Buy Zaggle Prepaid Ocean Services Ltd For Target Rs. 530 By JM Financial Services Ltd

Zaggle delivered another strong quarter with continued momentum across segments with revenue growing 43% YoY (30% QoQ) to INR 4.3bn, led by expanding client base and increased cross-selling. Operating leverage and lower employee costs aided EBITDA margin expansion by ~130bps YoY to 10.1%. D&A expense remained at 1.7% of revenue considering the company is capitalising tech investments. While operating cash flow remained negative owing to festive-related seasonality, management guided for OCF breakeven in FY26 and OCF positive by FY27. With rising cross-sell penetration (21% vs. 16% at IPO), new product traction (Zoyer, Zatix, ZIP), and recent acquisitions bolstering the ecosystem, we believe Zaggle has long growth runway in an underpenetrated market. We reiterate BUY with Sep’26 TP of INR 530 (~41% upside), assigning 30x Sep’27 P/E multiple, conservative considering the growth and profitability trajectory.

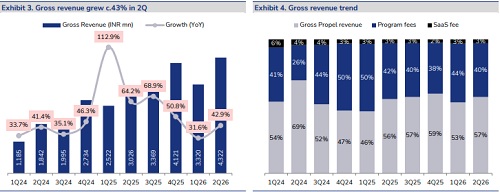

* Growth momentum sustained: Zaggle continued its strong topline growth momentum with 43% YoY (+30% QoQ) growth to reach INR 4.3bn on account of strong performance across segments. Software fees / Program fees / Propel platform revenue grew 38% / 38% / 47% YoY resp. driven by 1) addition of new clients and higher users per client, and 2) increased cross-selling and upselling. As of 2QFY26, company has 3,674 corporate customers (+14% YoY) with user base rising to 3.51mn (+16% YoY). Management noted that cross-selling (clients using 2 or more offerings) has now reached 21% from 16% at the time of IPO. Management reiterated its guidance of 40-45% revenue growth (on standalone basis) for FY26 while also noting that new offerings such as Zoyer, Fleet management, Zatix, ZIP are seeing strong traction.

* Operating leverage leading to margin expansion: While gross margin declined 103bps YoY (-401bps QoQ) mainly due to rising mix of lower-margin Propel business, EBITDA margin improved 134bps YoY (+99bps QoQ) to 10.1%, driven by lower employee cost and strong operating leverage. Notably, EBIT margin improvement was lower at 40bps YoY mainly due to higher D&A on account of capitalisation of new technology and product developments. D&A expense is expected to remain high due to increased investments towards AI integration. Management reiterated its guidance of 10-11% EBITDA margin in FY26, likely to improve to 14-15% over next 4-5 years on a standalone basis. Consolidated margins could be impacted marginally due to investments in Rio.Money. With robust revenue growth, strong operating leverage and cross-sell enabling minimal incremental cost of scaling businesses, we expect EBITDA to reach ~INR 2.7bn in FY27.

* Maintain ‘BUY’ with Sep’26 TP increased to INR 530: Basis consistently strong growth in the past few quarters and robust growth outlook due to higher cross-sell opportunities, better adoption of new offerings and strong management guidance, we increase our revenue estimates by 3-5% over FY26-28E. While we factor in increased incentives and cashbacks cost to align with growth, lower employee expenses will result in strong operating leverage leading to EBITDA estimates rising 4-5% over FY26-28E. Higher D&A expense due to capitalisation of tech cost subdues EPS increase to 2-3%. We continue to value the company at 30x Sep’27 P/E multiple to arrive at Sep’26 TP of INR 530 (vs. INR 520 earlier), ~41% upside at CMP. Maintain ‘BUY’.

* Margins improving but working capital requirement remains high: While margins have steadily improved over the years, working capital intensity remains elevated. In 1HFY26, operating cash flow (OCF) stood at outflow of INR 189mn, primarily due to seasonal factors such as early festive period leading to delays in corporate settlements and higher prepaid card loads. While management expects EBITDA margins (on standalone basis) to increase to 14-15% over next 4-5 years, OCF breakeven is expected due to stronger second-half inflows in FY26. Further, management expects EBITDA to OCF conversion ratio to improve to ~30% in FY27, and subsequently to 40%+ over time as scale efficiencies and working-capital discipline strengthen.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361