Buy Glenmark Pharma Ltd For Target Rs.1,725 by Motilal Oswal Financial Services Ltd

3Q largely in line; DF/US/EU drive earnings

Better prospects in US from FY26 onward

* Glenmark Pharma (GNP) delivered a largely in-line operational performance in 3QFY25. New launches and market share gains led to better-than-industry growth in the domestic formulation (DF) segment. US business remained largely stable due to the lack of meaningful launches in 3QFY25.

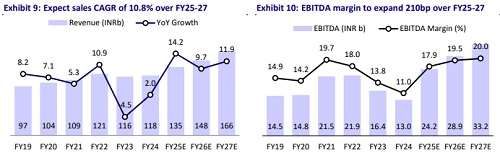

* We maintain our estimates for FY25/FY26/FY27. We value GNP at 25x 12M forward earnings to arrive at a TP of INR1,725.

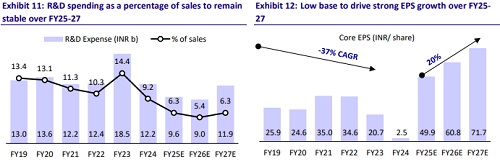

* GNP is building a niche product pipeline for the US market in the areas of respiratory and ophthalmology. The products are in the form of oral solids and injectables dosages. GNP is also enhancing its offerings in DF segment through the GLP-1 portfolio and partnered products. Accordingly, we estimate a 24% earnings CAGR over FY25-27. Maintain BUY.

Product mix, operating leverage drive margins YoY

* Revenue grew 35.1% YoY to INR33.9b (in line) in 3QFY25. DF jumped 305.7% YoY to INR10.6b (31% of sales) on a low base. Europe generics revenue grew 14.8% YoY to INR7.3b (22% of sales).

* RoW (RoW+LatAm) sales rose 3.3% YoY to INR7.5b (23% of sales).

* NA revenue increased 2.4% YoY to INR7.8b (USD93m; 22% of sales).

* Gross margins (GM) expanded 920bp YoY to 68% due to lower RM costs, a change in the product mix, and a low base of past year.

* EBITDA stood at INR6b (in line) vs. EBITDA loss of INR1.4b in 3QFY24.

* Accordingly, EBIDTA margin stood at 17.7%.

* Adj. PAT came in at INR3.5b (est. INR3.7b) vs. adj. loss of INR3.5b in 3QFY24.

* In 9MFY25, revenue/EBITDA grew 15%/127% to INR100.7b/INR18.1b, whereas PAT stood at INR10.5b (vs. a loss of INR979m in 9MFY24).

Highlights from the management commentary

* GNP expects an uptick in US business from 1HFY26 onward on the back of potential launches in the respiratory space.

* It has filed two ANDAs for generic nasal sprays. GNP filed g-Flovent ANDA for 44mcg pMDI in May’24. It is working on filing ANDA for other two strengths of g-Flovent and other respiratory products.

* One ANDA was filed during the quarter in the ophthalmology category; and GNP plans to file one additional ANDA in the upcoming quarter.

* The company maintained its FY25 revenue guidance of INR135b-140b with EBITDA margin of 19%.

* GNP expects its partner to receive Ryaltris approval in FY26 for China market.

* It plans to launch Envafolimab in more than 20 markets in FY25, with the first market launch expected in FY26.

Highlights from the management commentary

India

* Tislelizumab and Zanubrutinib will be launched in the next 3-4 months after the receipt of the required regulatory approvals.

* GNP expects full supply of Lirafit to begin in 4QFY25, after which it expects growth in diabetes therapy.

US

* The company holds FTF/180-day exclusivity for three products to be launched in FY27/FY28; targeting a market opportunity worth USD800m.

Europe

* GNP secured MHRA authorization for WINLEVI in the UK. The launch is planned in FY26.

Other key highlights

* Forex gain was INR230m for the quarter.

* R&D costs stood at 6.6% of sales, i.e., INR2.3b.

* Net debt was INR1b at the end of 3QFY25.

Valuation and view

DF: In-licensing/superior execution to aid growth

* GNP’s DF sales grew 44.7% YoY to INR35.4b in 9MFY25 due to market share gains in cardiac, dermatology and respiratory therapeutic areas and a low base of past year. This was partly offset by a YoY decline in the diabetes segment.

* To boost growth in DF market, GNP is focusing on launching specialty products in diabetes, derma and oncology through in-licensing and branded generics.

* GNP’s consumer care (GCC) primary sales grew 13% YoY in 3Q, driven largely by core brands such as Candid powder, La Shield and Scalpe.

* We expect a 13% CAGR in DF sales to INR58.7b over FY25-27, led by niche launches, market share gains, and inflation-linked price increases.

US: Niche launches to better business prospects; await USFDA regulatory resolution at Monroe

* In 9MFY25, US sales were flat YoY at INR23b (CC: down 3% to USD275m) due to the lack of new product launches and a delay in the scale-up of recent launches.

* GNP awaits FDA inspection at Monroe; however, it continues to take batches and file products on the injectable side.

* Further, the company plans to launch more respiratory and injectable products in the US market. It plans to file one ANDA in 4QFY25 and launch 12-13 products in the coming quarters.

* We expect an 11% CAGR in US sales to USD459m over FY25-27.

EU: Market share gains, expansion in new geographies driving growth

* In 9MFY25, GNP’s EU sales jumped 17% YoY to INR21.1b, driven by steady expansion in the generics market and strong growth in the branded market.

* Ryaltris continued to gain market share across all countries where the product has been launched.

* GNP recently received MHRA approval to market Winlevi in the UK, with the launch planned for FY26.

* The company is waiting for approvals of four respiratory brands, which were filed in 4QFY23.

* Consequently, we expect a 13% sales CAGR to INR36.5b over FY25-27.

RoW – Strengthening respiratory franchise

* In 9MFY25, RoW sales inched up 1% to INR20.2b. Slower growth was due to adverse currency movements in some of the key markets.

* Further, Ryaltris is a leading nasal spray in markets like South Africa and is witnessing a strong pickup after the launch in key markets in the region.

* In LATAM, respiratory is the key growth contributor. GNP is witnessing good traction in the first generic of Salmeterol + Fluticasone MDI for Brazil. Further, GNP launched Ryaltris in Mexico in 3QFY25.

* While the potential for new launches is high, we expect a 5% sales CAGR to INR31.4b over FY25-27.

Maintain BUY

* We largely maintain our estimates for FY25/FY26/FY27. We value GNP at 27x 12M forward earnings to arrive at a TP of INR1,725. We estimate a CAGR of 11%/16%/21% in revenue/EBITDA/PAT over FY25-27.

* GNP is expanding its product pipeline in US markets in the respiratory/injectable segments. It is also enhancing its differentiated offerings in the branded generic space. It has re-calibrated its spending on innovative R&D. GNP continues to make in-roads into newer markets for Ryaltris, in addition to improved traction in 41 markets. Compared to an earnings decline over FY22-24, GNP has made a strong comeback in FY25, thanks to improved execution and the sale of its API business. The earnings growth momentum is expected to strengthen over the next three years. Accordingly, we maintain BUY on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412