Buy Nuvoco Vistas Corporation Ltd for the Target Rs. 560 by Choice Institutional Equities

Business Overview:

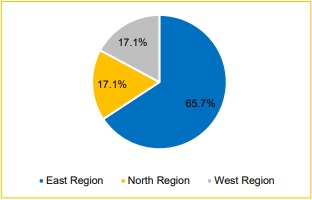

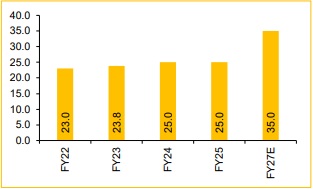

NUVOCO, the fifth-largest cement firm in India in terms of capacity, is set to scale up its capacity from 25 MTPA in FY25 to 35 MTPA by FY27E. This implies an ~18.3% CAGR over FY25–27E, driven by the Vadraj acquisition and 4 MTPA capacity expansion in the Eastern region. In this area, NUVOCO holds a dominant position, with 19 MTPA and the North with 6 MTPA capacity as of FY25. The company operates 13 cement plants, 58 RMC units, 150 MW of captive power, 44.7 MW of WHRS, and 5.3 MW of solar capacity.

As Nuvoco’s new capacities come online progressively, how would GST reduction help gain market share?

The reduction of GST to 18% is a significant tailwind for the cement sector, particularly as it improves affordability for retail customers and boosts demand in the housing and infrastructure segments. For NUVOCO, this comes at an opportune time when the company is expanding its capacity, from 25 MTPA to 35 MTPA, by FY27E, including the Vadraj acquisition and debottlenecking in the East. Lower tax is expected to stimulate incremental consumption, especially in Tier-II/III housing and IHB segments, where price sensitivity is higher. This will help ramp up volumes faster and sweat its new assets more efficiently. In addition, the GST reduction will enhance pricing for the sector as a whole. Nuvoco would gain market share in its core regions of East, North, and West India.

In the East, NUVOCO continues to strengthen its leadership position (~17% market share currently) and is adding 4 MTPA of capacity in the next 2 years, with growth expected by robust government spending — up 35% in West Bengal (to INR 393 Bn) and 18% in Jharkhand (to INR 226 Bn). Meanwhile, in the North (~5% share), state capex rose sharply by 40% to INR 537 Bn, further enhancing demand prospects.

Overall, these initiatives not only expand NUVOCO’s presence in high-growth regions but also deliver capacity at a competitive cost, reinforcing its long-term value creation strategy for investors.

What’s the cost-saving potential from NUVOCO’s ongoing initiatives in FY26E, and how does it impact EBITDA per tonne?

NUVOCO is targeting cost savings of around INR 50/t in FY26E through a series of initiatives, including: Ramping up slag usage, from 45,000 to 75,000 t/month, upgrading the Nimbol WHRS, from 4.7 MW to 6.6 MW, with an estimated capex of ~INR 100 Mn, increasing AFR usage, from the existing 12% to 15–16%, setting up hybrid wind-solar power in the North, reducing lead distance, by 12–15 km, and commissioning the Odisha railway siding to enable 100% clinker movement to Jaipur by Q3FY26E. With these measures, we expect NUVOCO’s EBITDA/t to surpass INR 1,000/t in FY26E.

Outlook:

We arrive at a 1-year forward target price (TP) of INR 560/share for NUVOCO. We now value the company using our EV/Capital Employed (EV/CE) framework, assigning a multiple of 1.6x for both FY27E and FY28E. This valuation remains conservative, considering the expected near-tripling of ROCE, from 3.9% in FY25 to 15.9% in FY28E, based on reasonable operational assumptions.

Risks:

* Financing: INR 12 Bn bridge loan reliant on equity conversion/partners.

* Operations: C/K ratio sustainability is tough in OPC-heavy Gujarat.

* Regulatory/Demand: Higher levies & infra slowdown risk margins.

Strategic foray into the Western region

Targeting ~35 Mnt cement capacity by FY27E

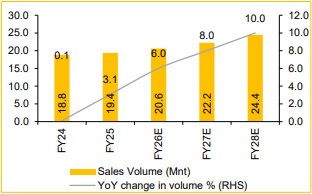

Volume expected to reach 24.4 Mnt in FY28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131