Buy Cello World Ltd for the Target Rs. 686 By Prabhudas Liladhar Capital Ltd

Ramp-up of glassware facility to drive growth

We visited CELLO’s new glassware facility at Falna, Rajasthan, and interacted with the management to gain insights on the outlook for Consumerware segment with the ramp-up of the facility and recent ADD on vacuum insulated flasks and other stainless steel vacuum vessels imported from China, and export pick-up in the Writing Instruments and Stationery segment. CELLO has been engaged in the glassware products business for 6 years, initially relying on imports. Thus, the company has developed a deep understanding of the glassware market, including customer preferences and the dynamics of product lines, pricing and distribution. With the commissioning of Falna facility, total production capacity for Opalware & Glassware has increased to ~45,000tpa for Opalware & Glassware (Daman & Falna).

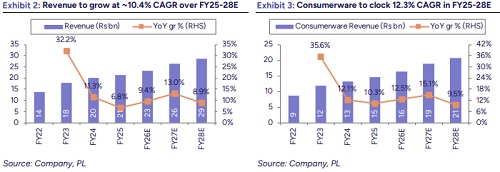

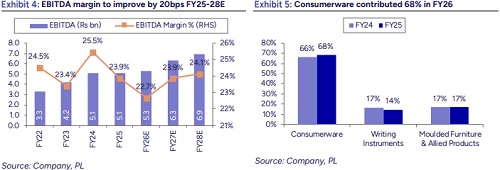

We estimate revenue/EBITDA/PAT CAGR of 10.4%/10.8%/12.5% for FY25-28E. We assign SOTP-based TP of Rs686 (Rs678 earlier), implying PE of 33x Sep’27E. Maintain ‘Buy’.

Key takeaways:

* Falna glassware facility - Enhancing self-reliance and growth: The company has commissioned a glassware manufacturing facility in Rajasthan, operational in a phased manner from 16th Mar’24, with a total capacity of 70tpd (around 18,000-20,000tpa).The plant, built with European machinery including a German furnace and Italian press-and-blow systems, ensures high productivity and superior precision in design and finish. The facility is currently operating 4 press lines and 1 press-and-blow line, with utilization at 60%, which is expected to reach 80% by Q3/Q4FY26.

* It is strategically located near raw material suppliers and benefits from dry weather conditions, making it an ideal environment for glass production. Major raw materials—silica (70%), soda ash (13%), limestone and dolomite (13%)—are sourced domestically from players such as Tata Chemicals, Reliance and Aditya Birla.

* The facility houses advanced equipment, including fire-polishing machines and a servo gob feeder, and produces ~70 SKUs, which is expected to rise to over 100 by Q3FY26.

* Of the required molds, 80–85% are procured from China at a cost of USD10,000–20,000 per unit, with the remainder produced in-house.

* The company incurred total capex of Rs2.6bn on the new glass facility and expects 23% capital incentive from the government over the next 10 years.

* On the energy front, the plant sources gas from IGL at Rs48–49 per SCM, with LPG as backup, and is installing a 2.1MW solar plant (to be operational by Nov’25) that will meet 20% of power needs, reduce energy costs by ~20% at the plant level, and is part of a broader plan to cut power and fuel expenses by ~40% in coming years.

* The facility has already achieved EBITDA breakeven and has strong revenue potential, estimated at Rs1,000–1,200mn in FY26 and Rs2,000– 2,500mn in FY27. The company is also adding a coldware and decorative glass line, which is expected to enhance value by ~20%. In line with anticipated import restrictions on the glassware segment, this strategic investment will reduce reliance on overseas suppliers and positions the company to benefit from rising domestic demand.

* Expansion of other consumerware products manufacturing at Falna: Starting Nov’25, the Falna facility will expand production to include plasticware and steel bottles. In the near term, 2 steel bottle lines and 1 plasticware line are planned, with a dedicated capex of Rs1–1.2bn. The management aims to develop the site into a large-scale, multi-product facility similar to its Daman plant.

* Consumerware segment to benefit from ADD on vacuum insulated flask and other stainless steel vacuum vessels imported from China: The ADD came into effect in Mar’25. CELLO, being the second-largest importer in this segment, is now strategically tying up with domestic manufacturers to substitute imports, as domestic capacity is insufficient to meet demand. Previously, Chinese imports were priced lower than domestic production, but with the new duty, domestic OEMs are ramping up capacities to bridge the gap and cater to the rising market demand. The ADD will help organized players like CELLO gain market share in future.

* Initiatives to reduce working capital days: The company’s working capital has increased due to : (a) inventory build-up of steel products, equivalent to 4–5 months of sales, caused by regulatory restrictions;. With normalization, inventory days are expected to reduce by 25–30 days, (b) higher receivables, as the company extended credit period during weak demand; collections are now improving, and receivable days are expected to return to levels seen 1.5 years ago; and (c) reduction of ~15 days in creditor levels, as the company has been paying suppliers faster to avail cash discounts. Overall, working capital intensity is expected to decline in the coming months, supporting better cash flows.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271