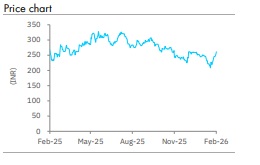

Buy Juniper Hotels Ltd for Target Rs 365 by Elara Capitals

Juniper Hotels (JUNIPER IN) reported better-than-expected Q3, driven by 300bps increase in occupancy and 9.4% ARR growth at the portfolio level. Occupancy growth was driven by the luxury portfolio, and ARR growth by upper/upscale portfolio. Tailwinds will continue as Trident BKC and Sofitel are expected to undergo renovation, which can lead to MICE activities shifting meaningfully to Grand Hyatt Mumbai (GHM), thus driving both occupancy and ARR for the hotel. This with commencement of 235-key Bengaluru luxury asset will drive growth in FY27E and beyond.

The timeline for inclusion of intergroup assets is unclear and hence, we have not built in any impact into JUNIPER’s financials. We have raised our EBITDA estimates by 5-9% and PAT estimates by 13-19% for FY26E and FY27E to factor in the benefits from GHM and operational cost benefits reaped through operating leverage. The next phase of organic room additions will be in FY29 with opening of 732 keys across three hotels. Maintain Buy with a higher TP of INR 365 (from INR 346 earlier), based on 16x (unchanged) Q3FY28E EV/EBITDA.

Bengaluru luxury asset with 235 keys to open in Q1FY27: The 235-key Bengaluru hotel will be operational in Q1FY27, although an operator is yet to be finalized upon. We have assumed an ARR of INR 12,000 and an occupancy of 40% for FY27E in our financial estimates. Management expects this property to contribute ~INR 0.25bn to EBITDA in FY27 and over ~INR 0.50-0.55bn FY28 onwards. JUNIPER has plans to further expand the Bengaluru property by adding another 273 keys in Phase II on the adjoining vacant land at the same premises, with construction targeted to commence by Q2FY27 and turn operational by early FY29.

JUNIPER to invest more than INR 8bn by FY28: The planned capex for 273-key Phase II of Bengaluru asset, Kaziranga resort and Guwahati hotel is INR 2.74bn in FY27 and INR 5.25bn in FY28. This capex will be funded through a mix of internal accruals and project-level debt, with leverage likely to remain comfortable. Rising operating cashflow continues to support planned expansion. JUNIPER is also evaluating expansion opportunities in Hyderabad, Delhi and Navi Mumba

Maintain Buy with a higher TP of INR 365: FY27 growth will be driven by GHM and opening of the 235-key luxury asset in Bengaluru. The next phase of organic room additions will be in FY29 with opening of 732 keys across three hotels. Timeline for inclusion of intergroup assets (726 keys across two hotels) remains unclear. We raise our EBITDA estimates by 5-9% and PAT estimates by 13-19% for FY26E and FY27E to factor in the benefits for GHM as well as operational cost benefits reaped through operating leverage. So, we raise our TP to INR 365 (from INR 346 earlier) based on 16x (unchanged) Q3FY28E EV/EBITDA. Maintain Buy

Please refer disclaimer at Report

SEBI Registration number is INH000000933