Neutral Alembic Pharma Ltd for the Target Rs.990 by Motilal Oswal Financial Services Ltd

Export strength offsets muted DF/API show

Re-assessing DF business for higher productivity and sustainable growth

* Alembic Pharma (ALPM) delivered a largely in-line performance for 1QFY26. Superior execution in the export market led to YoY growth in revenue/EBITDA/PAT for the quarter. This benefit was offset, to some extent, by a muted show in the domestic formulation (DF) and API segments.

* ALPM sustained its growth momentum in the US market on the back of new launches. Notably, upcoming introductions such as g-Entresto have the potential to further strengthen growth in the US generics segment. That said, a broader scope of business would be necessary to enhance capacity utilization and, in turn, improve the profitability of the US generics segment.

* Growth of non-US exports has been broad-based across focus markets.

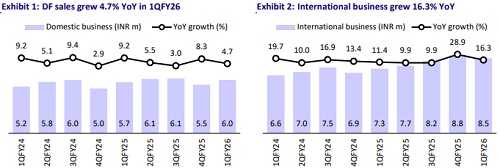

* The DF segment continues to struggle with growth. In 1QFY26, ALPM undertook measures to address certain challenges in this segment, which impacted the growth of the DF segment’s specialty category.

* We tweak our estimates for FY26/FY27 (+3%/+2%), factoring in: a) improved business prospects in the export market and b) near-term disruption in the DF segment. We value ALPM 22x 12M forward earnings to arrive at a TP of INR990.

* After a muted performance in FY25, ALPM is working to improve business prospects across its key markets. Growth in export markets is strengthening on the back of new launches and superior supply chain management. However, this is being offset to some extent by an inferior show in the DF and API segments. Considering these aspects, we expect a 24% earnings CAGR over FY25-27. The current valuation largely factors in the earnings upside. Hence, we reiterate a Neutral rating on the stock.

In-line 1Q; margin gain from product mix supports PAT growth

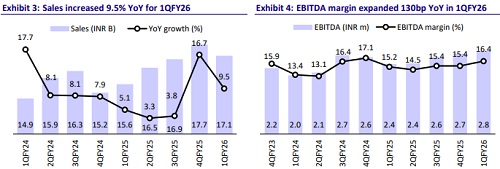

* ALPM sales grew 9.5% YoY to INR17b (in line).

* US generics sales grew 13% YoY to INR5.2b (USD61m; 31% of sales). Ex-US generics, export sales grew 21% YoY to INR3.3b (19% of sales). DF sales grew 5% YoY to INR6b (35% of sales).

* API sales were stable YoY at INR2.6b (15% of sales).

* Gross margin expanded 140bp YoY to 76% due to a better product mix.

* EBITDA margin expanded 130bp YoY to 16.4% (in line), led by a better gross margin. Higher R&D spend (+150bp YoY as a % of sales) was offset by lower other expenses (down 170bp as a % of sales).

* Consequently, EBITDA grew 19% YoY to INR2.8b (our est: INR2.7b).

* Adj. PAT grew 14.6% YoY to INR1.5b (in line).

Key highlights from the management commentary

* ALPM has guided for US sales to grow 10-15% YoY in FY26.

* Non-US sales are also guided to grow at 10-15% YoY in FY26.

* ALPM is addressing certain challenges in the DF business and has gained better control over channel inventory for its products. This, however, impacted specialty segment growth for the quarter.

* Data leakage by certain Chinese traders regarding exports from India has impacted ALPM’s API business.

* APLM expects to launch 4-5 products in the US in 2QFY26.

* Gross/net debt stood at INR11.8b/INR9.7b at the end of 1QFY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412