Reduce LTIMindtree Ltd For Target Rs. 5,360 By Choice Broking Ltd

Q1FY26 slightly better than expected; AI led cost program drives margins

• Reported Revenue for Q1FY26 stood at USD 1,153Mn up 2% Q0Q (vs CIE est. at USD 1,151Mn). The CC growth was 0.8% QoQ, while the cross-currency tailwind of 1.2% further gave Topline boost. In INR terms, revenue stood at INR 9.8Bn, up 0.7% QoQ.

• EBIT for Q1FY26 came at INR 14.0Bn, up 4.5% QoQ (vs CIE est. at INR 14.0Bn). EBIT margin was up 52bps QoQ to 14.3% (vs CIE est. at 14.3%).

• PAT for Q1FY26 came at INR 12.5Bn, up 11.1% QoQ (vs CIE est. at INR 12.1Bn) led by spike in other income with Forex gains of INR 1,290Mn against INR 230Mn in Q4FY25.

Strategic focus on high potential clients to drive growth momentum: LTIM offers a confident outlook for Q2FY26 with focus on maintaining sustained growth momentum. The company remains committed to its long-term USD 10Bn revenue aspiration. Q1FY26 LTIM recorded robust deal wins totalling USD 1.63Bn, up 1.9% QoQ, the third consecutive quarter TCV win of above USD 1.5Bn. The large deal team sees growing traction, a strong pipeline, & improved win rates. Despite a challenging macroeconomic environment, especially in BFSI where clients are cautious, LTIM witnessed descent growth in Q1. This was led by focused growth in high-potential client accounts barring the Top client from Hi-tech, which has been witnessing pressure since past few quarters. In Technology, Media & Communications, clients are pivoting to AI, opening long-term growth opportunities. Q1FY26 saw broad-based sequential growth, led by Consumer Business (6.2%) & Healthcare, Life Sciences & Public Services (4.8%). Europe showed strong performance with 9.7% QoQ growth, while North America grew 1.8% QoQ.

Fit4Future Cost Program delivers margin improvement: LTIM’s EBIT margin expanded 50 bps+ QoQ to 14.3% in Q1FY26, aided by the Fit4Future cost optimization program (~1% positive impact), the benefit from which were partly offset by visa seasonality. Management remains confident of further margin expansion in Q2FY26. HLS vertical saw margin pressure for a 2 nd consecutive quarter due to cyclical softness and project completions but is expected to recover. The NextEra JV with Aramco Digital in Saudi Arabia became fully operational in Q1 but is likely to operate below company-average margins. Though over 1,600 freshers were on boarded in Q1, however at net level there was 418 QoQ reductions in Headcount (83,889 in Q1FY26) resulting in increased Utilization to 88.1% (optimal level would be 86-87%), which we believe will drive nonlinearity in growth ahead. LTIM is ramping up hiring & using AI to strengthen talent supply chain. Attrition stood at 14.4%, reflecting workforce stability.

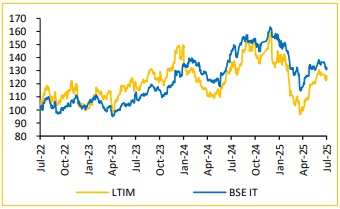

View and Valuation: LTIM performance presents a mixed outlook. While it secured strong TCV deals in the last two quarters, these gains haven’t yet fully translated into revenue growth. Margins have weakened over the past 6–8 quarters due to SG&A investments and wage hikes. Though margin improvement efforts are underway led by Fit4Future Program, we believe the slower deal conversions given the uncertain macro dynamics might delay the margin improvement process to some extent. Thus, we have maintained a conservative margin expansion stance in FY26 given the dynamic macro-economic scenario. As a result, we raise our estimates marginally by 1-2%, maintain our rating to ‘REDUCE’, and revise target price to INR 5,360, implying a PE multiple of 25x (maintained) on average of FY27E & FY28E EPS of INR 214.4.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131