Buy PI Industries Ltd for the Target Rs. 3,780 by Motilal Oswal Financial Services Ltd

Lower volume offtake in CSM drags performance

Operating performance misses our estimates

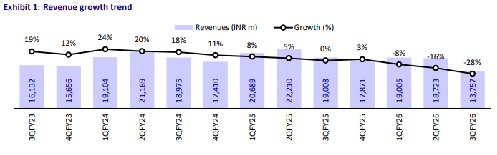

? PI Industries (PI) reported a weak quarter as revenue declined 28% YoY, primarily due to a 32% YoY dip in the CSM business, attributable to global slowdown and cautious customer scheduling (volume declined 29% YoY). Domestic Agri/Pharma also reported a revenue decline of 8%/6% YoY. While gross margins expanded by 630bp YoY due to a better product mix, lower volumes led to adverse operating leverage, thereby resulting in an overall EBITDA margin contraction of 500bp YoY.

? We expect a gradual stabilization in industry conditions after a prolonged downcycle marked by channel destocking, weak commodity prices, and cautious farmer spending. While pricing remains soft and demand visibility is still evolving, management has begun seeing early signs of improvement, particularly in order scheduling and volume traction, thereby guiding sequential revenue growth with EBITDA margins in the range of 26-27%.

? Factoring in the weak 4Q performance and a slower-than-anticipated industry recovery, we reduce our FY26/FY27/FY28 earnings estimates by 9%/11%/10%. We reiterate our BUY rating with a TP of INR3,780 (based on 35x FY28E EPS)

Adverse operating leverage hurts margins

? Revenue stood at INR13.6b (est. INR16.9b), down 28% YoY. Agrochemicals business revenue was down 28% YoY to INR13.2b, and pharma business revenue dipped 6% YoY to INR599m

? EBITDA was INR3b (est. INR4b), down 41% YoY. EBITDA margin contracted 500bp YoY to 22% (est. 23.9%); gross margin was 59% (up 630bp YoY); employee expenses rose 650bp YoY to 16.6%; other expenses grew 470bp YoY to 20.5% of sales. Adj. PAT was down 38% YoY to INR2.3b (est. INR3b).

? PI’s net profit included an exceptional income due to the writeback of contingent consideration of INR1.3b, partially offset by additional provisioning of retirement benefits of INR209m as per the new labor code.

? The EBIT margin for the Agrochemical business was 21.8% (down 730bp), and Pharma reported an EBIT of INR580m vs. a loss of INR599m in 3QFY25.

? For 9MFY26, PI’s revenue/EBITDA/adj. PAT declined 17%/21%/23% to INR51.5b/INR13.6b/INR10.3b. Our 4QFY26 implied revenue/EBITDA/PAT dipped ~16%/22%/21% YoY, while sequentially we have built in a 9%/17%/ 12% growth

Highlights from the management commentary

? Electronic Chemicals: The company anticipates commercializing 4–5 new molecules this year, primarily aimed at semiconductor and other high-end application segments. Additionally, it has secured five new customers in the electronic chemicals space, mainly from Japan and Europe.

? Pharma: Over the past 12 months, the pharma segment added several new customers, including strategic and large pharmaceutical clients, positioning the business for sustained mid- to long-term growth. Profitability declined due to one-off processing costs and an unfavorable product mix. Meanwhile, the company incurred capital expenditure of INR616m during 9MFY26.

? Biologics: PI has strengthened its product development and distribution footprint across the US, Brazil, and Mexico. It expanded to 33 distributors in Brazil and 28 in Mexico, with strong farmer engagement, and is building a Midwest distribution network in the US. The company also launched two products each in Brazil and Mexico and received California approval for its disease control product, unlocking access to the largest US market

Valuation and view

? PI’s growth trajectory is expected to pick up gradually from 4QFY26, led by the commercialization of new products and scaling up of newly launched products, signaling improving demand prospects.

? The company’s medium- to long-term growth story will be led by 1) improving growth prospects in the CSM business (five molecules commercialized in 9MFY26) due to the rising pace of commercialization of new molecules (order book of USD1.2b); 2) healthy launch pipeline of new products (four products commercialized in 9MFY26, and two new products to be launched in 4QFY26) in the domestic market; 3) biological industry continuing to outpace the chemical industry; and 4) the ramp-up of its pharma business.

? We expect a CAGR of 14%/15%/12% in revenue/EBITDA/adj. PAT over FY26-28. We reiterate our BUY rating with a TP of INR3,780 (based on 35x FY28E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412