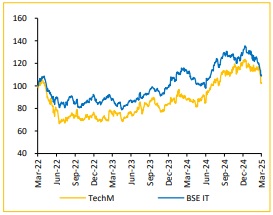

Buy Tech Mahindra Ltd For the Target Rs. 1,865 by Choice Broking Ltd

Assessing Q3 Results in Light of Trump Tariffs & Macroeconomic Challenges

TechM Revenue & PAT below estimates, EBIT beats expectations.

• Revenue for Q3FY25 came at INR 132.8Bn up 1.4% YoY but down 0.2% QoQ (vs consensus est. at INR 133.9Bn).

• EBIT for Q3FY25 came at INR 13.5Bn, up 91.7% YoY and 5.9% QoQ (vs consensus est. at INR 13.2Bn). EBIT margin was up 481bps YoY and up 59bps QoQ to 10.2% (vs consensus est. at 9.8%).

• PAT for Q3FY25 stood at INR 9.8Bn, up 92.6% YoY but down 21.4% QoQ (vs consensus est. at INR 10.6Bn).

Improved deal win rates in key verticals and strategic markets to drive growth: TechM is focused on enhancing growth capabilities and revenue mix to achieve its FY27 goals. The company reported strong Q3 results in key sectors, such as BFSI (2.7% sequential growth, 9.5% YoY in CC terms) and Healthcare & Life Sciences (4.5% QoQ, 2.7% YoY in CC terms). Demand remains strong in prioritized markets like North America, Europe, and APJ. Q3FY25 saw a significant rise in net new deal wins, totalling $745Mn, with LTM deal wins improving to $2.4Bn. Key wins include network transformation for a chemical manufacturer, digital transformation for a European Telco, and IT support for an automaker. The company also launched TechM AgentX, a GenAI-powered solution, improving productivity by up to 70% and is investing in AI, automation, and talent development.

Potential slowdown in IT spends amid Trump tariffs: TechM may face revenue challenges due to uncertainty over the Fed's interest rate decisions and concerns about a potential US economic slowdown. With 50% of its revenue from US, a dip in IT spending or delayed contract renewals from key sectors like Communications, Manufacturing, Technology, and BFSI could affect top line growth. Additionally, currency volatility poses a risk to profit margins. However, easing inflation and stable tariff policies could drive increased demand, helping US enterprises make more confident IT spending decisions

TechM workforce, attrition, and ambitious 15% EBIT target by FY27: As of Q3FY25, TechM's workforce stood at 150,488 employees, reflecting a sequential decrease of 3,785 but a YoY increase of 4,238. The IT segment maintained an onsite/offshore distribution of 22.7% onsite and 77.3% offshore. The LTM IT attrition rate was 11.2%, up 60bps from the previous quarter. TechM achieved an EBIT margin of 10.2% for Q3FY25, marking a 60bps increase from the prior quarter and a notable YoY improvement. The company aims for a 15% EBIT margin by FY27, driven by ‘Project Fortius’, focusing on efficient delivery, pricing excellence, and cost optimization. Despite expected wage hikes in Q4 impacting margins by 1%-1.5%, TechM plans to mitigate this through AI, automation, and operational improvements.

View and Valuation:

Based on the foundational inputs regarding margins, there is strong confidence in sustaining the positive trajectory established in H1. We expect Revenue/EBIT/PAT to grow at a CAGR of 4.5%/ 33.3%/ 39.1% respectively over FY24-FY27E. We maintain our rating to BUY and arrive at a revised target price of INR1,865 implying a 26x PE on FY27E EPS of INR71.7.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Ltd ( 1 ).jpg)