Accumulate Gujarat State Petronet Ltd for Target Rs. 367 by Elara Capitals

Demand drops amid high LNG price

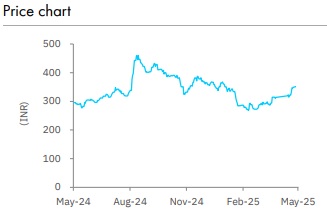

The stock price of Gujarat State Petronet (GUJS IN) has outperformed for the past three months (up 18%) versus the Nifty Midcap Index (up 10% in the same period) due to increase in market value of its subsidiary, Gujarat Gas (GUJGA IN, Reduce, CMP: INR 462, TP: INR 443). The core transmission business was hit by a drop in volume offtake across sectors due to high LNG prices. GUJS’ amalgamation with its subsidiary, GUJGA, is likely to be completed in July-October 2025. The newly-carved entity, GSPL Transmission (GTL) is likely to be listed in July-October 2025. We expect the spin-off of GUJGA stake from GUJS to unlock the value of GUJS’s core gas transmission (growth yet to be factored into valuation, due to holding company discount versus GUJS’ subsidiary, GUJGA). So, we reiterate Accumulate with an unchanged TP of INR 367.

EBITDA down 67% YoY led by a drop in volume and lower tariff: GUJS’ standalone Q4 EBITDA and PAT were down 67% and 73% YoY to INR 1.2bn and INR 0.7bn (Elara: INR 2.1bn and INR 1.6bn). The earnings miss was on account of lower-than-expected gas transmission volume. EBITDA and PAT were down 35% and 48% QoQ, led by an 11% drop in gas transmission volume. EBITDA declined YoY due to a 47% reduction in transmission tariff from May 2024 by the Petroleum & Natural Gas Regulatory Board (PNGRB). Meanwhile, GUJS has filed a petition in the court against the PNGRB tariff order, but is yet to receive relief.

Demand softened across sectors: Gas transmission volume fell 23%/11% YoY/QoQ to 25.8mmscmd (Elara: 29mmscmd). Volume for all the sectors dropped within 3-65% YoY. Offtake for the Power sector reduced a sharp 65% YoY, while the drop in CGD volume was lower at 3%. QoQ too, all the sectors reported a de-growth in 1-24% range. The impact of high spot LNG prices at ~USD 14/mmbtu in Q4 was seen more on price-sensitive sectors such as Refining and Power. The drop in Fertilizer offtake was likely due to shutdown of plants. Following GUJGA’s Q4 earnings call, we expect Q1FY26 volume trend to be mixed. Softened LNG prices may lead to a growth in Refining and Power. CGD demand may be hit by low industrial PNG demand.

Reiterate Accumulate with a TP of INR 367: We cut FY26E and FY27E EBITDA by 13% and 15%, due to lower gas volume at 33mmscmd for FY26E (from 36mmscmd) and 37mmscmd for FY27E (from 41mmscmd), We introduce FY28E EPS at INR 16.2, ascribing a 16% YoY growth, due to 13% growth expected in transmission to 42mmscmd (owing to benefit from addition of major LNG export capacity, starting FY27).

So, we maintain our TP at INR 367, assuming a 5% (from 4%) gas volume CAGR in FY25-30E and a 10.2% (unchanged) WACC. We reiterate Accumulate, due to expectations of value unlock from GUJGA holdings owing to GUJS’ reverse merger with GUJGA. Due to the merger plan of GUJGA, Gujarat State Petroleum Corporation (GSPC) and GUJS, GUJS’ investors would get GUJGA shares close to the latter’s current market valuation.

Please refer disclaimer at Report

SEBI Registration number is INH000000933