Accumulate Waaree Energies Ltd for Target Rs 3,309 by Elara Capitals

Scale Shields Solar Giant

Waaree Energies (WAAREE EN IN) , India’s solar module leader , has a 14.1% domestic market share in FY25. The company thrives on growing domestic and global demand, supported by rapid capacity expansion, backward integration, BESS, inverter & green hydrogen diversification , and green energy acquisitions. Overcapacity may cap margin gains at ~ 19– 20%. The stock has corrected 20% in the past six months , with current valuation reflecting overcapacity concerns and margin compression. We initiate on WAAREE EN with an Accumulate rating and a TP of INR 3,309.

PV manufacturing pioneer: WAARE E EN is one of India’s largest solar module ma k er, with an installed capacity of 23GW (modules) and 5.4GW (cells) . The company plans to scale up module and cell capacit y to 28GW and 15.4GW, respectively, by FY27, while backward integrating into 10 .0GW of wafer -ingot manufacturing and diversifying into battery energy storage systems (BESS), inverters, and green hydrogen , led by favorable policies , such as ALMM and DCR . With a IN R 150bn expansion plan, a record 25GW orderbook worth ~INR 600 bn as on FY 26YTD , and a growing mix of high -margin DCR modules, the company is positioned to deliver strong financial performance , in our view .

Orderbook fuels visibility: Backed by a consolidated orderbook of ~25GW, the company enjoys significant revenue visibility, with ~41% of orders from overseas and the rest domestic . The US remains WAARE E EN ’s largest export s market, driven by utility -scale projects with longer execution cycles, while domestic projects offer quicker turnaround. The EU push adds diversifi cation, ensuring capacity utili zation and volume growth.

Path to full integration by FY27: WAARE E EN is on track to transform into one of India’s most integrated solar producers by FY27, led b y capacity expansion of 28GW of modules, 15.4GW of cells, and 10 .0GW of wafers & ingot s. The rollout of ALMM -II and likely shift to a 90 – 100% DCR -based domestic market will spike local cell demand , prompting accelerated ramp -ups ahead of schedule.

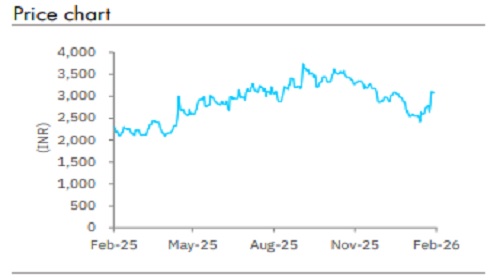

Initiate with Accumulate and a TP of INR 3,309: We expect a revenue CAGR of 40% and an EBITDA CAGR of 39% during FY25 -28E . We initiate WAARE E EN with a n Accumulate rating and a TP of INR 3,309 on 14x FY 28E EV/EBITDA . The stock has corrected 20% in the past six months . Current valuation factors in oversupply concerns and margin pressure . Backward integrat ion sustain s the next 2 -3 years ’ outperformance . Key risks include : 1) in creased domestic competition may squeeze pricing & margin , and 2) US dependence heightens sensitivity to policy, tariff s, and geopolitical shifts .

Please refer disclaimer at Report

SEBI Registration number is INH000000933