Buy Granules India Ltd For Target Rs.665 by Motilal Oswal Financial Services Ltd

Finished dosages remain the key earnings driver

CAPA at Gagillapur to be completed by Mar’25E

* Granules India (GRAN) delivered better-than-expected revenue, while EBITDA/PAT stood in line for the quarter. The traction in finished dosage (FDF) remained robust for six quarters now. However, reduced off-take of intermediates (PFI)/API impacted the overall growth for 3QFY25. GRAN has taken comprehensive initiatives to address issues highlighted by the USFDA at its Gagillapur site. Further, it continues to develop products in CNS/ADHD and oncology segments.

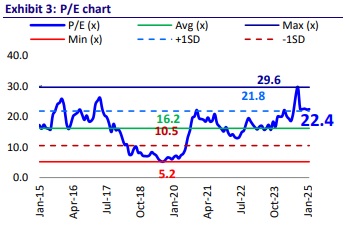

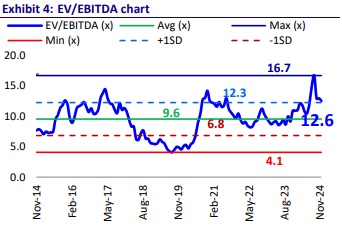

* We cut our earnings estimates by 8%/6%/6% for FY25/26/27 factoring in: 1) ongoing remediation measures that resulted in calibrated production from the Gagillapur site, 2) marginal addition in costs related to the failure to supply and higher air freight, and 3) additional opex related to the Genome Valley. We value GRAN at 19x 12M forward earnings to arrive at our TP of INR665.

* While regulatory issues at Gagillapur have lowered the growth prospects over the near term, GRAN continues to build a product pipeline to not only enhance diversification but also increase the product offering in the developed market. Further, it is also building the manufacturing capacity to meet future requirements. Reiterate BUY.

Product mix benefits more than offset by lower operating leverage

* GRAN’s sales declined 1.5% YoY to INR11.4b (our est. of INR10.4b) due to a voluntary pause at the Gagillapur facility led by the USFDA inspection. FDF sales grew 13.7% YoY to INR8.7b (76% of sales). PFI sales dipped 24% YoY to INR1.3b (12% of sales). API sales declined 36.6% YoY to INR1.4b (12% of sales).

* Gross margin (GM) expanded 470bp to 62% due to a change in segmental mix and lower RM cost.

* However, the EBITDA margin dipped 140bp YoY to 20.2% (our est: 22.5%), due to higher employee/other expenses (up 120bp/500bp as a % of sales).

* EBITDA declined 8.1% YoY to INR2.3b (our est INR2.4b) for the quarter.

* Adjusted PAT declined 6.4% YoY to INR1.2b (our estimate: INR1.2b).

* In 9MFY25, GRAN’s revenue declined 1.4% to INR32.8b, while EBITDA/PAT grew 11.5%/20.1% YoY to INR6.9b/INR3.5b.

Highlights from the management commentary

* GRAN indicated complete implementation of CAPAs at the Gagillapur site by Mar’25. GRAN is applying systemic changes from a regulatory perspective.

* The production at Gagillapur has started in a staggered manner from Oct’24.

* The near-term growth would be driven by new launches from the GPI site, which includes products under the CNS/ADHD segment.

* The company is working on 7-8 products under the oncology segment.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412