Buy Brainbees Solutions Ltd For Target Rs. 480 By JM Financial Services Ltd

Mixed quarter; outlook improving going ahead

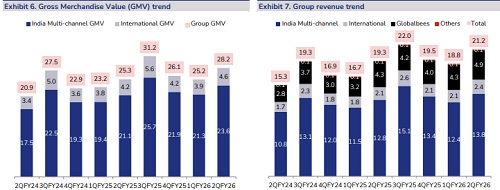

FirstCry reported a mixed 2QFY26, with IMC GMV growing 12% YoY due to delayed consumption owing to GST reforms and slower offline business, whereas International GMV grew 8.9% YoY. GlobalBees revenue got dragged due to non-core brands leading to 14% YoY despite core brands growing 30% YoY. While consolidated gross margin declined 60bps YoY to 36.7% due to increased discounting in IMC; Adj. EBITDA margin improved 160bps YoY to 5.8% due to better operating leverage. While quarter’s performance was impacted by GST reforms and GlobalBees drag, strong brand positioning, rising home brand salience, and omni-channel presence, coupled with store expansion plans, position the company for a healthier growth and margin expansion ahead. We maintain ‘BUY’ rating with revised SoTP-based Sep’26 TP of INR 480.

* India Multi-channel (IMC) impacted by delayed consumption: IMC segment saw GMV growth of 12% YoY (+11% QoQ), a miss on JMFe by 2%. Growth was driven by 12% YoY growth in transacting users, though order volume grew 7% only. The moderation in growth was mainly due to 1) delayed consumption in 2nd half of quarter due to GST reforms, 2) slowdown in offline business due to muted demand environment and closure of 38 COCO stores in 3Q. Revenue stood at INR 13.8bn, 7.9% YoY growth. While YoY growth has been muted, there has been improvement on sequential basis in both online and offline. We believe that moats for FirstCry remain intact with BabyHug being the largest childcare brand in the country and private labels accounting for c.55% of the GMV in FY25. Gross margin has declined 30bps YoY due to increased discounting to revive growth in late 2Q; however, Adj. EBITDAM saw a rise of 60bps YoY to reach 9.1% due to improved marketing efficiency. Management reiterated guidance of early-teens revenue growth in FY26 as 2H is expected to be much better. Growth is likely to be supported by store expansion in 2H as ~25 COCO stores have been added in 1H and management had guided for ~90-100 stores in FY26.

* Profitable growth remains the key focus in International segment: International segment saw a GMV growth of 8.9% YoY (+16.4% QoQ), a beat of c.2% on JMFe. Revenue stood at INR 2.4bn, +13.3% YoY (+13.7% QoQ). Management reiterated its focus on optimising topline mix to yield superior GMV-revenue conversion and margin improvement. As a result, adjusted EBITDA margin expanded 11ppts YoY (+240bps QoQ) to reach -8%. Management believes its existing moats (brand strength, customer trust, and network effects) will sustain its long-term positioning. Company is planning to replicate its omni-channel strategy of IMC to International as well with 1st COCO store being opened in KSA in Aug’25.

* GlobalBees sees drag from ‘Non-core’ brands: GlobalBees experienced slower revenue growth of 14% YoY to reach INR 4.9bn. Management has been deliberately reducing ‘Other brands’ to focus on ‘Core categories’, which have grown stronger at 30% YoY. However, rationalisation of ‘Other brands’ led to dragged margins with flattish Adj. EBITDAM at 2% resulting in Adj. EBITDA of INR 85mn. Adj. EBITDA from core brands has been at ~5% (post corporate expenses) in 1H. Rationalisation of brands is expected to complete in next couple of quarters post which growth and margins are expected to return to normalised levels. Others segment, which primarily includes Education, delivered INR 111mn in revenue, 22.3% YoY (+15.4% QoQ) growth.

* Margin and profitability: In 2QFY26, gross margin (GM) declined to 36.7%, -60bps YoY (-180bps QoQ) due to increased discounts in IMC and drag from Non-core brands in GlobalBees. GM is expected to improve in coming quarters supported by an increase in home brands in overall mix, increase in share of Kids & Babies Fashion in GMV and rising home brand and 3 rd party margins due to economies of scale. Despite GM decline, Adj. EBITDA margin improved 160bps YoY (+80bps QoQ) to 5.8%. As a result, Adj. EBITDA stood at ~INR 1.2bn in 2Q (c.51% YoY/+30% QoQ). Margin improvement was better operating leverage in IMC and reduced losses in international. Management noted that India Multi-channel is yet to reach its steady-state EBITDA margin, and margin expansion will continue over the next 4-5 years.

* Maintain ‘BUY’ with Sep’26 TP of INR 480 (vs. INR 460 earlier): Basis 2Q results, We lower revenue estimates marginally (0-2% over FY26-29E) considering improved focus on growth in International business being offset by drag from GlobalBees (non-core) brands. We don’t see any change in growth trajectory for IMC business. We believe that losses in International segment have peaked now and hence should experience sharper margin recovery. Along with this, factoring in better operating leverage with controlled advertising and fulfilment costs, EBITDAM estimates increase of 10-40bps over FY26-29E. However, lower ESOPs costs result in lower Adj. EBITDAM expansion of 0-30bps over FY26-29E. PAT estimates are increased by 1-2% in FY26-29E due to higher than expected other income. We expect the company to deliver c.15% revenue growth over FY25-30, while Adj. EBITDA CAGR would be ~37%, driven by sustained margin expansion across segments. We now value India Multichannel / GlobalBees Brands / Others at 35x / 25x /15x Sep’27E Pre-Ind AS Adj. EBITDA (vs. 35x / 30x / 20x earlier factoring in slower profitability trajectory for GlobalBees and Others segment) while International segment multiple at 1.5x Sep’27E sales, resulting in increased Sep’26 TP of INR 480. We recommend ‘BUY’.

* Faster delivery initiative scaling rapidly: Management highlighted strong traction in its fasterdelivery initiative, supported by an in-house logistics network that has expanded from 4 to 13 cities over the last 6–7 months. This has improved delivery TAT, lifted growth in these cities, and enhanced overall customer experience. The company plans to scale this network further so that roughly half of shipments are fulfilled in-house by mid-next year. Importantly, this expansion has been achieved without meaningful gross-margin dilution, giving management confidence to step up marketing while maintaining healthy unit economics.

* India Multi-Channel remains significantly undervalued: While last few quarters have been undoubtedly a tough for FirstCry, its IMC segment still managed to deliver Adj. EBITDA growth of 15% in 2QFY26. With growth recovery likely in FY26 onwards, we expect the segment to deliver 3- year EBITDA CAGR of c.23%. As shown in exhibit 1, at CMP, IMC only implies 26.0x Pre Ind AS Adj. EBITDA multiple, significantly lower than traditional retailers with lower growth and minimal margin expansion potential. Hence, the slightest hint of growth recovery could be a significant rerating event for FirstCry.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361