Neutral Senco Gold Ltd for the Target Rs. 375 by Motilal Oswal Financial Services Ltd

Improved SSSG print; margin volatility continues

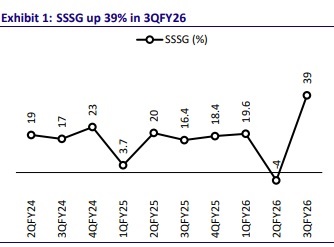

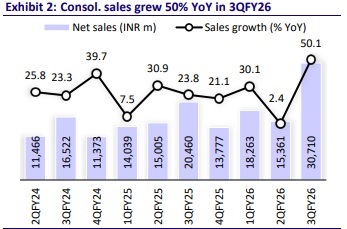

* Senco Gold (SENCO) delivered a consolidated revenue growth of 50% YoY to INR30.7bn, witnessing a sharp acceleration after clocking 2% growth in 2Q (peers >20%). SSSG stood at 39% (21% in 9MFY26), aided by festive demand and a higher old-gold exchange mix (43% of revenue). However, amid elevated gold prices, gold volumes declined 3% QoQ and ~10% in 9MFY26. Management highlighted that the demand momentum has been sustained in 4Q, and expects to deliver >25% revenue growth.

* The company opened four stores (+15% YoY) during the quarter, bringing the total store count to 196 (111 COCO, 83 FOCO, and 2 Dubai). SENCO is on track to reach 200 stores by FY26. ? GM expanded sharply by 830bp YoY to 19.9% (vs. est. 14.3%; 17% in 2QFY26), adjusted to custom duty in base. Inventory gains were added ~350bp in 3Q and ~250bp in 9MFY26 gross margins, which led to a sharp beat to our estimates. SENCO has a lower inventory, hedging to 55-60% in 9MFY26 vs. the earlier 95% in FY25. EBITDA margin expanded 810bp YoY to 13.4% (est. 6.7%, 6.9% in 2QFY26). EBITDA margin adjusted to inventory gain stood at ~9.5–10% in 3Q and ~8.5% in 9M. Management guide 7.5- 7.8% EBITDA margin is sustained. However, given the competitive pressure, we model 7.2% margin for FY27/FY28 (close to the average of FY23-25).

* Given the inconsistencies in operating performance and low hedging ratios, we remain cautious on SENCO’s operating margin performance going ahead. We reiterate our Neutral rating with a TP of INR375 (18x Dec’25).

Beat on profitability; 3Q remains volatile

* Healthy sales growth: SENCO posted a strong consolidated revenue growth of 51% YoY to INR30.7bn (est. INR23.9b). The 3Q performance remained volatile; 2QFY26 revenue growth was 2% YoY (peers were >20%) and 28% in 1QFY26. Titan (Jewelry standalone, ex-bullion), Kalyan, and P N Gadgil (retail) delivered revenue growth of 40%, 42%, and 36% in 3Q. Average transaction value (ATV) rose 8% QoQ to INR93,000, while average selling price rose 6% QoQ to INR60,270, reflecting improved realizations.

* Inventory gain and margin expansion: Consolidated gross margin expanded sharply by 830bp YoY to 19.9% (vs. est. 14.3%; 17% in 2QFY26), adjusted for the customs duty impact in the base quarter. Last year in 3QFY25, the company’s gross margin dipped 710bp due to the impact of hedge accounting. Inventory gains were added ~350bp in 3Q and ~250bp in 9MFY26 gross margins,, which led to a sharp beat to our estimates. Employee expenses rose 31% YoY (adjusted for a one-time INR62mn labor code impact), while other expenses increased 63% YoY. EBITDA margin expanded 810bp YoY and 640bp QoQ to 13.4% (est. 6.7-6.9% in 2QFY26), supported by the sharp improvement in gross margins. ? Strong improvement in profitability: EBITDA grew 282% YoY to INR4.1b (est. 1.6b). APAT grew 396% to INR2,687m (est. INR796m, 2QFY26 INR488m).

* In 9MFY26, net sales/EBITDA/APAT jumped 30%/135%/202%

Key takeaways from the management commentary

* Gold volume declined by ~3% QoQ in 3Q and ~10% in 9MFY26, while the diamond segment recorded a 12.5% growth during 9MFY26.

* For FY27, the company plans to open 18–20 stores, split evenly between COCO (8–10) and franchisee (8–10) formats.

* Inventory stood at INR 46bn (up 55% YoY) to support wedding-season demand. Higher gold prices increased working capital requirements, funded through bank borrowings of INR 22.5bn (up 44% YoY).

* The company hedged 55–60% of inventory in 9MFY26 in a volatile gold price environment (normally 75-90%). In FY25, 95% of its inventory has been hedged

Valuation and view ? Led by the beat on gross margin, we raise our EPS estimates by 12% for FY27 while maintaining the same for FY28.

* SENCO’s gross margins have historically been volatile, reflecting its low level of hedging and resultant inventory gains. Management guided that a 7.5-7.8% EBITDA margin will be sustained. However, given the intense competition, we model 7.2% margins for FY27/FY28 (near the average of FY23-25).

* We model a revenue/EBITDA CAGR of 14%/-6% over FY26-28. However, adjusting the inventory gain, we model an EBITDA CAGR of 10%.

* We reiterate our Neutral rating with a TP of INR375 valued at 18x Dec’27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412