% and 10% YoY network addition. Even after adjusting for benefits from the early festive season, SSSG growth remained in double digits. Sales/ Pre-IndAs EBITDA per sqft grew by 11%/26% YoY as the cost of retailing increased only by 6% YoY, reflecting strong execution. We concur with the management‘s strategy of re-investing gross margin gains towards driving higher throughput per sqft, leading to share gains. Its quick commerce initiative is also yielding good results with revenue contribution ranging from 1.5% to 9% across stores depending upon the maturity profile. The company continues to consistently invest in supply chain improvement, which is completely funded through internal cash flows, further strengthening its execution capabilities. We marginally tweak our estimates post the 2Q results. We maintain BUY with unchanged TP of INR 175 via DCF methodology (10% WACC and 6% terminal growth), implying 64x P/E multiple Sep’27 (Pre-Ind AS 116).

* Revenue exceeds expectation: Revenue grew 22% YoY to INR 29.8bn (4% beat on JMFe), driven by robust SSSG of 12.8% and healthy 10 % YoY network expansion to 12.8mn sqft. EBITDA grew 30% YoY to INR 3.9bn (12% beat on JMFe), with EBITDA margin expanding ~80bps YoY to 13.2%. This improvement was led by 10bps YoY gross margin expansion to 28.3% and operating leverage benefits, as employee costs and other expenses declined by 40bps YoY each. Reported PAT grew 46% YoY to INR 1.5bn (22% beat), supported by 53% YoY rise in other income and 70bps YoY decline in ETR to 25.5%, partly offset by 20% YoY increase each in interest and depreciation costs. On a Pre-Ind AS basis, EBITDA grew 40% YoY to INR 2.4bn, with margins improving ~100bps YoY to 8.1%. Pre-Ind AS adjusted PAT grew 50% YoY to INR 1.49bn.

* Store expansion: The company’s total store count stood at 742 at the end of 2QFY26, with a retail area of 12.8mn sqft; out of the 25 stores added this quarter, 23 were in tier-3 cities, resulting in a 1% QoQ decline in average store size to 17.2K sqft as the average size of the new store opened was ~14.4K sqft. We note that East/South grew the fastest at 29%/27% YoY, buoyed by the early festive season and higher store expansion in the South. North, on the other hand, grew by only 15% YoY, while the West grew by 22% YoY.

* Other KPIs: The company added 25 new stores during the quarter (vs. our estimate of 22). Sales productivity improved with sales per sqft at INR 2,370 vs. our expectation of INR 2,250 (strong beat here too). The incremental rental cost (non-Ind AS portion) decreased by 20bps YoY to 5.2%. In addition, the apparel segment registered strong 25% YoY revenue growth to INR 12.6bn with 90bps YoY higher share to ~42.2%, while the FMCG segment’s share declined 1% YoY to 28.7% and its revenue grew by 18% YoY to INR 8.5bn. General merchandise share was largely maintained at 29.1% and the segment grew by 23% YoY to INR 8.7bn. Private label brand contribution stood at 73.6% in 2QFY26, compared to 74.7% in 2QFY25.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361