Buy Essel Propack Ltd for the Target Rs. 270 by Motilal Oswal Financial Services Ltd

Margin expansion across key markets drives profitability

In-line operating performance

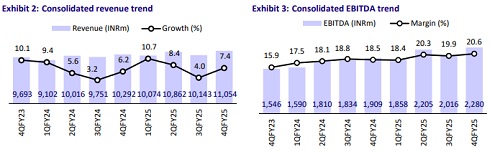

* EPL reported EBITDA of INR2.3b (+19%YoY) in 4QFY25, in line with our estimate, driven by robust EBITDA growth of 64%/21%/16% YoY in Europe/America/EAP. AMESA was down 4% YoY, primarily due to currency depreciation in Egypt.

* EPL continued its trajectory of margin expansions, supported by margin gains in Europe and the Americas, led by restructuring, cost optimization and an increasing mix of personal care segment. We expect this trend to continue going ahead, led by margin expansion across geographies.

* Management has guided for double-digit revenue growth and EBITDA growth higher than revenue growth. We maintain our estimates for FY26/FY27 and value the stock at 16x FY27E EPS to arrive at our TP of INR270. Reiterate BUY

Product mix continues to improve, aiding operating performance

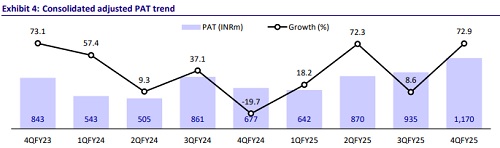

* Revenue grew ~7% YoY to INR11b (est. INR10.8b). Gross margin remained in line at 58%. EBITDA margin expanded 210bp YoY to 20.6% (est. 21.1%), led by improving margins in the Americas and Europe. EBITDA stood at INR2.3b (est. in line), up 19% YoY. Adj. PAT grew 73% YoY to INR1.2b (est. INR1b).

* Revenue from the Americas/Europe/EAP grew 14%/5%/9% YoY to INR3b/INR2.7b/INR2.4b, while revenue from AMESA remained flat at INR3.6b.

* EBITDA margin rose 110bp/620bp/130bP YoY for Americas/Europe/EAP to 19%/17.2%/19.6%, whereas EBITDA margin contracted for AMESA by 90bp YoY to 19%. EBITDA for Americas/Europe/EAP grew 21%/64%/16% YoY to INR578m/INR465m/INR475m, while it declined for AMESA by 3.7% YoY to INR676m during the quarter.

* In FY25, revenue/EBITDA/adj. PAT grew by 8%/20%/53% YoY to INR42b/INR8.5b/INR3.9b. Net debt declined to INR4.5b from INR6b in FY24, led by strong cashflow generation. CFO stood at INR8b vs. INR5.9b in FY24.

Highlights from the management commentary

* Guidance: EPLL expects to maintain double-digit revenue growth and EBITDA growth higher than revenue growth, driven by strong traction in the ‘Personal Care & Beyond’ segment. Margin expansion is expected to continue, supported by an improved product mix and ongoing cost optimization in the US and Europe.

* Expansion: EPLL has projected FY26 capex at ~INR3.8b (including greenfield plant in Thailand), with FY27 capex guided at INR3.8b-INR3.9b. Capacity expansion in Brazil (40 million tubes per annum) is expected to become operational in the current quarter, while the Thailand plant is set to start contributing from H2FY26.

* US tariffs: EPL experiences a minimal tariff impact due to local manufacturing in the US and exports to the US accounting for less than 5% of total revenue, with most customers benefiting from contractual pass-through of duties. Additionally, the potential imposition of tariffs on Chinese imports could present a competitive advantage for the company.

Valuation and view

* EPLL continues to experience a healthy operating performance across geographies, driven by a new customer addition, favorable product mix and the scale up of the new plants (in Brazil). We expect this trend to continue.

* With the improved product mix, operational efficiencies and the focus on increasing market share across geographies in the beauty and cosmetics, we expect a CAGR of 9%/14%/21% in revenue/EBITDA/adjusted PAT over FY25-27. We value the stock at 16x FY27E EPS to arrive at our TP of INR270. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412