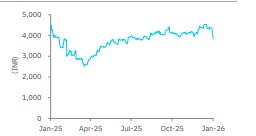

Buy KEI Industries Ltd for Target Rs.4,575by Elara Capitals

Capacity constraints block growth; margin up on mix

KEI Industries (KEII IN) reported 20% topline growth in Q 3FY2 6, 9% lower than our estimates, as capacity constraints in Cables hindered robust volume growth as posted by peers . In Q3, EHV cable sales and exports both spiked , which helped improve margins by 100bps YoY. Management has guided for FY26 sales growth of 20% and that KEII will maintain this run rate in the next 3 -4 years, along with margin improvement during the year. The new Sanand plant is also expected to commence production from Q4. We reiterate Accumulate with a higher TP of INR 4,575, on 3 1x December 2027E P/E and remain positive on KE II as a long - term play in the C&W industry , led by robust sales growth, continuous margin improvement, and export focus.

Steady volume growth; surge in copper price drives sales, albeit lower than peers: KEII delivered 20% YoY sales growth in C&W , which was lower than peers (Havells 33%, Polycab 56%), as capacity constraints in cables led to a volume growth of only 10% for KEII. The surge in copper prices (up 50% YoY) contributed to a 10% YoY value growth for KEII. Q3 also saw exports spike 95% YoY as KEII witnessed robust demand from Australia, UAE, the Middle East and Europe . Management expects FY26 sales to grow 20%, led by Q4FY26 growth of 25%+ YoY , thereafter maintaining 20% CAGR in the next 3 -4 years , led by growing exports, rising retail presence, and continued rise in domestic demand, led by new capacity.

Sanand plant to start contributing from Q4FY26: As per management, the Sanand plant is expected to commence production of LT and HT cables in Q4 , with monthly revenue contribution of ~INR 2.5bn expected. The capacity of MV cables is expected to ramp up from July -Aug with EHV capacity commencing from March 2027. In 9MFY26, KEII incurred a capex of INR 9.28bn , of which INR 7.7bn has been towards the Sanand plant , INR 720mn for new land purchase at Salarpur , INR 240mn for new land purchase at Sanand and INR 630mn for plant and machinery. KEII expects a capex of INR 2bn to be incurred in Q4. The Sanand project is expected to generate INR 60bn sales at peak capacity. In the next 3 -4 years, KEII plans to incur an additional INR 20bn capex for a new greenfield project apart from Sanand.

Margins up on higher EHV, exports: EBITDA margin expanded 100bps YoY to 10.8% in Q3, led by a favorable product mix as exports and EHV surged in Q3 , leading to C&W EBIT margins growing 190bps YoY . KEII expects margin to improve in FY26, and is targeting 11% EBITDA margins in FY27.

Reiterate Accumulate with a higher TP of INR 4,575: We lower our EPS by 4% for FY2 7E and 2% for FY28E , due to delay in new capacities at Sanand impacting sales . We raise our TP to INR 4,575 from INR 4,425 on 31x (unchanged) December FY27E P/E as we roll forward by a quarter. We reiterate Accumulate as KEI I is the second -largest C&W company with a dominant market share in India , and strong sectoral tailwinds . The company has maintained its growth guidance of 20% in the next four years , with focus on growing exports presence. Higher capacity utilization, continued margin improvement, strong cashflow generation, and rising exports opportunity are key catalysts. We expect an ROE of 16% in FY26 E -28E .

Please refer disclaimer at Report

SEBI Registration number is INH000000933.