Buy Larsen & Toubro Ltd For Target Rs.4,300 by Motilal Oswal Financial Services Ltd

Strong beat on inflows; margins flat YoY

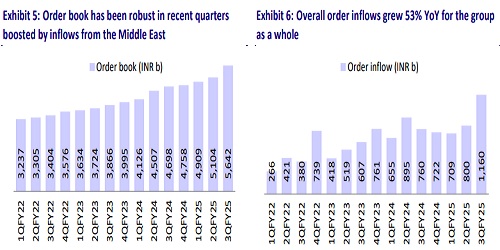

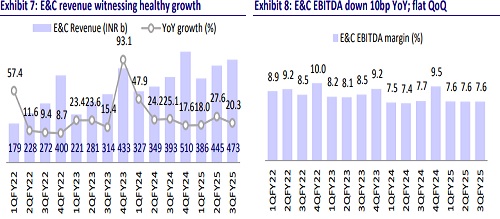

Larsen and Toubro (LT) surpassed the street’s estimates on core E&C order inflow (up 64% YoY) and execution (up 20% YoY) in 3QFY25. Order inflow was driven by a healthy mix of domestic and international orders, thereby allaying concerns about weaker domestic inflows so far. Core E&C margin was flat YoY at 7.6%. Further support for execution growth and margins will come from improved execution in the coming quarters. Based on strong 9MFY25 performance, LT has raised its guidance for order inflow and revenue growth and expects a fairly comfortable NWC. Strong inflows of INR987b for the quarter and a healthy order prospect pipeline at INR5.5t have enhanced revenue visibility for LT. We maintain our positive stance on LT and expect it to further benefit from new initiatives across electrolyzers, semiconductors, data centers, and real estate in the coming years. We trim our estimates to bake in slightly lower margins for core E&C and maintain BUY with an unchanged TP of INR4,300 on roll-forward to Mar’27E earnings, valuing core business at 30x two-year forward earnings and 25% holding company discount to subsidiaries.

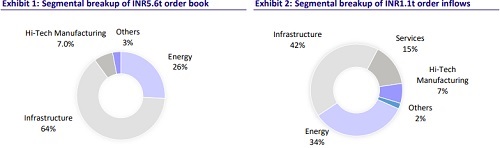

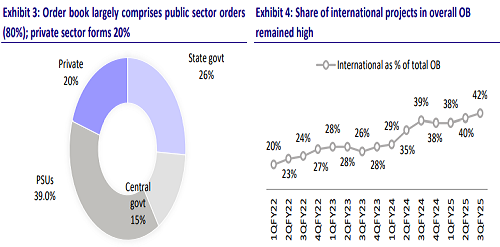

Consolidated results were lower than our estimates on lower margins

LT reported consolidated revenue/EBITDA/PAT of INR647b/INR63b/INR34b, which grew 17%/9%/14%. Consolidated revenue/PAT came in 3%/11% below our estimates, mainly due to lower-than-expected margins. For the core E&C business, order inflows came in much above estimates at INR963b, up 64% YoY. In an encouraging development, domestic orders at INR459b jumped 126% YoY, while international orders grew 26% YoY to INR504b, buoyed by the receipt of major orders in Renewable and Power T&D business. This resulted in core E&C order book of INR5.6t, up 19% YoY. Core E&C revenue came in at INR473b (up 20% YoY), slightly below our estimate of INR485b as domestic execution was flat YoY, while international execution improved by 56% YoY. EBITDA margin at 7.6% for the core business was largely flat YoY. Margin came in below our estimates of 8.1%, led by margin contraction in Energy Projects and flat infra segment margins. Prospect pipeline dow

Prospect pipeline down 12% YoY; domestic orders poised for an uptick

LT’s prospect pipeline for 4QFY25 at INR5.5t is down 12% YoY, due to a fall in hydrocarbon and carbon lite prospects. Major part of domestic prospect pipeline is expected from public health infrastructure, energy, urban infra, water, B&F etc. Domestic orders during 3QFY25 also jumped 126% YoY, with key wins from thermal power, renewable, power transmission, precision engineering, minerals & metals, water, commercial buildings and hydrocarbon onshore. The company is well-placed in 4-5 large orders and has a strong visibility of INR500b in inflows for 4QFY25. In some water-related orders, LT had to slow down the execution in line with delayed payments, which have now started improving

Guidance upgraded for inflows and revenues

Based on strong 9MFY25 performance, LT expects to exceed its initial order inflow growth guidance of 10% YoY. It has raised its revenue growth guidance to over 15% for the full year. NWC is also comfortable at 12.7% of sales and the company expects to maintain it at the similar levels for the full year versus 15% guided earlier. We had expected LT to outperform its initial guidance. However, margin improvement has fallen short of our expectations and we expect it to improve as certain large projects in the Middle East reach the revenue and margin recognition stage. Further, capital allocation toward new-age ventures like green energy, data centers and semiconductor design will be unveiled in the new FY27-31 Lakshya plan.

Valuations and view

We trim our estimates by 4%/1%/2% for FY25/26/27 to bake lower margins in core E&C segment. We roll forward our TP and maintain our BUY rating with an unchanged SOTP-based TP of INR4,300, valuing the core business at 30x P/E on a two-year forward basis. Our multiple takes into account a strong prospect pipeline and improvements in NWC and RoE, despite margins being still far off from the earlier highs.

Key risks and concerns

A slowdown in order inflows, delays in the completion of mega and ultra-mega projects, a sharp rise in commodity prices, an increase in working capital, and increased competition are a few downside risks to our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412