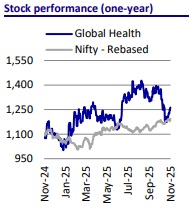

Buy Global Health Ltd for the Target Rs. 1,480 by Motilal Oswal Financial Services Ltd

Expanding the Care canvas - a long runway for growth ahead!

* We analyzed the supply-demand dynamics of hospitals in the Noida/Greater Noida regions, given the recently commissioned hospital of Medanta.

* From the service availability perspective, there are ~6,000 superspecialty beds available for patients at industry level.

* From a demand perspective, hospitals in Noida/Greater Noida have a patient population radius of 250km. Patients can come from places such as Western UP, South Delhi, Uttarakhand, Haryana, and Rajasthan.

* The business prospects for Medanta remain promising as the population base, to be catered to by the healthcare services industry, remains underserved after utilizing the current bed capacity.

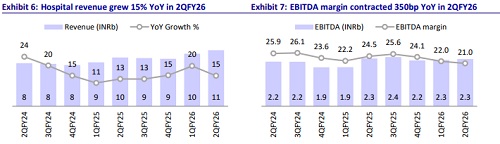

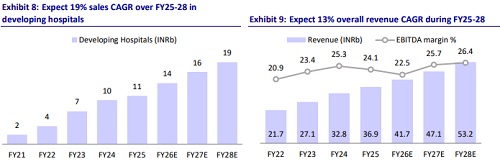

* While FY26 EBITDA would experience a drag due to opex loss from Noida, we expect an EBITDA breakeven within 12-15 months. Subsequently, FY27/FY28 would witness a clear runway for EBITDA growth, fueled by performance from Gurugram, Lucknow, Patna, Noida, Ranchi, and Indore.

* Additionally, we believe that operational cash flow from the currently operational hospitals, combined with surplus cash of INR7b, would be sufficient to fund the ongoing capex program at Mumbai, South Delhi, Pithampura (Delhi), Guwahati, and incremental capex at existing locations. Reiterate BUY.

Medanta Noida – a strategic entry into Noida with a fully-equipped multispecialty platform

* ‘Medanta’ is an established healthcare service provider in North India, with a presence in Gurugram (since CY09), Lucknow (CY19), and Patna (CY21).

* In fact, utilization of the Lucknow hospital for patients since the pandemic has enhanced the brand recall of Medanta in North India.

* With 226 beds, comprising 80 ICU beds, Medanta Noida is equipped with advanced medical technology. Medanta would be offering healthcare services across 20+ specialties, with the respective doctor talent onboarded.

From expansion to earnings: Noida drag to fade; EBITDA growth to drive the FY26-28 period

* With front-loading of cost and occupancy to pick up over the near to medium term, we expect an operating loss of INR1.3b from the Noida hospital in FY26. The EBITDA breakeven is expected in the next 12-15 months, and profitability is expected to scale up from 4QFY27.

* The new unit of Ranchi would also have some operational expenses in the near term. Since it is an addition to the existing facility, the operating leverage and EBITDA margin improvement are likely to be faster.

* The existing hospitals (Gurugram/Lucknow/Patna/Indore) continue to improve in patient volumes and realization.

* Accordingly, we expect 21%/6% EBITDA CAGR for developing (ex-Noida) and mature hospitals. Overall, we expect a healthy scale-up of EBITDA (16% CAGR including Noida operations) over FY26-28 (Exhibit 4) to INR14b.

Cash flow from operations to meet the capex requirement

* Even if we assume Medanta’s 1HFY26 operating cash flow of INR3.2b normalizes over the next five years—translating into ~INR32b—together with the existing INR7b surplus cash, the cumulative INR39-40b available would be broadly adequate to fund the INR41b capex program (including maintenance capex) planned by the company.

* We continue to value Medanta at 30×12M EV/EBITDA multiple, arriving at a target price of INR 1,480. Backed by strong operational momentum over the next 3-5 years and a well-defined expansion pipeline that strengthens revenue visibility beyond FY28, we reiterate our BUY rating on the stock.

Above views are of the author and not of the website kindly read disclaimer

.jpg)