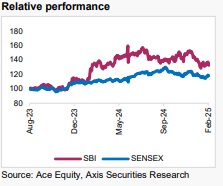

Buy State Bank of India For the Target Rs. 1,025 By the Axis Securites

Recommendation Rationale

Growth visibility is healthy; momentum remains buoyant: SBI has reaffirmed its credit growth guidance of 14-16% in FY25, supported by healthy demand visibility in the retail portfolio and a strong corporate pipeline. Currently, the corporate loan pipeline stands at Rs 4.8 Tn (largely capex driven), of which Rs 2.2 Lk Cr have been sanctioned. The bank continues to eye a healthy corporate credit growth of 10-12% in FY25. Additionally, the management remains confident of retail credit growth holding-up well as the bank exits FY25 and beyond. The recent budget announcements have opened doors for the bank to pursue credit growth opportunities in the SME segment. With the bank revamping its SME lending processes and enabling lower TAT, the management remains confident of growth in this segment. The bank also expects growth in the Xpress Credit portfolio to pick up gradually (expecting double-digit growth), supported by the budgetary boost to consumption. We expect SBI to deliver a healthy advances growth of 13% CAGR over FY25-27E.

Asset Quality trends to remain healthy: In Q3FY25, the SMA2 book inched-up sharply QoQ. However, it includes a long-term government sector customer of the Bank, with fund-based outstanding of Rs 58 Bn. The account has been pulled back subsequently. The management highlighted that the risk of this account falling back into SMA 2 is negligible. The bank had consciously pulled back growth in the unsecured Xpress credit portfolio, citing systemic asset quality concerns. The portfolio quality continues to hold up well. Going ahead, the management does not expect any major negative surprises on asset quality across segments. Thus, as credit costs continue to normalise with the book ageing, SBI remains confident of capping credit costs at 50bps across cycles

Confident of maintaining NIMs at 3+%: The sharp margin contraction (meaningfully higher vs expectations) was on account of the increase in CoF and lower treasury gains, while yields remained largely steady. The bank will continue to focus on risk-adjusted returns while not compromising on yields. SBI has not shied away from letting go of growth opportunities where the risk-reward was not favourable. Going ahead, with the SME segment exhibiting strong growth potential, the bank expects yields to find support given SME yields are better than corporate advances. In the event of a 25bps rate cut, the management expects the impact on NIMs to be negligible (2-3bps) despite the 28% EBLR book getting repriced immediately. Currently, ~60% of SBI’s book is MCLR-linked and fixed rate and the impact on NIMs would be with a lag, which would be offset by the downward repricing on CoD/CoF. Thus, the management remains confident of defending NIMs at 3+% over the medium term

Sector Outlook: Positive

Company Outlook: SBI remains well-poised to sustain its growth momentum supported by its comfortable LDR, providing it levers to accelerate credit growth (especially in retail and SME), offering scope to support NIMs. We believe SBI could continue to deliver a sustainable RoA of 1% over the medium term supported by (1) Healthy growth visibility across segments, (2) Strengthening deposit franchise with focus on CASA deposits, (3) Ramping-up the fee income profile, (4) Controlled Opex and Provisions.

Current Valuation: 1.4x Sep’26E ABV; Earlier Valuation: 1.4x Sep’26E ABV

Current TP: Rs 1,025/share; Earlier TP: Rs 1,040/share

Recommendation: We maintain our BUY recommendation on the stock.

Alternative BUY Ideas from our Coverage:BoB (TP – Rs 280), ICICI Bank (TP – Rs 1,500), HDFC Bank (TP – Rs 2,000)

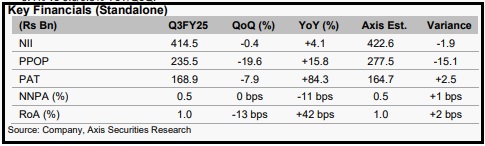

Financial Performance

Operational Highlights: Advances grew by 14/4% YoY/QoQ. Deposits growth was slowed down sequentially to 10/2% vs 9/4% QoQ. This growth was driven by TDs (+13/4% YoY/QoQ), while CASA growth stood at 4%/flat YoY/QoQ. CASA Ratio stood at 37.6% vs 39.5/38.4% YoY/QoQ. LDR remains comfortable at 76.6% vs 75.4% QoQ. Domestic LDR at 68.9% vs 67.9% QoQ.

Financial Highlights: NII growth was weak and grew by 4% YoY and was flat QoQ, a ~2% miss vs our expectations. Domestic/Global NIMs stood at 3.15/3.01%. Non-interest income growth was weaker than expected, de-growing by 4/28% YoY/QoQ, possibly owing to lower treasury gain. Opex de-grew by 6% YoY, though it increased by 5% QoQ. Employee Opex was down 17% YoY and was up 4% QoQ. C-I Ratio inched up to 55.1% vs 60.3/48.5% YoY/QoQ, driven by weaker top-line growth. PPOP grew by 16% YoY/-20% QoQ. Credit costs were significantly lower than expected at 9bps vs 8/47bps YoY/QoQ. PAT grew by 84/-8% YoY/QoQ.

Asset Quality improved marginally with GNPA/NNPA at 2.07/0.53% vs 2.13/0.53% QoQ, helped by controlled slippages. Slippages during the quarter stood at Rs 41.5 Bn with a slippage ratio of 0.4% vs 0.6/0.5% YoY/QoQ.

Key Takeaways

Focused efforts at strengthening deposit franchise: The bank continues to focus on improving the share of CA deposits alongside maintaining its leadership position in SA deposits by further strengthening customer outreach and branch network. In the SA deposits, the bank’s focus remains on opening high-quality SA accounts with a focus on salaried accounts. This has seen healthy traction having opened 9.5-10Lk accounts over the last 9 months. SBI will eye clawing back its CASA Ratio to 40% (vs to help control CoF. SBI does not intend to get into a rate war and has been pricing its deposits at competitive rates.

Outlook SBI remains well poised to continue its growth with no visible challenges on growth and asset quality. Expecting some pressure on CoF amidst continued challenges on deposit mobilisation, we trim our NII estimates by 2-4% over FY25-27E. While we expect Opex and credit costs to remain controlled, the possibility of near-term headwinds on NIMs cannot be ruled out. Additionally, we expect credit costs to gradually normalise. Resultantly, we trim our earnings estimates by 3-8% over FY26-27E. We expect SBI’s RoA/RoE to range between 1-1.1%/15- 17% over the medium term. We expect SBI to deliver factor-in a steady Advances/Deposits/NII/Earnings growth of 13/11/12/9% CAGR over FY25-27E.

Valuation & Recommendation We maintain our BUY rating on the stock with a revised SOTP-based target price of Rs 1,025/share (Valuing the core book at 1.4x Sep’26E ABV vs. current valuations of 1.4x Sep’26E ABV and valuing subsidiaries at Rs 302), thereby implying an upside of 36% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633