Reduce PI Industries Ltd For Target Rs. 3,590 By JM Financial Services Ltd

CSM contraction continues

PI’s 2QFY26 earnings print was better than our and consensus expectations albeit against modest expectations. CSM exports continued to shrink for the 3 rd consecutive quarter as the US tariffs became an added hurdle over and above the existing demand-related challenges. Given the uncertain outlook, the management backed away from growth guidance (single-digit growth and strong 2H was highlighted in 1QFY26). We don’t see the outlook improving for the company, especially in CY26, with the generic threat looming for the pyroxa business and expyroxa business struggling for meaningful growth since the last 5-6 years. Besides this, the pharma business and other diversification still being at a nascent stage will not be able to lift the company’s performance in the near term. Factoring in the challenges, we cut our FY26-28 EPS estimates by 5-6% and maintain REDUCE with a revised Dec’26 TP of INR 3,590 (based on 30x Dec’27E EPS) (from INR 3,745 earlier, based on 30x Sep’27E EPS)

* EBITDA beat on modest estimates: PI Industries’ 2QFY26 consolidated gross profit came in 5% above JMFe at INR 10.7bn (down 7% YoY), as revenue was 5% above JMFe while 1% below consensus and stood at ~INR 18.7bn (down 16% YoY) and gross margin came in slightly higher than expected at 57.3% (vs. JMFe of 57.1% and 51.8% in 2QFY25). During the quarter, other expenses came in lower at ~INR 3.1bn (vs. JMFe of ~INR 3.4bn and ~INR 3.3bn in 2QFY25). As a result, EBITDA came 22%/8% above JMFe/consensus and stood at INR 5.4bn (down 14% YoY). Further, PAT was 26%/3% above JMFe/consensus at ~INR 4.1bn (down 19% YoY). Consol EBITDA margin was higher than expected at 28.9% (vs. JMFe of 24.9%). Further, based on standalone numbers (which primarily has agro business and doesn’t include the recent pharma acquisitions), EBITDA margin in the standalone business moved up to 34.6% (vs. 32.4% in 1QFY26 and 30.6% in 4QFY25 and 3QFY25). Moreover, difference between Standalone and Consol EBITDA reflects INR 657mn EBITDA loss in subsidiaries (vs. INR 546mn EBITDA loss in 1QFY26).

* CSM sales ahead of modest estimates: PI's agri CSM revenue was 9% above JMFe and stood at INR 14.1bn (down 18% YoY). This is the 3 rd consecutive quarter that PI has seen YoY sales dip in its CSM sales. The company has indicated recovery from 4QFY26 on the back of customer offtake plans. Domestic revenue was 4% below JMFe and stood at INR 4.0bn (down 13% YoY) as erratic rainfall disrupted demand. Going forward, it expects overall price pressure to persist in the generics space. Pharma sales was up at INR 634mn (up 54% YoY). The company incurred INR 167mn capex in 2QFY26 (earlier INR 148mn capex in 1QFY26 and ~ INR 1.3bn FY25) for the pharma piece.

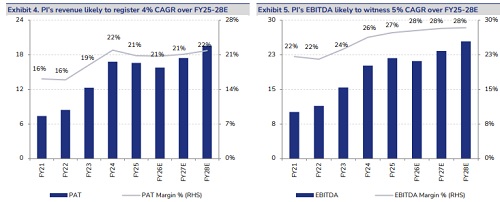

* Estimate 5% EPS CAGR over FY25-28E; maintain REDUCE: The company has refrained from any guidance due to the uncertain outlook. We now build in 7% CSM contraction in FY26 and a generous ~8% CSM growth in FY27/28. Factoring in this and management commentary, our FY26-28 EPS estimates are revised downwards by ~5-6%. In our view, there could be further downside risks to our current estimates in case ex-pyroxa business fails to pick up meaningfully in FY27. We now expect PI to register 5% EBITDA/EPS CAGR over FY25-28E. Though the company’s efforts for diversification in pharma and electronic segments, as well as ex-Pyroxa agri portfolio are visible, the wait for the meaningful contribution continues. We roll forward to Dec’27E earnings and maintain REDUCE with a revised Dec’26 TP of INR 3,590 (from INR 3,570 earlier) (based on 30x Dec’27E EPS).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361