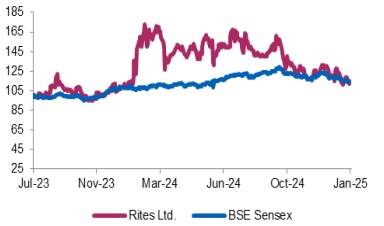

Buy Rites Ltd For Target Rs.305 by Axis Securities

Strong Order Book & Pickup In Export Sales to Drive Growth

Est. Vs. Actual for Q3FY25: Revenue – MISS ; EBITDA Margin – MISS ; PAT – BEAT

Change in Estimates post Q3FY25 (Abs.)

FY25E/FY26E: Revenue: -6%/-7%; EBITDA: -9%/-7%; PAT: -5%/-8%

Recommendation Rationale

* Healthy order book: The company won 110+ orders worth Rs 1,933 Cr in Q3FY25. Its overall order book remains healthy at Rs 7,978 Cr, providing revenue visibility for the next 2-2.5 years. The consultancy segment comprises 35% of the order book, which is a highmargin business. Moreover, we foresee sustainable growth in the company's domestic and overseas consultancy businesses. Additionally, higher capital outlay in the budget for 2024-25 for Railways will act as a growth catalyst for the company.

* Export verticle to support revenue growth: The company has export orders worth Rs 1,320 Cr. Revenue from the export stream is expected to pick up from Q2FY26. Keeping this in view, we expect the company to grow its revenue at a CAGR of 27% over FY25- FY27E.

* Higher competitive Intensity: At present, new orders are being won through a competitive bidding process, and the share of nomination (higher margin) based orders has reduced to 37%, putting pressure on margins. We therefore foresee moderation in the margin profile from the earlier 26% to 20%-22% moving ahead and accordingly revise our estimates downward

Sector Outlook: POSITIVE

Company Outlook & Guidance: The management has guided for 40% of export orders to be executed in FY26 and the balance 60% in FY27, with lower-than-historical margins. For FY26, the management expects at least 20% revenue growth and margins to be around 20-22%.

Current Valuation: 24x FY27E (Earlier Valuation: 24x FY27E EPS)

Current TP: Rs 305/share (Earlier TP: Rs 325/share)

Recommendation: We maintain our recommendation of BUY on the stock

Financial Performance

RITES Ltd. reported a weak set of numbers during Q3FY25 with revenue of Rs 576 Cr (down 16% YoY), attributed to lower revenue in the Quality Assurance business, a decline in the Turnkey business due to projects being in the early stage, and delays in the Exports business due to geopolitical reasons. Its EBITDA stood at Rs 118 Cr (down 31% YoY), and PAT at Rs 110 Cr (down 15% YoY). The company registered EBITDA margins of 20.4% in Q3FY25 (our estimate: 21%) compared to 24.8% in Q3FY24.

During the quarter, RITES booked Consultancy sales of Rs 309 Cr (down 5.9% YoY), Export sales of Rs 1 Cr (down 98.7% YoY), Leasing sales of Rs 40 Cr (up 10.3% YoY), and Turnkey sales of Rs 223 Cr (down 12.9% YoY). The EBITDA margins of Consultancy and Leasing stood at 39.8% and 35.7%, respectively.

Outlook

Higher capex outlay in the Union Budget 2024-25 for Railways and Highways has provided the company with large opportunities to grow its business verticals. The company has a robust order book position with a clean balance sheet, high return ratios, and a healthy dividend payout. We expect the company to post revenues/EBITDA/APAT growth of 27%/33%/29% CAGR, respectively, over FY25-27E. However, owing to higher competitive intensity, pressure on margins will persist.

Valuation & Recommendation

The stock is currently trading at 24x/20x FY26E/FY27E EPS. We value the company at 24x FY27 EPS to arrive at a TP of Rs 305/share, implying an upside of 20% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633