Buy Adani Ports & SEZ Ltd for the Target Rs. 1,770 by Motilal Oswal Financial Services Ltd

Container-led momentum continues; integrated logistics platform enhances long-term visibility

* In Oct’25, Adani Ports & SEZ (APSEZ) reported 6% YoY growth in cargo volumes, supported by a 24% rise in container volumes (driven by international volume and operationalization of new port). Total cargo handled in Oct’25 stood at 40.2mmt, while YTD volumes reached ~284mmt, with container volumes recording an average growth rate of ~22%.

* Adani Ports’ cargo mix is diversified across commodities and geographies; however, the growth and contribution of coal volumes have been declining, from ~38% of total cargo in FY24 to ~33% in FY25 and ~32% in 1HFY26. The decline in coal volumes is being offset by diversifying the cargo mix toward coastal coal and container volumes.

* At India level, volumes at major ports stood at 76.3mmt, up ~12% YoY. Container cargo at major ports increased ~13% YoY to 17.7mmt in Oct’25. Non-major port volumes fell 6.4% YoY in Oct’25 to 60.1mmt. Coal and POL, which together account for ~25% each of the commodity mix, declined ~13% and ~12% YoY, respectively.

* The logistics arm, anchored by Adani Logistics (ALL), has scaled up rapidly across container train operations, ICDs, warehouses, and trucking, with 12 multi-modal logistics parks, 132 trains, 3.1m sq. ft. of warehousing, and 1.3mmt of grain silos, offering true “shore-to-door” solutions.

* With integrated end-to-end offerings, APSEZ captures higher customer wallet share and builds cargo stickiness, while its diversified and scalable model underpins sustainable growth. This positions APSEZ to achieve its goal of becoming India’s largest integrated transport utility by 2029, with logistics and marine emerging as key growth engines alongside its dominant ports franchise. We reiterate our BUY rating on the stock with a TP of INR1,770 (premised on 15x FY28E EV/EBITDA).

Port-sector leadership intact as APSEZ commands a 28% market share

* APSEZ operates the largest private port network in India with 15 ports and terminals across the west, south, and east coasts, offering a total capacity of 633MMT, along with four international ports in Israel, Sri Lanka, Tanzania, and Australia.

* APSEZ’s domestic market share rose to 28.1% as of Sep’25 from 27.4% in Sep’24. Management highlighted that its domestic port volume growth over the past decade has been nearly three times the industry growth rate.

* Container market share has also expanded steadily to 45.9% from 36% during Mar’20-Sep’25. Key capacity expansions, such as the automated Colombo West International Terminal and new berths at Dhamra, along with the rapid ramp-up of Vizhinjam, strengthen the growth pipeline.

* Looking ahead, APSEZ targets 850MMT of domestic and 150MMT of international cargo volumes by 2030, with deeper integration into DFC-linked hinterland corridors and industrial clusters driving long-term growth.

Logistics business – Accelerating the shift to a unified logistics ecosystem

* As the company aims to become India's largest integrated transport utility company by 2029, it is strengthening its capabilities in all logistics segments (ports, CTO, warehousing, last-mile delivery, ICDs, etc.). Hence, it offers end-toend services to its customers, thereby capturing a higher wallet share and making the cargo volume sticky in nature.

* ALL expanded its services to cover container train operations, container handling in logistic parks, and warehouses offering storage and trucking solutions. With 12 multi-modal logistics parks, 132 trains, 3.1m sq. ft. of warehousing space, and 1.3mmt of grain silos, ALL aims to establish a nationwide presence by further developing logistics parks and warehouses.

* With significant capital investments planned for the trucking operations— INR10-15b in FY26 and INR50b by FY30—APSEZ maintains a hybrid model, owning 937 trucks and operating over 26,000 via third parties. It is also expanding value-added services like freight forwarding to improve RoCE.

Marine services: A swiftly scaling high-margin growth engine

* Marine operations have emerged as another high-growth vertical within APSEZ, with a diversified fleet of 127 vessels (excluding 46 vessels operated by Adani Harbour across APSEZ ports), including tugs, anchor handling tug supply vessels, multipurpose support vessels, workboats, and barges.

* The business has been strengthened by acquisitions, such as Ocean Sparkle in 2022 and Astro Offshore in 2024, along with the establishment of TAHID to manage international operations in the MEASA region.

* In 2QFY26, marine revenue jumped 237% YoY to INR6.4b, with EBITDA surging to ~INR3.4b and margins expanding to 52.7%. The surge was driven by vessel additions, integration of acquired entities, and higher demand from Tier-1 customers.

* Marine business RoCE improved to 15% in 1HFY26 from 13% in FY25.

* Management is aiming to double its revenue from INR11.4b in FY25 (INR11.8b achieved in 1HFY26), positioning the segment as a profitable and capitalefficient business that complements port operations while extending APSEZ’s reach across global shipping routes.

Valuation and view

* With strong cash flows, a healthy cash balance of INR130b, and a net debt-toEBITDA ratio of 1.8x, Adani Ports is well-positioned for further expansion. Capacity enhancements at key ports, ongoing infrastructure projects, and global port acquisitions provide visibility for steady growth in FY26 and beyond.

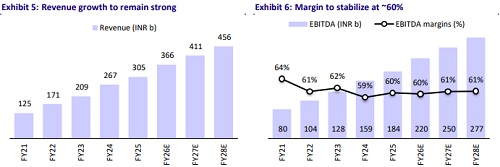

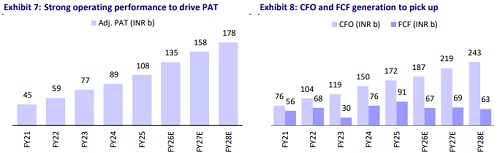

* APSEZ’s diversified cargo mix and ongoing infrastructure investments are expected to support its target of 505-515MMT cargo handling in FY26. We expect APSEZ to report 8% growth in cargo volumes over FY25-28E. This would drive a CAGR of 14%/15%/18% in revenue/EBITDA/PAT over FY25-28E. We reiterate our BUY rating with a revised TP of INR1,770 (premised on 15x FY28E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412