Buy Oil India Ltd For Target Rs. 515 By JM Financial Services Ltd

Operational earning largely in line, PAT hit by sharp jump in dry well write-off

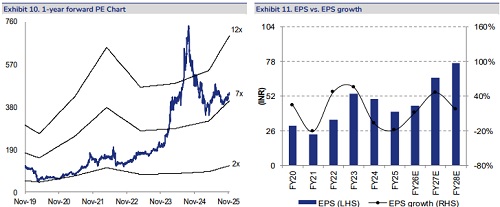

Oil India’s 2QFY26 standalone EBITDA, at INR 23.1bn, was better than JMFe/consensus of INR 21.1bn/INR 22bn led by higher transportation income at INR 4.5bn vs. JMFe of INR 1.6bn and aided by slightly better crude realisation but partly offset by lower gas realisation and oil and gas sales volume. However, PAT, at INR 10.4bn, was significantly lower than JMFe/consensus of INR 15.5bn/INR 15.4bn, due to sharply higher dry-well write-off of INR 9.8bn vs. JMFe of 1.6bn. NRL’s 2QFY26 GRM was strong at USD10.6/bbl (before excise duty benefit), resulting in higher EBITDA of INR 9.9bn. Consolidated EBITDA was also higher QoQ at INR 32.9bn in 2QFY26 (vs. INR 28.1bn in 1QFY26) aided by higher EBITDA from NRL. We maintain BUY (unchanged TP of INR 515) based on our Brent crude price assumption of USD 70/bbl (while CMP is discounting ~USD 60/bbl of net crude realisation). Further, Oil India’s earnings is likely to grow at a robust ~16% CAGR over the next 3-5 years driven by: a) strong 20-25% output growth in the next 1-3 years aided by commissioning of the Indradhanush gas pipeline; and b) expansion of NRL refinery from 3mmtpa to 9mmtpa. Further, Oil India is also a robust dividend play (4-5%). At CMP, Oil India trades at 6.1x FY28E EPS and 1.0x FY28E BV.

* Standalone EBITDA at INR 23.1bn, better on higher transportation income; however, PAT significantly lower at INR 10.4bn due to higher dry-well write-off of INR 9.8bn: Oil India’s 2QFY26 standalone EBITDA, at INR 23.1bn, was better than JMFe/cons of INR 21.1bn/INR 22bn led by higher transportation income at INR 4.5bn vs. JMFe of INR 1.6bn (and vs. INR 1.4bn1.6bn historically) and aided by slightly better crude realisation but partly offset by lower gas realisation and oil and gas sales volume. However, PAT, at INR 10.4bn, was significantly lower than JMFe/consensus of INR 15.5bn/INR 15.4bn, due to sharply higher dry-well write-off of INR 9.8bn vs. JMFe of 1.6bn (drywell write-off tends to be seasonally low during 2Q due to the monsoon). Hence, standalone 2QFY26 EPS was lower at INR 6.4/share. Dry well write-off seems to be higher as Oil India exited from one block in Gabon (SHAKTI-11 G-245) and accordingly penalty towards unfinished work programme of INR 0.4bn along with provision of INR 1.9bn towards impairment of wells & other assets has been charged to P&L. Consolidated EBITDA was also higher QoQ at INR 32.9bn in 2QFY26 (vs. INR 28.1bn in 1QFY26) aided by higher EBITDA from NRL. However, consolidated PAT was lower at INR 14.3bn, due to lower share of profit of associate/JVs at INR 2bn (vs. positive INR 7.2bn in 1QFY26).

* Crude sales volume and production lower than JMFe (though realisation better); further, gas sales volume and realisation was lower than JMFe: In 2QFY26, crude sales volume was slightly lower than JMFe (at 0.83mmt, up 0.6% QoQ but down 1.4% YoY); further, crude production was also lower than JMFe (at 0.848mmt, down 0.6% QoQ and down 3.1% YoY); hence, sales as % of production was in line at ~98% vs. historical 97-99%. However, computed net crude realisation was slightly better at USD 66.1/bbl vs. JMFe of USD 65.4/bbl. But gas sales volume was also 3% lower than JMFe (at 0.66bcm, down 5.2% QoQ but up 2.2% YoY) while gas production was also lower than JMFe (at 0.804bcm, down 2.8% QoQ but up 0.6% YoY). Further, domestic gas realisation was also lower at USD 6.8/mmbtu.

* NRL’s 2QFY26 GRM was strong at USD10.6/bbl (before excise duty benefit), resulting in higher EBITDA at INR 9.9bn: NRL’s GRM (before excise duty benefit) was strong at USD10.6/bbl in 2QFY26 (vs. JMFe of USD 7.0/bbl and vs. USD 5.02/bbl in 1QFY26); however crude throughput was slightly lower at 753tmt or 100% utilisation (vs. 799tmt in 1QFY26). Hence, NRL’s EBITDA was higher at INR 9.9bn in 2QFY26 vs JMFe of INR 8.7bn (and vs. INR 7.9bn in 1QFY26); so, PAT was also higher at INR 7.3bn vs. JMFe of INR 5.5bn (and vs. INR 4.9bn in 1QFY26).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)