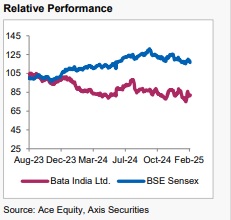

Hold Bata India Ltd For the Target Rs. 1,320 By the Axis Securites

Recommendation Rationale

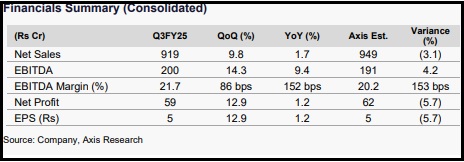

Topline remains muted: The company reported subdued revenue growth of 1.7% YoY (vs. expected 5%), as a prolonged EOSS and strong double-digit growth in Hush Puppies were offset by a weak demand environment. However, management highlighted that growth was volume-driven across channels, marking a shift after several quarters, aided by category simplification and affordability initiatives. Inventory optimisation remains a key focus, with a 12.1% YoY reduction in Q3FY25. With zerowaste merchandising at its core, store expansion is gaining momentum, now spanning three towns. Additionally, the "ladies closed" category was streamlined from 11 to three price points, improving consumer decision-making and driving a strong uptick in sales volume.

Margins Improvement: EBITDA margins improved by 152 bps YoY to 21.7% (beat), driven by a 13 bps expansion in gross margins and effective cost-control measures, with other expenses declining by 3.6% YoY. This margin expansion reflects the company's continued focus on operational efficiencies and disciplined expense management

Premium continues to perform: Floatz achieved a notable 1.29x YoY growth in revenue and 1.25x growth in volume, establishing itself as a Rs 100 Cr+ brand. Meanwhile, the Power brand recorded a 1.09x YoY growth, reinforcing its position as a key contributor to both the athleisure segment and overall revenue growth. Management remains optimistic about a demand recovery, driven by a strategic focus on volume-led revenue growth through affordable and fresh product offerings. Additionally, a disciplined approach to cost control, with an emphasis on efficiency and productivity, will remain central to sustaining profitability

Sector Outlook: Cautiously optimistic

Company Outlook & Guidance: Due to near-term challenges and limited upside potential, we maintain our HOLD rating on the stock

Current Valuation: 40x Dec’26 EPS (Earlier valuation: 42x Sep’26 EPS )

Current TP: Rs 1,320/share (Earlier TP: Rs 1,290/share)

Recommendation: With a 2% downside from the CMP, we maintain our HOLD rating on the stock.

Financial Performance Bata India reported revenue of Rs 919 Cr, registering a modest 1.7% YoY growth. EBITDA stood at Rs 200 Cr, marking a ~9.4% YoY increase, with EBITDA margins improving by 152 bps to 21.7% (beat), driven by a 13bps gross margin expansion and cost optimization initiatives. PAT came in at Rs 59 Cr, up ~1.2% YoY. Additionally, the company incurred a one-time exceptional expenditure of Rs 11 Cr towards VRS.

Financial Performance (Cont’d) Store Guidance:

In Q3FY25, store additions remained muted, with the total store count at 1,953. However, gross additions continued steadily as the company strategically shut unprofitable stores to optimise growth and enhance operational efficiency. Expansion is expected to accelerate, with a target of 30-40 new stores per quarter, including franchise outlets.

Outlook We remain positive on the long-term outlook of the company, as its investments in backend processes are expected to drive overall efficiency. Its premiumisation and casualisation strategies, particularly through the fast-growing sneakers segment and franchiseled expansion in Tier 3-5 towns, should yield positive results over time. The company's disciplined approach to retail network expansion and marketing investments further supports this positive trajectory. Additionally, the company's ERP project has gone live, and management anticipates benefits in terms of speed, agility, and operational accuracy. However, near-term challenges persist, with a significant portion of the mass portfolio still under pressure. Given these factors, we retain a cautious stance and maintain our HOLD rating on the stock.

Valuation & Recommendation: We expect Bata’s Sales/EBITDA/PAT to grow at 9%/11%/19% CAGR over FY24-27E. We maintain a HOLD rating on the stock with a revised TP of Rs 1,320/share, implying a downside of 2% from the CMP. We value the company at 40xDec-26EPS.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633