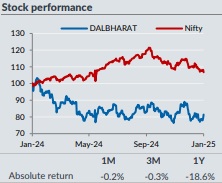

Add Dalmia Bharat Ltd For Target Rs. 2,129 By Yes Securities Ltd

Except PAT, numbers are broadly in-line with our estimate.

Result Synopsis

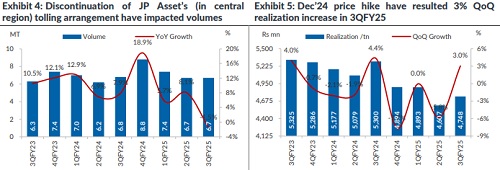

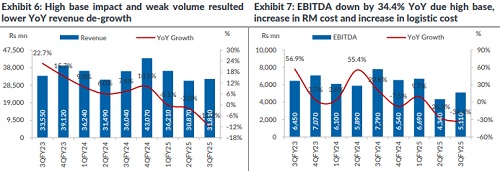

In 3QFY25, DALBHARA’s revenue down by 11.7% YoY (+3% QoQ) mainly due to lower volume and weak realization. Cement volumes for the quarter stood at 6.7mt (a fall of 1.5% YoY/ flattish QoQ) due to discontinuation of JP Assets and sluggish demand in key market region. While realization dropped by 10.4% YoY to Rs4748 due to high base impact and weakness in cement pricing. However, it has improved marginally (+3%) on QoQ supported by cement price hike in Dec’24. EBITDA in absolute number down by 34.4% YoY (+17.7% QoQ), also EBITDA margin dropped to 16.1% in 3Q FY25 vs. 21.6%/ 14.1% in 3QFY24/ 2QFY25 respectively. Despite certain drawbacks, EBITDA/tn have improved to Rs763 (+17.7% QoQ) as compared to Rs648 in 2QFY25, while down by 33.4% due to high base impact. ~Rs115/tn improvement in EBITDA/tn mainly led by 1). Marginal increase in realization coupled with better cost structure despite similar volume production in 3Q. Overall operating cost per tonne remained flattish QoQ primarily 5.8%/ 4.6% reduction in P&F/ Other expenses which is partially off-set by 15.1%/ 1.6% increase in raw-material cost/ logistic cost per tonne. Adj. PAT decline by 76.8% YoY but increased by 32.6% QoQ. The QoQ increase in Adj. PAT led by higher EBITDA and lower tax expenses which is partially offset by higher depreciation, lower other income, and increase in interest expenses.

At present, we remain cautious on any valuation re-rating especially till 2QFY26E unless the company comes up with a clear expansion road map to become 75mtpa. Few issues discourage us i.e., 1). Discontinuation of Jaypee Assets tolling arrangements and volume transportation from eastern to central region likely to lead increase in logistic cost, 2). Unclear expansion road map to become 75mtpa/ 110-130mtpa by FY28E / FY30E amid intensifying competition. and 3). Weak pricing environment. However, its ongoing expansion of 2.4mt/ 0.5mt at North-East & Bihar grinding units likely to add volume by 1QFY26E. Also, the ongoing cost saving programs to provide comfort from FY26E onwards. Our estimates, valuation multiple, recommendation remain unchanged for the DALBHARA. At CMP the stock is trading at 11x Sep’26 EV/EBITDA and we value the stock at 13x Sep’26 EV/EBITDA at TP of Rs Rs2,129 with ADD recommendation. Weak pricing, lower volume and increase in in-put cost are the key downside risk to our assumptions.

Result Highlights

* Revenue Rs31.8bn (-11.7% YoY/ + 3% QoQ), is ~4.8% below our est. of Rs33.4bn. EBITDA Rs5.1bn (-34.4% YoY/ +17.7% QoQ), is 4.1% below our est. of Rs5.3bn. Adj. PAT Rs610mn (-76.8% YoY/ +32.6% QoQ), is ~51.6% below our est. of Rs1.3bn.

* Volumes 6.7mt (-1.5% YoY/ flattish QoQ), is ~7.5% below our est. of 7.2mt. While Realization Rs4748/tn (-10.4% YoY/ +3% QoQ), is ~2.8% above our est. Rs4617.

* EBITDA/tn Rs763 (-33.4% YoY/ +17.7% QoQ), is 3.6% above our est. of Rs736 led by better-than-expected realization and lower than expected volume. Despite having same volume number, the P&F and other expenses per tonner have come down which has partially off-set by increase in RM cost and logistic cost per tonne.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632