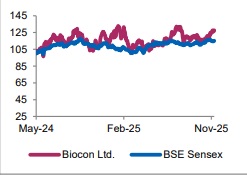

Buy Biocon Ltd For Target Rs. 450 by Axis Securities Ltd

Resilient Momentum in Biosimilars Driving Growth

Est. Vs. Actual for Q2FY26: Revenue: INLINE; EBITDA Margins: INLINE ; PAT: INLINE

Changes in Estimates post Q2FY26

FY26E/FY27E: Revenue: 1.0%/1.2%; EBITDA: -4.6%/-3.8%; PAT: -10.4%/0.1%

Recommendation Rationale

• Operational Performance: Biocon reported an in-line performance for Q2FY26, with revenue rising 19.6% YoY and 9% QoQ to Rs 4,296 Cr, driven by strong traction in biosimilars (up 24.7% YoY) and generics (up 24.7% YoY). Growth in biosimilars was led by the successful launch and market traction of bUstekinumab, bAspart, bBevacizumab, and bAflibercept across key markets.

• CRDMO Business Update: The CRDMO (Syngene) business posted muted growth, as expected, while continuing to expand its global footprint and capability set. Syngene secured its first global Phase III clinical trial mandate from a US-based biotech and is expanding its Bengaluru biologics facility with a GMP bioconjugation suite to enable end-to-end ADC manufacturing.

• R&D Investments and Pipeline Progression: R&D spending stood at Rs 251 Cr, representing 7.7% of revenue (ex-Syngene), underscoring Biocon’s continued investments in advancing its biologics and generics pipeline. The company’s momentum remains strong, supported by new filings such as Semaglutide (generic Ozempic) and the imminent launch of Denosumab, along with the California CalRx insulin supply partnership, which is expected to expand to other US states. Biocon is well-positioned to sustain its growth trajectory in H2FY26, backed by robust product launches, pipeline progression, and global expansion.

• Balance Sheet Strengthening and Outlook: Biocon significantly strengthened its balance sheet by settling structured debt obligations with Goldman Sachs and Kotak using proceeds from the QIP and executing a debt restructuring agreement with Edelweiss. The company has already begun realizing margin benefits from the reduction in interest costs in Q2 and expects further improvement through H2FY26. The full annualized savings of around Rs 300 Cr in interest expense are expected to be visible from FY27.

Sector Outlook: Positive Company

Outlook: Management expects strong double-digit revenue growth in FY26, driven by sustained momentum in Biosimilars, margin recovery in Generics from H2, and steady growth in the CRDMO segment. Recent launches, including Yesintek, Yesafili, Bevacizumab, Insulin Aspart, and Denosumab, are expected to accelerate growth in the Biosimilars business. Profitability is likely to improve through new generic launches such as Liraglutide, Sacubitril/Valsartan, and Everolimus, coupled with operating leverage benefits. Following the Rs 4,500 Cr QIP, debt reduction, and a strengthened balance sheet provide further flexibility to pursue future growth opportunities. Management remains confident of sustaining revenue momentum and delivering margin expansion in FY26 and beyond.

Current Valuation: Blended EV/EBITDA on SOTP on FY27E earnings.

Current TP: Rs 450/share (Earlier TP: Rs 380/share)

Recommendation: BUY

Financial Performance

Biocon reported a steady financial performance in Q2FY26, with revenue rising 19.6% YoY and 9% QoQ to Rs 4,296 Cr, driven by strong contributions from the Biosimilars and Generics segments. The Biosimilars business grew 25% YoY, supported by the successful launches of four biosimilars — bUstekinumab, bAspart, bBevacizumab, and bAflibercept — across multiple geographies. The Generics segment delivered robust 24% YoY growth, aided by new product launches such as Liraglutide and Sacubitril + Valsartan, along with a strong performance in the base formulations and API business

Reported EBITDA stood at Rs 835 Cr, up 23.5% YoY and 9% QoQ, with EBITDA margins at 19.4%, remaining broadly flat on both an annual and sequential basis. Reported PAT came in at Rs 133 Cr