Buy Zen Technologies Ltd for the Target Rs.2,150 by Choice Broking Ltd

Sky wars are real – India needs 5,500–6,500+ anti-drone shields

We expect the drone market in India to expand at ~35% CAGR over FY22– FY30E. The growth poses a grave security threat. We believe, this, in turn, has catalysed demand for cost-effective countermeasures, with the anti-drone market expected to grow at a faster clip of ~38.9% CAGR over FY23–27E. Our estimates suggest India will require 5,500–6,500+ anti-drone systems to secure its strategic assets. This represents a market potential of INR 66,000– 78,000 Cr – a structural shift redefining modern air defence.

Training wars without bullets; simulators are invisible force multiplier

The shift towards cost-efficient combat-readiness has accelerated the adoption of simulator-based training. ~80% of ‘Agniveer’ training uses highfidelity simulators, thus delivering 50–60% of cost-saving and swift operational preparedness.

We believe ZEN, backed by its proprietary IP, would encash this opportunity. The global military simulation market is projected to reach USD 13.2 Bn by 2030 (6.1% CAGR), wherein India is emerging as a key growth engine.

Strategic acquisitions fortify ZEN’s evolution

We believe that ZEN is transitioning from a pure-play training & simulation provider to a vertically-integrated defence tech platform. The INR-1,300 Mn acquisition of ARIPL & ARI Labs strengthens its position in naval simulation. Meanwhile, enhancing its IP depth, ZEN has taken a stake each in Bhairav Robotics & Vector Technics, which is targeting INR 1,000 Mn rev. in 2–3 yrs

Strategic acquisitions fortify ZEN’s evolution We believe that ZEN is transitioning from a pure-play training & simulation provider to a vertically-integrated defence tech platform. The INR-1,300 Mn acquisition of ARIPL & ARI Labs strengthens its position in naval simulation. Meanwhile, enhancing its IP depth, ZEN has taken a stake each in Bhairav Robotics & Vector Technics, which is targeting INR 1,000 Mn rev. in 2–3 yrs

ZEN’s exports take flight – powered by diplomacy, trust & proven tech

In our view, India’s unique diplomatic position, maintaining strategic ties with both, the US and Russia, makes it a neutral defence partner. Combined with growing trust in Indian equipment, it’s encouraging several countries to look beyond traditional suppliers. ZEN, with its expanding footprint (in US, and UAE) is well-placed to benefit. With Govt backing and global RFP momentum, we anticipate ZEN’s export share to rise, from 5% to 20–25% by FY27E.

Investment View

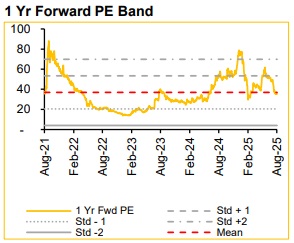

We initiate coverage on ZEN, a rare defence-tech player, which is expanding into futuristic weapon platform. The ZEN’s current order book stands at INR 7,545 Mn (i.e. 0.77x of FY25 revenue). We expect ZEN to deliver Revenue /EBITDA/PAT CAGR of 34.2%/31.5%/29.2% over FY25–28E. We assign a ‘BUY’ rating with a target price of INR 2,150, implying 51.0% upside, valuing the company at 35x PE on an average FY27–28E EPS of INR 61.4; implying industry low PEG ratio of 1.45. We have used DCF for sanity check, which implies fair value of INR 2,125.

Upcoming Trigger:

We expect meaningful order inflows (~INR 6,400 Mn) for ZEN, from October this year. Discussion with a couple of friendly countries is underway; which could materialise in FY27E. Rising global RFP activity further enhances revenue visibility.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131