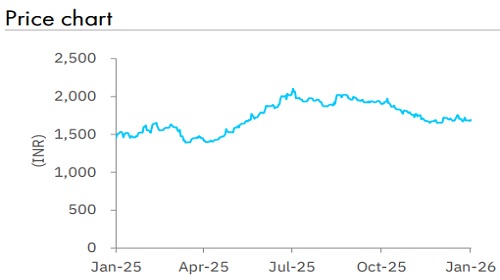

Buy Gland Pharma Ltd for Target Rs2,225 by Elara Capitals

Signs of growth pick-up

Gland Pharma (GLAND IN) reported Q3FY2 6 better than our expectations – Revenue and EBITDA came in 3-4% better than expected . PAT , helped by higher other income and lower tax rate , came in 15% ahead. After five consecutive quarters of lackluster performance, Q3 showed some signs of pick -up in growth . While the 22% overall topline growth benefitted from a very low base of Q3FY25 and currency depreciation YoY, there were definite signs of pick -up in the business as well. The regulated markets business benefitted from new contracts in the US and licensing income from Europe. Cenexi ’s EBITDA margin improvement to 2.9% enhanced overall profitability. We raise our FY26 E core EPS estimate s by 6% and retain our FY27E/ FY 28E core EPS estimate s. We stay shy of management’s target of 15% growth beyond FY27 . We find the stock attractive after the recent correction – Upgrade to BUY from Accumulate , with target price unchanged at INR 2,225.

Regulated markets business shows signs of pick-up: Revenue for the regulated market business (mostly the US) was up 10% YoY (in USD) in Q 3. While the low base of USD 93m n in Q3FY25 helped, it is still a pick up from the USD 97m levels of past five quarters. Management indicated that some of the new GPO contracts in the US that were won earlier are now starting to contribute to growth and guided to continued growth momentum . Incremental product licensing to European customers of Cenexi is helping as well.

Cenexi breaks even; to improve upon the base: The Cenexi ,subsidiary in the EU reported 2.9% EBITDA margin , in line with the guidance of a break -even in Q3. Management guided to at least EUR 200m n revenue and positive EBITDA in FY27 and sustained margin improvement thereafter.

Semaglutide opportunity can add on: GLAND has set up capacity for fill -n -finish of 40mn injectable cartridges. Additional 100m n capacity will be ready by Q2FY27 . The capacity could be used for peptides / injectables / other drug -device combinations. Given indications of shortage of fill -n -finish capacity for the semaglutide opportunity that opens up for generic firms in several markets in FY27 , this could turn out to be a major growth driver.

Additional medium-term growth drivers: Management named additional growth drivers in the medium term. These include complex injectables for the US market, biosimilar CDMO business in India and GLP -1 CDMO in Cenexi. The company has already entered into agreements with Dr. Reddy’s Labs in India and another pharma company in China for a biosimilar CDMO. It also disclosed an oncology injectable CDMO for a European Pharma, starting 2028.

Upgrade to BUY; TP retained at INR 2,225: We raise our FY26E core EPS estimates by 6% and retain our FY27E/FY28E core EPS estimates . GLAND trades at 2 2.7x FY27E core P/E . We retain our target price at INR 2,225, which is 24.8x FY2 8E core EPS plus cash per share. We find the stock attractive after the recent correction – Upgrade to BUY from Accumulate. Continued growth pressure in the US business and delayed turnaround at Cenexi are key risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933