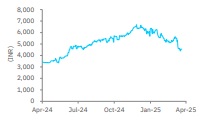

Accumulate Persistent Systems Ltd For Target Rs. 5,620 By Elara Capital

Near-term headwinds drag on revenue target

Persistent Systems (PSYS IN) Q4 numbers were ahead of our as well as the Street’s estimates. Growth was led by BFSI and hi-tech verticals while healthcare was muted. The company reported a sequential margin expansion of 70bp, led by operating leverage. For FY25, the company reported revenue growth of 18.8% in USD terms and 19% in CC terms. It retained USD 2bn revenue target for FY27 and BFSI & hi-tech will likely lead growth. The ask rate to reach FY27 revenue target is 19% growth each in FY26 and FY27, which looks aggressive in the backdrop of near-term headwinds in the healthcare vertical due to US DOGE-led funding freeze. PSYS continues to aspire for 200-300bp margin expansion for the next 2-3 years. We retain Accumulate with a lower TP of INR 5,620 based on 39x FY27E P/E.

Broad-based growth across verticals and geographies: PSYS reported growth of 4.5% QoQ in CC terms and 4.2% in USD terms in Q4. In INR terms, growth was 5.9% QoQ and 25.2% YoY. Q4 growth was led by North America and the EU, as revenue from these markets rose 4.2% QoQ and 6.7% QoQ, respectively. RoW market growth moderated to 2.3% QoQ in Q4 after a strong uptick of 9.1% QoQ in Q3. Vertical-wise, BFSI and hi-tech verticals led growth, up 6.1% QoQ and 5.2% QoQ, respectively. Healthcare growth moderated to 0.4% QoQ, due to a large client ramp-down coupled with spending cuts from USAID and DOGE-related uncertainty impact. Total contract value (TCV) came in at USD 517.5mn, down 13% QoQ. LTM attrition was up 30bp QoQ to 12.9%. PSYS reported a net addition of 653 employees in Q4, taking its strength to 24.6K

Margin improves, led by reduction in SG&A cost: Q4 EBIT margin was up by 70bp to 15.6%. Tailwinds include improved utilization of 20bp, reduction in SG&A cost by 30bp, higher earnout credit of 20bp and depreciation in the INR of 40bp. Headwinds included negative 40bp impact from multi-year managed services deals. Management reiterates 200-300bp EBIT margin improvement target in the next 2-3 years. Margin levers are rationalization of SG&A & subcontractor cost, and pricing etc.

Retain Accumulate with a lower TP of INR 5,620: PSYS reiterates there are adequate opportunities available for USD 5bn revenue aspiration as the addressable market is large for its current three verticals. The company, however, did not rule out venturing into new verticals. Management also said it did not want to start as a weak firm in that case; hence, it prefers M&A route to expand into new verticals. Its AI-led offerings continue to find interest in client systems, and it is also helping them to win contracts. We believe near-term headwinds in the healthcare vertical could be drag on revenue aspirations for FY27. We have tweaked our revenues by 2.3% FY27E and expect a 17.7% revenue CAGR during FY25-27E. We introduce FY28 estimates. Cost rationalization will likely help in margin expansion; we assume a 200bp margin expansion during FY25-27E. We reiterate Accumulate with a lower TP of INR 5,620 from INR 6,090 based on 39x (past three-year average; from 40x earlier) FY27E P/E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933