Weekly Sectoral Outlook 25th August 2025 by GEPL Capital Ltd

NIFTY 50 : 24870 weekly change (+0.97%)

INFERENCE & EXPECTATION

* As highlighted in our earlier report, the 25,000 level acted as an immediate hurdle for the index and played out well. On the daily chart, the index faced rejection near the (25160) 61.80% Fibonacci retracement level of the prior down move (25669–24337). On the weekly timeframe, the price action has resulted in the formation of a shooting star candlestick pattern, a classical bearish signal that often indicates potential trend exhaustion or reversal when it appears after a rally. The long upper shadow highlights intra-week strength that was eventually sold into, suggesting that sellers regained control at higher levels. Additionally, the weekly MACD remains in sell mode, further indicating a cautious sentiment for the near term.

* For Traders: Short positions can be considered below 24800 level. The downside potential extends to 24350 (-1.81%) and 24000(-3.22%). To manage risk effectively, a stop-loss at 25150 (1.41%) on a closing basis is advised.

* For Investors: Investors can consider accumulating on any dip towards 24350 –24000 levels. The target for this investment is set at 26,277 (7.91%) and 27000 (10.88%), offering significant upside potential.

NIFTY AUTO 25329 Weekly change (+5.02%)

Observation

* On the monthly scale, the index has been in a prominent bullish structure since forming a bottom in April 2025 near the 50% Fibonacci retracement level. It continues to maintain its winning streaks, reinforcing the strength of the prevailing uptrend.

* On the weekly scale, the index registered a strong breakout from a 13-week tight consolidation phase with a gap-up move, highlighting robust bullish momentum and renewed buying interest. Despite broader market volatility, the Auto index has managed to outshine peers and sustain its weekly gains, underscoring its high relative strength.

* The price action remains well-supported above key moving averages, namely the 12-week, 26-week, and 50-week EMAs, which collectively affirm the strength and stability of the ongoing trend. Momentum indicators also complement this view, with the MACD firmly in buy mode and the histogram bars rising steadily, signaling an acceleration of positive momentum.

Inference & Expectations

* Based on a thorough evaluation of the price structure and supporting indicator insights, it is evident that the AUTO Index has demonstrated notable outperformance.

* Our analysis suggests the index is poised for an upward move, with a potential target of 27700 (9.36%). However, a decisive break below the 24200 (-4.45%) level would invalidate the bullish outlook.

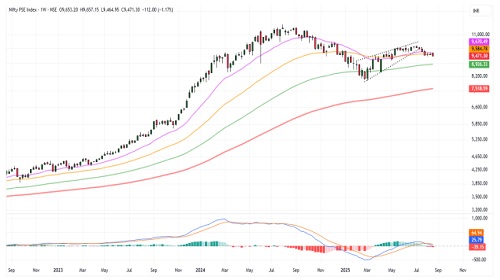

NIFTY PSE : 9471 weekly change (-1.17%)

* On the monthly scale, the index has been forming a lower top formation, and the current close sustaining below the prior month’s low signals a continuation of weakness.

* On the weekly scale, the index has displayed bearish price action with a breakdown from the rising wedge pattern, a development that typically warrants caution in the near term. On the daily scale, the weakness is further reinforced as the index continues to form a sequence of lower tops and lower bottoms, confirming the downtrend structure.

* Adding to this bearish tone, the index is trading below all its key moving averages, namely the 20-day, 50-day, and 200-day EMAs, which denotes a lack of trend strength and underscores selling pressure at higher levels.

* Momentum indicators confirm the weakness, as the MACD’s bearish crossover signals further downside risk.

Inference & Expectations

* A comprehensive assessment of the price structure and indicator insights reveals that the NIFTY PSE Index has been underperforming.

* Our analysis points to a bearish outlook, with potential downside targets at 8900 (-6.2%) & 8500 (-10.25%).

* However, a sustained move above the 9850 (4%) level would invalidate this bearish view.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer