Buy Ipca Laboratories Ltd for the Target Rs. 1,600 by Motilal Oswal Financial Services Ltd

Beat on estimates; DF/API drive earnings

Strengthening DF presence/integrating Unichem/reviving exports

* Ipca Laboratories (IPCA) delivered slightly better-than-expected revenue in 2QFY26, while EBITDA/PAT beat our estimates by 18%/22%. Segmental mix and cost-control measures led to improved profitability in 2Q.

* IPCA is consistently growing at a higher rate than the industry (IPM) rate in the domestic formulation (DF) segment. Notably, it outperformed IPM in acute and chronic therapies. On promising growth prospects, IPCA would be adding one division in the cosmetic dermatology segment.

* Excess inventory of certain products impacted generics exports formulation business in 1HFY26, which is expected to revive in the coming quarters.

* IPCA is integrating Unichem operations by using Unichem products to broaden the offerings in its focus markets and shifting the outsourcing of API to its site.

* We raise our earnings estimates by 6%/3%/3% for FY26/FY27/FY28, factoring in a) sustained industry-beating growth in branded DF segment, b) improvement in profitability of Unichem operations, and c) a gradual recovery in generics exports business.

* We value IPCA at 28x 12M forward earnings to arrive at a TP of INR1,600. We expect a CAGR of 10%/15%/20% in revenue/EBITDA/PAT over FY25-28. IPCA is not only progressing well in its focus markets of DF and exportsgenerics/branded but also working toward building synergy from Unichem operations. Maintain BUY.

Margin expansion driven by better product mix/operating leverage

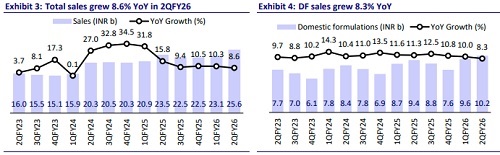

* 2Q sales grew 8.6% YoY to INR25.6b (our est: INR24.8b).

* Formulations sales grew 2% YoY to INR14.1b (60% of sales). Export formulation sales declined 9% YoY to INR4.9b (20% of total sales). DF sales grew 8% YoY to INR10.2b (40% of total sales).

* Within export formulations, generics declined 6% YoY to INR2.7b (54% of export sales), branded grew 2% YoY to INR1.4b (29% of export sales), and institutional sales declined 29% YoY to INR796m (17% of export sales).

* API sales grew 28% YoY to INR4.1b (15% of sales). Export API sales grew 45% YoY to INR3.2b (79% of API sales). Domestic API sales declined 11% YoY to INR868m (21% of API sales).

* Revenue from subsidiaries grew 15% YoY to INR6.3b (25% of sales).

* Gross margin (GM) expanded 160bp YoY to 69%.

* EBITDA margin expanded 250bp YoY to 21.3% (our est: 18.5%), driven by gross margin expansion and better operational efficiency (employee costs down 70bp YoY as % of sales). EBITDA grew 23% YoY to INR5.5b (our est: INR4.6b).

* 2Q included an exceptional expense of INR582.6m related to the provision for European Commission fee.

* Adj. for the provision, PAT grew 41% YoY to INR3.2b (our est: INR2.7b).

Highlights from the management commentary

* For FY26, IPCA expects revenue growth of 10-11% YoY in DF, 14-15% in API, and 9-10% YoY in branded export formulation.

* It guides for 8-9% YoY growth in generics formulation export revenue in 2H.

* IPCA is on track to build synergy from the Unichem acquisition. It has shut EU site and has transferred production to Baddi site, a step toward improving profitability. IPCA is also in the process of transferring outsourced API to procure from IPCA site. The overall process, including regulatory approvals, would take 12-15 months.

* Also, 12 Unichem products are filed through IPCA channel in export markets. This would take 1-1.5 years for commercial success, considering the regulatory approval process.

Valuation and view

* We raise our earnings estimates by 6%/3%/3% for FY26/FY27/FY28, factoring in a) sustained industry-beating growth in branded DF segment, b) improvement in profitability of Unichem operations, and c) gradual recovery in generics exports business.

* We value IPCA at 28x 12M forward earnings to arrive at a TP of INR1,600. We expect 10%/15%/20% revenue/EBITDA/PAT CAGR over FY25-28. IPCA is not only progressing well in its focus markets of DF and exports-generics/branded but also working towards building synergy from Unichem operations. Maintain BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412