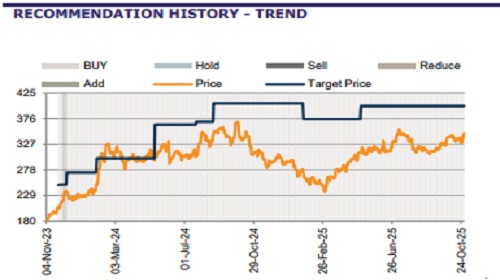

Buy Bharat Petroleum Corporation Ltd For Target Rs. 455 By Emkay Global Financial Services Ltd

BPCL reported best-in-class gross margin in Q2FY26. SA EBITDA/APAT was up 7%/5% QoQ to Rs103.4/64.4bn – a 39%/52% beat to our estimate, driven by reported GRM of USD10.8/bbl (Emkay: USD7.7/bbl), despite Russian crude share down to ~20% and discounts remaining range-bound at ~USD1.5/bbl. Implied marketing margin was also higher than expected, by 11% at ~Rs7.5/kg. LPG under-recoveries declined 45% YoY and QoQ to Rs11.5bn, and are expected to ease further due to decline in Saudi CP, with Q3FY26 underrecovery expected at Rs25/cyl vs Rs100/cyl in Q2. H1FY26 capex stood at Rs58bn, though full-year target is intact. SA net cash rose QoQ. We raise FY26- 28E EPS by 18-22%, building in better margins amid a favorable macro environment. We roll over to Sep-27E, raising our TP by ~14% to Rs455; BUY.

Result Highlights

BPCL’s Refinery volumes at 9.8mmt (down 4% YoY/ 6% QoQ) missed our estimate by 5%, with utilization healthy at ~110% and distillate yield largely steady QoQ at 85%. GRM of the Mumbai/Kochi/Bina refinery was USD9.0/10.9/15.9 per bbl in Q2, improving 121% QoQ on average. We believe there could be USD1-2/bbl inventory gains, especially from Bina. Domestic sales volume rose 2.3% YoY to 12.7mmt vs industry growth of 1.6% YoY (though lagging IOCL, HPCL volume growth), with overall volume up 2% YoY to 13.0mmt (in-line). Exports declined 20% QoQ to 0.36mmt. Petrol sales rose 5.3%, while diesel sales fell 0.6% YoY vs industry growth of 6.4% and 3.3% YoY for petrol and diesel, respectively. Opex was 6% higher than estimated at Rs74.5bn (up 8% YoY/6% QoQ). Finance costs rose 13% QoQ to Rs4.2bn, while net cash was up 2% QoQ to ~Rs40bn (~Rs90bn net debt YoY). D/A rose 4% QoQ to Rs19.5bn, while other income of Rs11.9bn (up 29% YoY/ 63% QoQ) came at a 20% beat. Q2/H1FY26 capex stood at Rs34/58bn. The Board declared final dividend of Rs7.5/sh. Forex loss was Rs5.6bn.

Management KTAs

Russian crude saw fall in share in Q2FY26 to 21% as it was unavailable in Aug, with share currently down at 10-15%. Discounts have been rangebound since the last few months at USD1.5-1.7/bbl. LPG under-recovery was down at ~Rs100/cyl in Q2, while it should be sharply down for Q3 at ~Rs25/cyl. Marketing inventory gain in Q2 was on account of MS and HSD. H1FY26 capex was Rs58bn, though H2 would see more ordering; full-year guidance is maintained. Other Income is driven by interest income on cash.

Valuation

We value BPCL on SOTP-EV/EBITDA-based methodology, with investments at 30% holdco discount. We roll over to Sep-27E, retaining our blended target EV/EBITDA at 6x, amid the upcoming capex cycle. Key risks: Adverse crude oil prices and downstream margins, currency movement, government policies, and project issues.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354