Buy Glenmark Pharma Ltd for the Target Rs.2,430 by Motilal Oswal Financial Services Ltd

Innovation validated; blockbuster potential unfolds

AbbVie partnership signals a new era for Glenmark Pharma (GNP) GNP’s subsidiary, Ichnos Glenmark Innovation (IGI), has signed an exclusive licensing agreement with AbbVie for its lead investigational asset, ISB-2001.

* The deal validates several aspects of GNP: a) the strength of IGI’s BEAT protein platform for oncology and auto-immune diseases; b) the potential of ISB-2001 to treat relapsed/refractory multiple myeloma; and c) the commercial viability of ISB-2001 following successful clinical trials and subsequent commercialization.

* Moreover, AbbVie has established itself as a diversified biopharma leader, combining scientific innovation with strong commercial execution. In oncology, the company has built a robust presence anchored by two cornerstone therapies: Imbruvica, a BTK inhibitor, and Venclexta, a BCL-2 inhibitor. These medicines have transformed the treatment landscape for chronic lymphocytic leukemia and other B-cell malignancies, generating multi-billion-dollar revenues and reinforcing AbbVie’s reputation as a pioneer in hematologic cancer.

* Notably, oncology accounts for the majority of global licensing deals. This agreement ranks as the fourth-largest worldwide in terms of upfront payment.

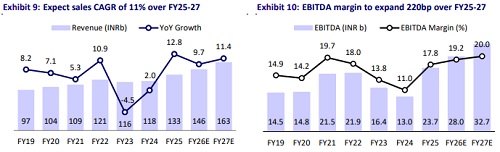

* Based on the contours of the deal, we add an NPV of INR470 per share to the 27x 12M forward base business earnings to arrive at our TP of INR2,430. Over the past two years, GNP has: a) reduced its financial leverage; b) improved the commercial prospects of innovative R&D; c) strengthened its ANDA pipeline for the US market; and d) undertaken a strategic reset in its domestic formulation business. Accordingly, we estimate 11%/17%/20% sales/EBITDA/PAT CAGR over FY25-27, reaching INR163b/INR33b/INR20b. Reiterate BUY.

Deal details

* Under the agreement, AbbVie will receive exclusive rights to develop, manufacture, and commercialize ISB-2001 across key developed markets, including North America, Europe, Japan, and Greater China.

* GNP will retain the rights to develop, manufacture, and sell in emerging markets, including the rest of Asia, Latin America, Russia/CIS, the Middle East, Africa, Australia, New Zealand, and South Korea.

* IGI will receive an upfront payment of USD700m from AbbVie, contingent on regulatory approvals. Additionally, the company is eligible to earn up to USD1.2b through achievement-based development, regulatory, and commercial milestone payments. IGI will also receive tiered, double-digit royalties on sales generated by AbbVie.

* ISB-2001 is a first-in-class trispecific T-cell engager that targets BCMA and CD38 on myeloma cells and CD3 on T-cells. It is currently in Phase 1 clinical trials for relapsed/refractory multiple myeloma (RRMM).

Leading global licensing deal in terms of upfront payment

* The GNP-AbbVie agreement ranks as the fourth-largest deal in the pharmaceutical industry based on the size of the upfront payment.

* Notably, 9 out of the top 10 licensing deals over the past seven years have been in the oncology space.

* ADCs, bispecifics, and protein degraders are currently commanding the highest upfront payments in licensing deals.

Scientifically superior drug to treat RRMM

* ISB-2001 is a CD3 plus T-cell engager (TCE) that co-targets BCMA and CD38, designed to improve cytotoxicity against multiple myeloma. This increases the chance of hitting cancer even if one antigen is downregulated (a known resistance mechanism associated with BCMA-only therapies).

* The overall response rate (ORR) achieved so far is the highest among approved treatments. ISB-2001 also demonstrated a high complete/stringent complete response (CR/sCR) rate of 30% at active doses, along with a favorable safety profile. While these rates may appear lower and milder at this stage, longer follow-up would be required.

Strong commercial prospects for ISB-2001

* The business prospects of commercialized drugs to treat RRMM have been significant, with Darzalex, Jannsen recording the maximum annual sales of USD9b for MM and AL amyloidosis. Several drugs were commercialized during CY20-23, which continue to scale up in terms of revenue.

* CAR-T and bispecifics are the fastest-growing segments, with revenues expected to double over the next three years. Newer bispecifics (Teclistamab, Elranatamab, Talquetamab) are in the earlier stages of ramping up.

* Notably, the number of patients diagnosed with MM has been increasing, accounting for 0.9% of the global cancer patient population. Annually, about 160k-180k new cases of MM are diagnosed worldwide.

* AbbVie’s oncology portfolio includes four major products, with cumulative sales of USD8b.

* The portfolio includes a combination of established blockbuster drugs and rapidly scaling new launches. It also includes multiple investigational cancer therapies spanning a broad range of mechanisms.

* Backed by its superior treatment profile and AbbVie’s robust commercial strength, ISB-2001 holds strong potential to emerge as a blockbuster drug in the RRMM space.

Valuation and view

* We add an NPV of INR470 per share, factoring in the upfront receipt of USD700m as well as the receipt of USD1.2b linked to development, regulatory, and commercial milestones payments.

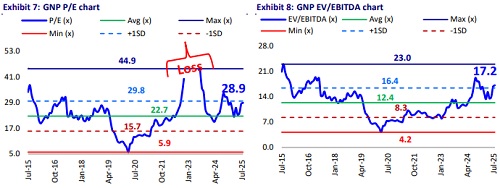

* We expect a 23% earnings CAGR over FY25-27, led by 10%/7%/12%/14% CAGR in the domestic formulation/US/EU/ROW segment and 200bp margin expansion.

* In addition to the significant commercial benefit from innovative R&D, GNP is actively strengthening its US generics pipeline in the respiratory and injectable segments.

* Accordingly, we assign a 27x 12M forward earnings to arrive at an SOTP of INR2,430. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412